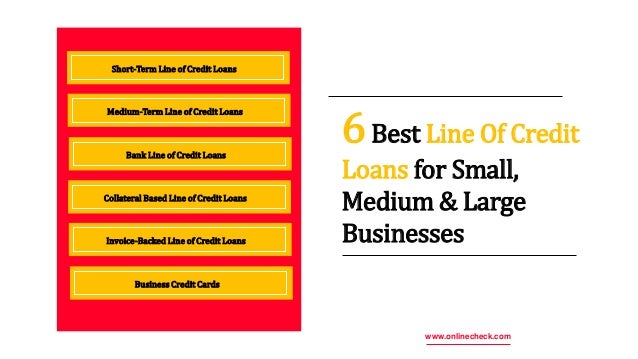

Best Line Of Credit For Small Business

Liquidity and cash flow coverage is also important to getting a business loc.

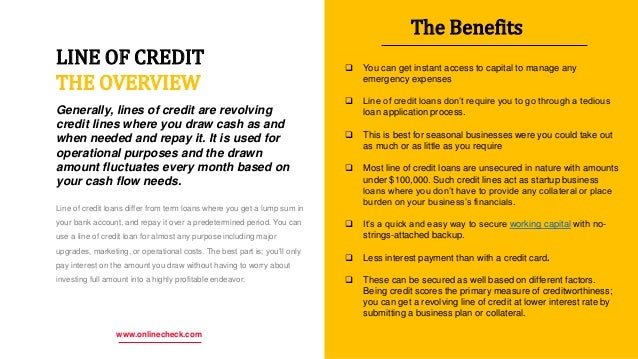

Best line of credit for small business. A business line of credit is a possible option for a small or start up business to get the capital needed to manage cash flow fund day to day operations and take advantage of new opportunities. Lines of credit are usually smaller than term loans. Small business line of credit. A business line of credit offers capital on a revolving basis.

Best unsecured business line of credit. The best small business line of credit lenders base the credit limit on various factors including a business owner s credit score time in business annual revenues liquidity and cash flow coverage. With a line of credit for small businesses you can draw capital as needed and your credit can be drawn from multiple times. A business line of credit can help businesses even out cash flow and is typically used for inventory purchases project costs.

Even better even if you have a low credit score you have the chance to get approved for a business line of credit. But while a line of credit can be beneficial for many businesses it s not always clear which lender represents the best option. The best thing about a business line of credit is that you can get approved in as quick as 24 hours. When your business experiences growth or encounters issues with uneven cash flow easy access to cash can be the only way to keep your head above water that s why establishing a small business line of credit can be an excellent option for short term financing.

It s kind of like a business credit card but lines of credit usually work better for large working capital expenses. Unlike a traditional business loan you have the flexibility to borrow up to a set amount typically anywhere from 50 000 to 500 000 repaying only the amount you withdraw with interest. Credit cards should be used for small daily purchases as lines of credit typically aren t very liquid. Business line of credit cons.

Our picks for the best business lines of credit come with limits ranging from 10 000 to 3 million. A business line of credit gives access to a pool of funds to draw from when you need capital.

/how-letters-of-credit-work-315201-final-5b51ed66c9e77c0037974e85.png)

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)