Best Whole Life Insurance For Young Adults

Policies are available with level premiums so it is easy to budget and some of their plans allow access to tax free cash values.

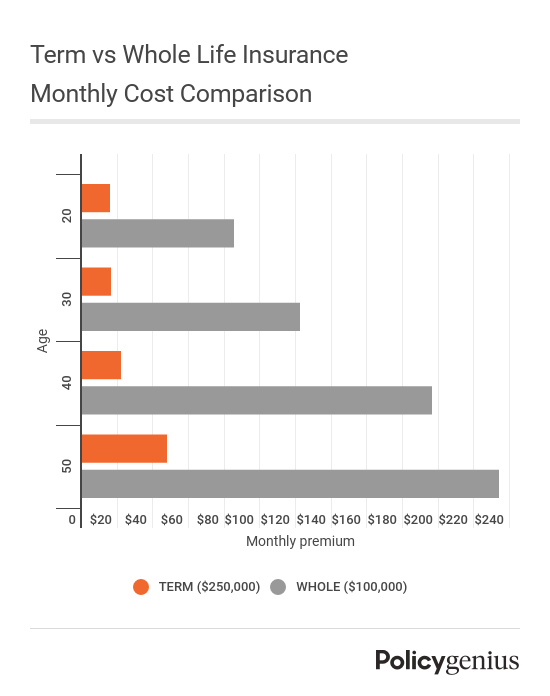

Best whole life insurance for young adults. One of the best ways to start your child on the road to financial security is with a permanent whole life insurance policy designed for young adults ages 15 through 17. Benefits of life insurance for young adults rates stay the same for the life of the policy you can secure this valuable life insurance for young adults at a fixed rate. New york life offers three different types of whole life insurance plans including a customizable plan. Term insurance is their best option.

Whole life policies offered by mutual insurance companies can also pay dividends to help increase returns further. Term life insurance is an affordable way for young adults to get the protection they need for a set number of years. Other benefits of permanent life insurance for young adults include. You may experience an illness a fatal car accident or other unexpected.

I m young do i really need life insurance. To start compare your rate on policygenius. Hopefully not but no one can predict the future. Unlike term life which has no savings component whole life insurance features a guaranteed growth rate in the cash account of a policy.

Term life insurance is also a good option for young families because it can offer protection for your children as they grow up giving you peace of mind. The best life insurance for young adults is simply term insurance. What young adults do need from life insurance is inexpensive simple and affordable coverage. Buying life insurance when you re young saves money lots of it.

/GettyImages-494765811-5ac3920fc5542e0037b4ab4b.jpg)

/ProtectiveLife-63fd02ddf24c4ac89d4f634d0f7cfa84-ab87d9e36cf3498f8230be2d7e6b1b60.jpg)