Best Company To Get A Home Loan Through

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

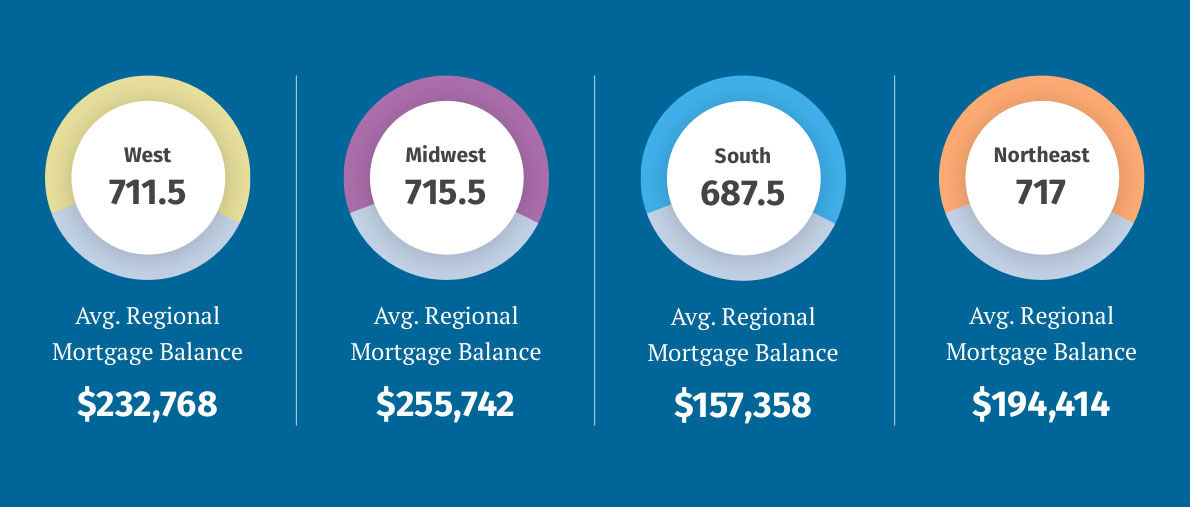

Just as when you bought the home you will most likely undergo a credit check and pay closing costs.

Best company to get a home loan through. Compare mortgage rates and best mortgage lenders get prequalified and then preapproved for a mortgage and plan for your down payment and closing costs. If you want a traditional bank experience where you get your loan through a face to face interaction with a human mortgage banker chase has you covered. On a 200 000 home loan you would pay 2 000 in loan origination fees. News ran a nationwide survey through google surveys in february 2020.

On the other hand individual states regulate mortgage companies and more stringently as well. Check and improve your credit. After spending over 400 hours reviewing the top lenders nerdwallet has selected some of. The federal deposit insurance company fdic regulates and audits full service banks.

Known for customer service the lender has an a better business bureau rating and received a rating of five among the best in the 2018 u s. Primary mortgage origination satisfaction study. When selecting mortgage companies. Most homebuyers will pay 1 of the total loan amount in origination fees when they get a loan on their own.

Probably the biggest selling point of the costco mortgage program is that members of the warehouse club get access to preferred pricing on loan origination fees. The bank has more than 4 900 branches and nearly half of all american households as customers in some form including banking credit cards and other businesses too. Quicken loans is a nationwide mortgage lender with several mortgage options.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/quicken-loans-58046d043f8048f7a244b6aed0ecc154.png)