Best Tax Relief

Both companies offer services throughout the united states.

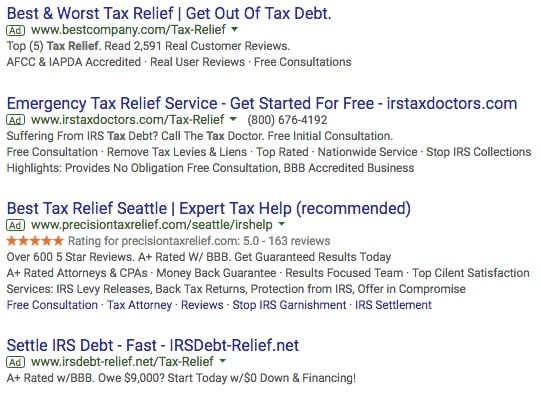

Best tax relief. First and foremost is the company s 30 day money back. Optima tax relief and tax defense network have earned the top spots on our list because of their high quality services and positive customer reviews. They are particularly skilled at working with the irs giving them an in depth knowledge of tax laws. Instant tax relief identifies by name the people who will be handling your case.

Has earned awards for excellence in customer service. Tdn charges a flat rate fee and will not work with customers who owe less than 10 000 in tax debt. Tdn is owned by moneysolver a national financial firm and is one of the most well known names in tax debt relief. They also seem to have one of the fastest turnarounds for getting tax relief from the irs compared to their competition.

The tax relief companies that stood out above the rest are community tax optima tax relief tax defense network anthem tax services and instant tax solutions. The best tax debt relief companies will begin by investigating your case to determine where the debt is coming from and your eligibility for certain programs. Best tax relief customer service. These sound customer reviews and long history in business are why we named tdn our best tax relief company overall.

Generally the price of tax resolution services varies. Additionally they offer services for flat fees and openly discuss work time expectations for cases. Optima tax relief has a 10 000 minimum debt requirement. On average tax relief costs 2 000 7 000.

No matter which company you choose all of them charge for their initial investigation though some companies fold this fee into their overall cost. Reputable tax relief companies are hard to come by but precision tax relief rose to the top in nearly every aspect of our analysis. Best customer service a tax relief company that focuses on emergency tax relief for individuals and businesses with more than 20 000 in tax debt. Optima tax is our 1 recommended tax relief company because they offer tax relief and are one of the most open when it comes to cost and pricing.

The representatives on their tax team have over 100 years combined experience in resolving tax issues helping those with debt or tax issues of at least 10 000. In this guide we ll provide tips for making a wise choice when choosing a company to assist with tax relief examine the best companies in the industry and answer frequently asked questions. The top two tax relief companies are rated so closely that both deserve mention here.

:max_bytes(150000):strip_icc()/PRecision-7e0ee4ec0e804b75a641cd2a0f8f4cae.png)