Brokerage Account Fees

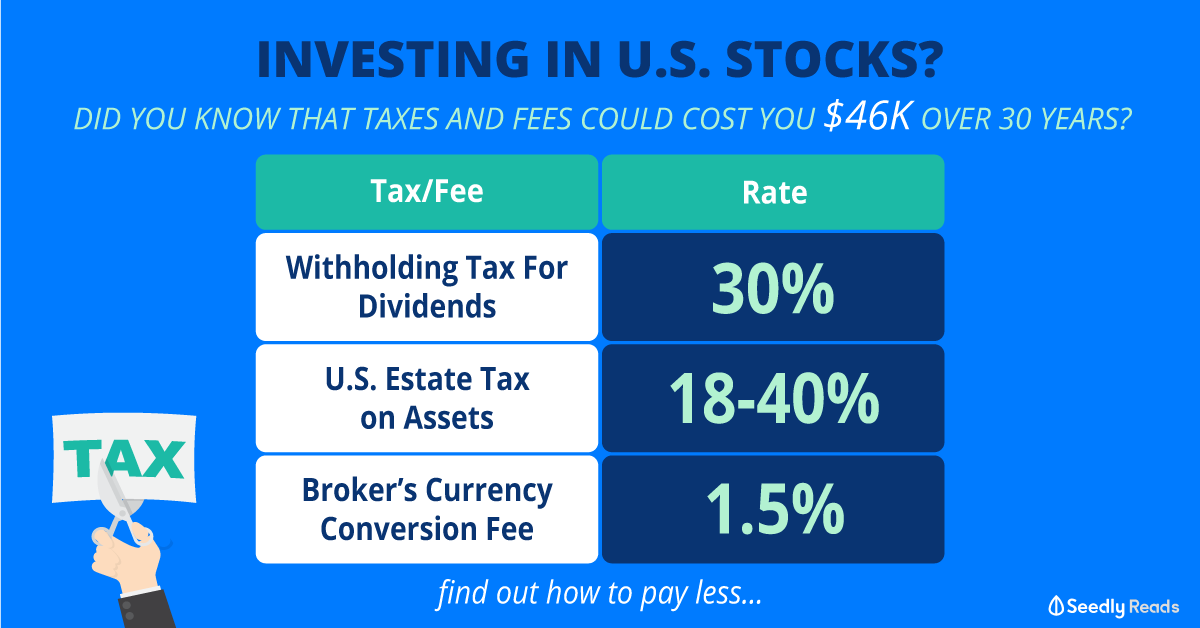

Sell orders are subject to an activity assessment fee from 0 01 to 0 03 per 1 000 of principal.

Brokerage account fees. Stock brokerage account commission fees comparison. Brokerage fees include annual fees to maintain the brokerage account subscriptions for premium. Broker assisted brokerage accounts in singapore fees comparison. For instance saxo markets charges a minimum fee of us 4 and a trading fee of 0 06 per transaction.

For every transaction made i e. A brokerage fee is a fee charged by the broker that holds your investment account. Most brokerage houses charge commission fees that range in a narrow band of 0 08 to 0 28 of your contract value. The cash trading account s and cash security account will only be closed when the securities have been transferred out of citibank brokerage.

In singapore the online stock brokerage account space is already a highly competitive space. This schedule contains information about the fees and charges that apply to your account and your transactions. 0 00 commission applies to online u s. Fee schedule for brokerage accounts 1 2 3 fees please read carefully.

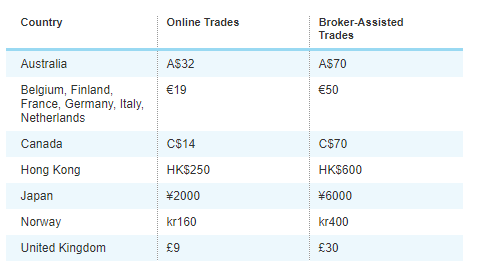

However if you are not comfortable with a do it yourself approach to trading and would want help from a human broker assisted accounts are the way to go. Please note that fees and other information are subject to change without notice. 3 brokerage charged shares warrants and listed managed investments. 1 for gst rounding reasons the final brokerage fee may vary from the stated or expected brokerage fee by a couple of cents.

Be a chase. For every stock that is bought or sold the brokerage charges a minimum fee and a trading fee based on the size of your transaction. If you have further queries please contact our citiphone hotline at 65 6225 5225. Account maintenance fees vary between 0 to 50 per account.

Clearly online brokerage accounts offer better rates than offline broker assisted accounts. Equity trades exchange traded funds etfs and options 0 65 per contract fee in a fidelity retail account only for fidelity brokerage services llc retail clients. If you want to invest beyond your basic 401 k or roth ira you are going to need to open something known as a brokerage account now i want to talk to you about five things you may want to consider before you open a brokerage account so you are ultimately happy with the decision you make about not only the type of account you open but the firm with which you establish a relationship.