Best Corporation For Small Business

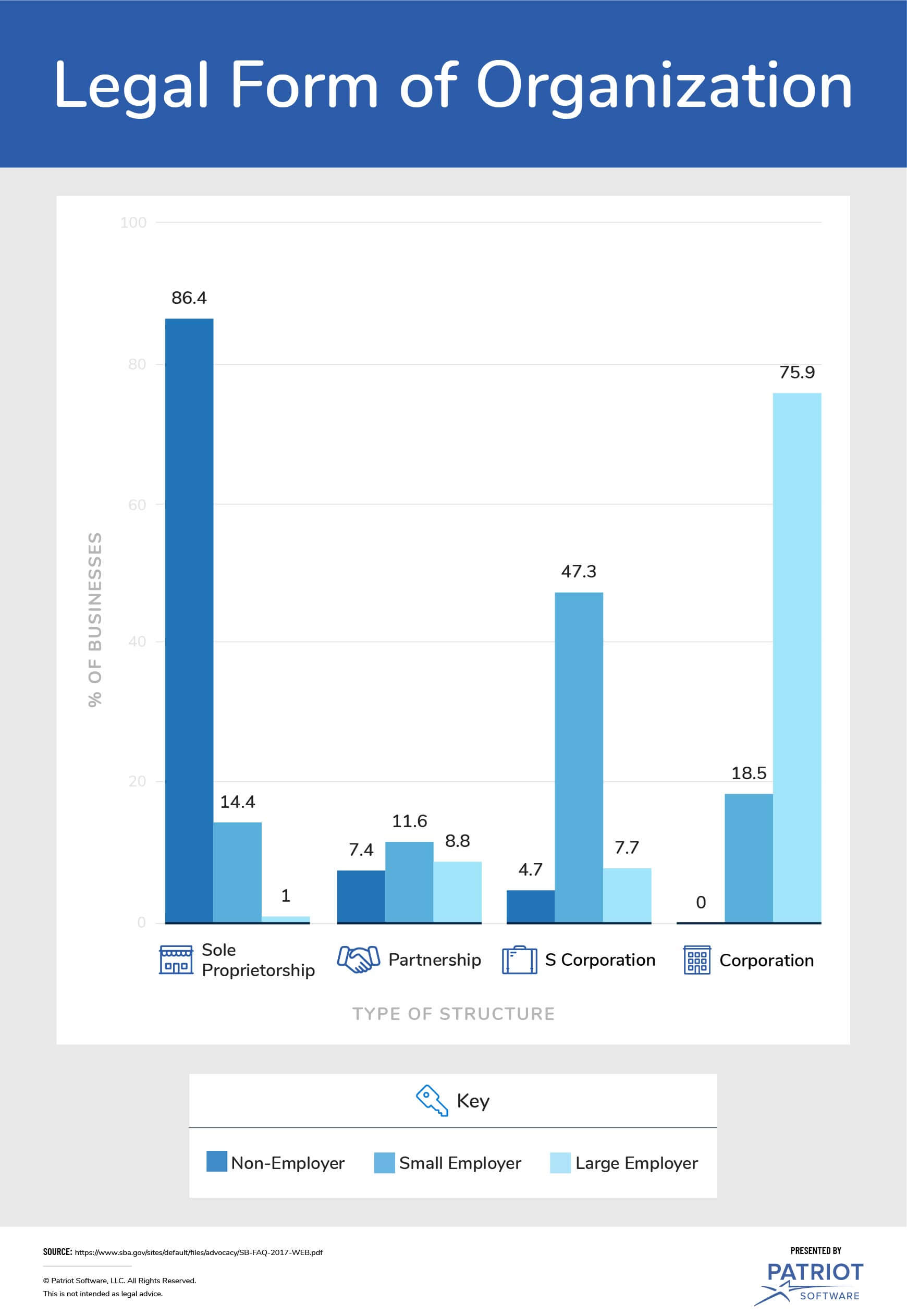

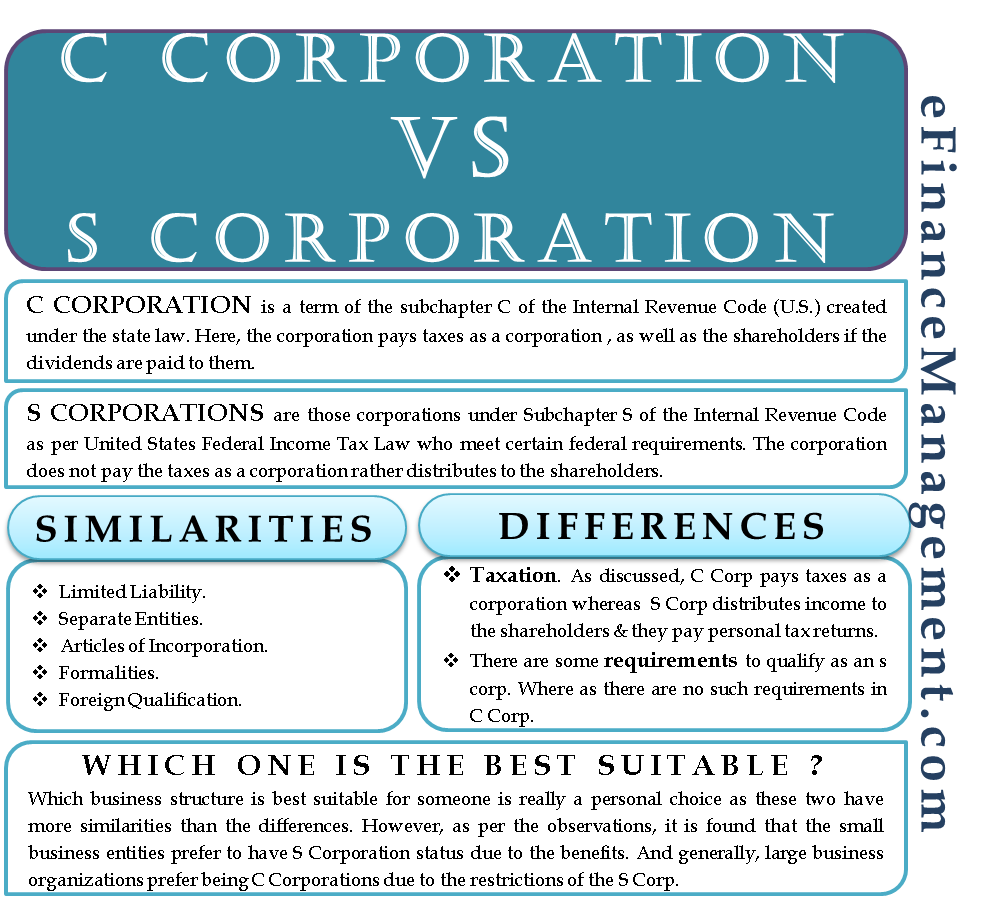

For example a business owner that operates a c corporation is essentially taxed twice.

Best corporation for small business. The protection of personal assets is a benefit that attracts many business owners to the s corporation but this structure also provides other perks especially compared to other types of corporations. This status allows the taxation of the company to be similar to a partnership or sole proprietor as opposed to paying taxes based on a corporate tax structure. While an s corporation has strict rules against nonresident alien shareholders c corporations might just be the perfect entity choice for immigrant owned businesses. You should choose a business structure that gives you the right balance of legal protections and benefits.

About the author s deborah sweeney is the gm vp small business services at deluxe corporation. S corporations can be particularly beneficial to small businesses due primarily to the tax benefits and legal protection afforded to its shareholders. Which business type is best. You may have the opportunity to take longer lunches work from home or spend a little more time on balancing your personal life.

