Best Cash Out Refinance Options

The amount of cash you want is high relative to the balance of the loan you re replacing and the terms of the new loan are better.

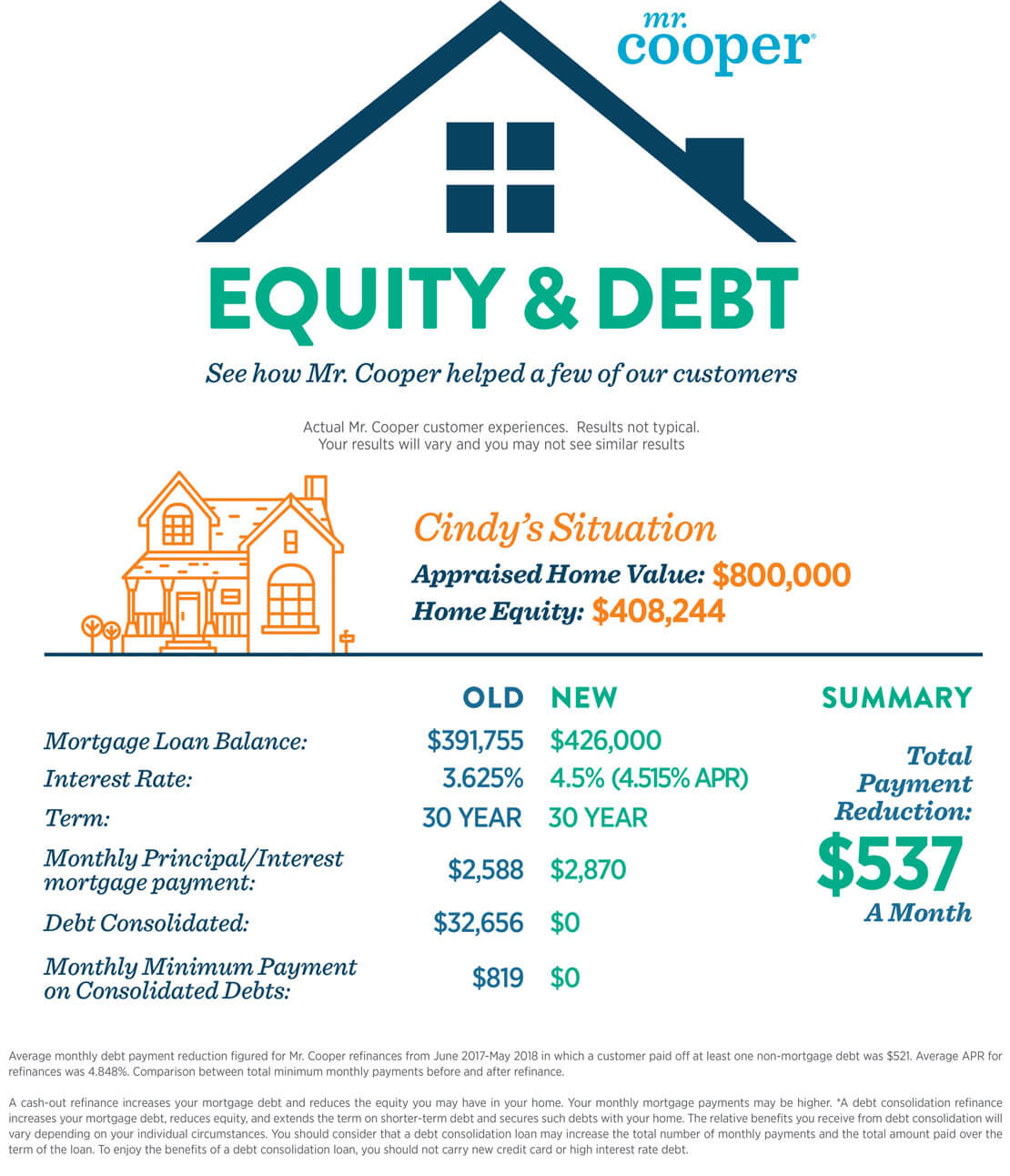

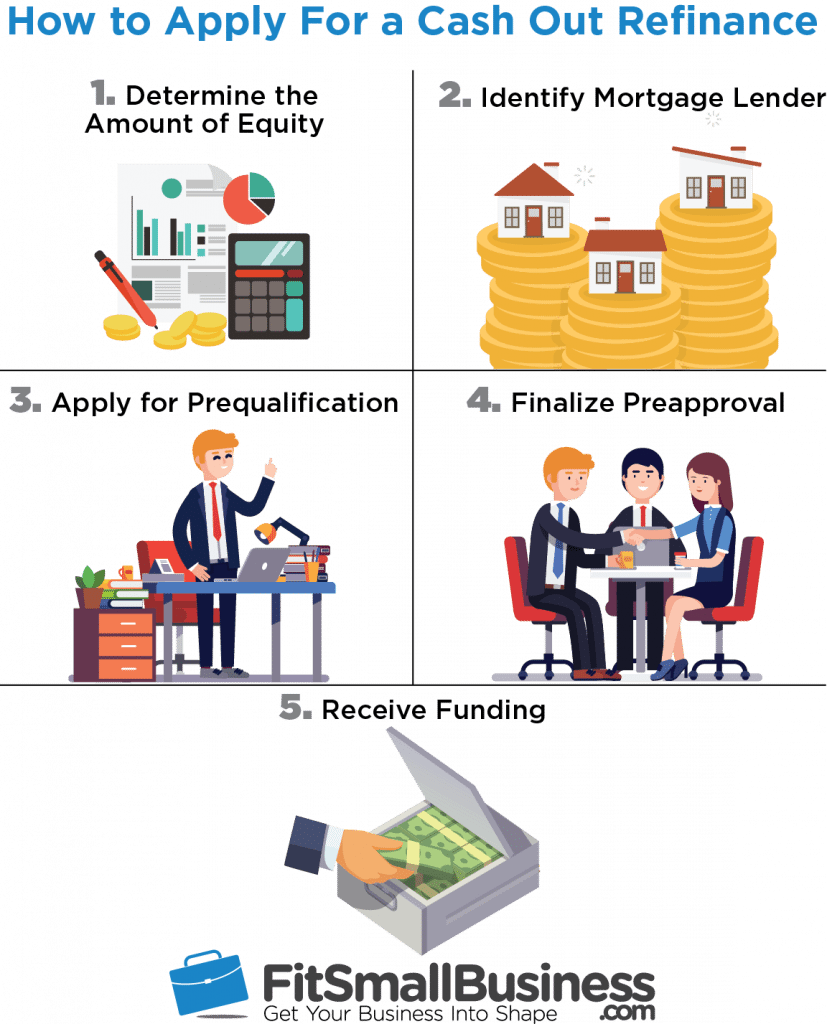

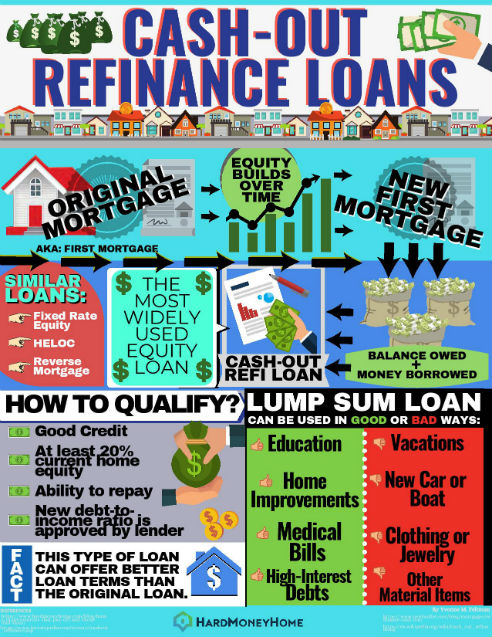

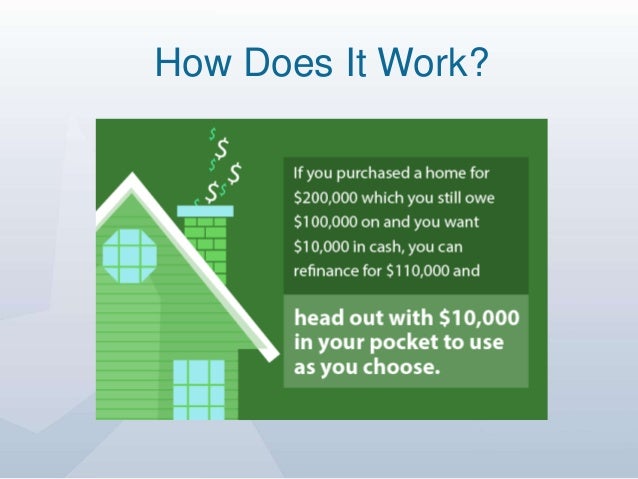

Best cash out refinance options. The cash out refinance can be your best choice in these cases. Cash in refinance is less common than rate and term refinance or cash out refinance. A cash out refinance is a mortgage refinancing option where the new mortgage is for a larger amount than the existing loan to convert home equity into cash. Your options for cash out refinance lenders are extensive from all digital outfits with speedy online applications to major banks with branches nationwide for in person service.

And if you decide to go that route the company offers multiple types of refinancing and home equity loans to choose from including fixed and adjustable rate refinance loans fha and va refinance and cash out refinance. Lenders generally require you to maintain at least 20 percent equity in your home after a cash out refinance so you d be able to withdraw up to 140 000 in cash. See competitive cash out refinance mortgage rates using nerdwallet s cash out refi rate tool. You take the.

A cash out refinance replaces your current mortgage with a loan for more than you owed. It s an interest saving option if you ve got the cash to do it because this type of loan can offer a lower mortgage rate shorter repayment term or both. What makes bank of america the best mortgage refinance company for member discounts however is its preferred rewards program. You ll bring cash to the closing table to pay down your loan balance with this type of mortgage refinance.

Footnote 1 based on your personal situation and financial needs your lender can provide the information you need to help you choose the best option for your specific financial situation. As of june 2020 cash out refinancing is positioned as one of the best options for homeowners. Reasons to use a cash out refinance.

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)