The best bank for your small business is going to depend on your specific needs. None of these companies paid the penny hoarder to make the list. The structure of small business is often times a little more flexible than those of large corporations. So here s how the best small business banks stack up.

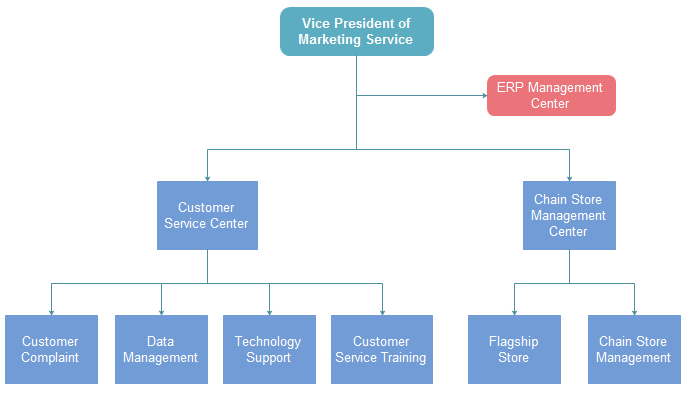

Three basic types of business organizations there are three basic types of business organizations. 5 best banks for small businesses. That said we don t know your business finances or your cash flow. A corporation is a.

But here are our five favorites. Because the environment in a small business is ever changing your schedule may be also. Although small businesses can be llcs some large businesses choose this legal structure. An s corporation is any business that files taxes under subchapter s of chapter 1 of the internal revenue code.

One example of an llc is anheuser busch companies one of the leaders in the u s. By 2016 venturity was already larger than most accounting firms that serve small businesses but it wasn t making enough to invest in the solid growth that chris mckee considered essential. Each type serves a specific purpose situation or concern relating to taxes liability your control of management and how you receive profits and losses. First the corporation is taxed on its profits for the.

/what-is-a-subsidiary-company-4098839_FINAL-8828f4a412d546bfa9c96a19845541a3.png)

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)

/improve-your-small-business-2951413-556a7d287050409bbd876af010f74be6.png)