Buisness Lines Of Credit

Bank has three options you can consider.

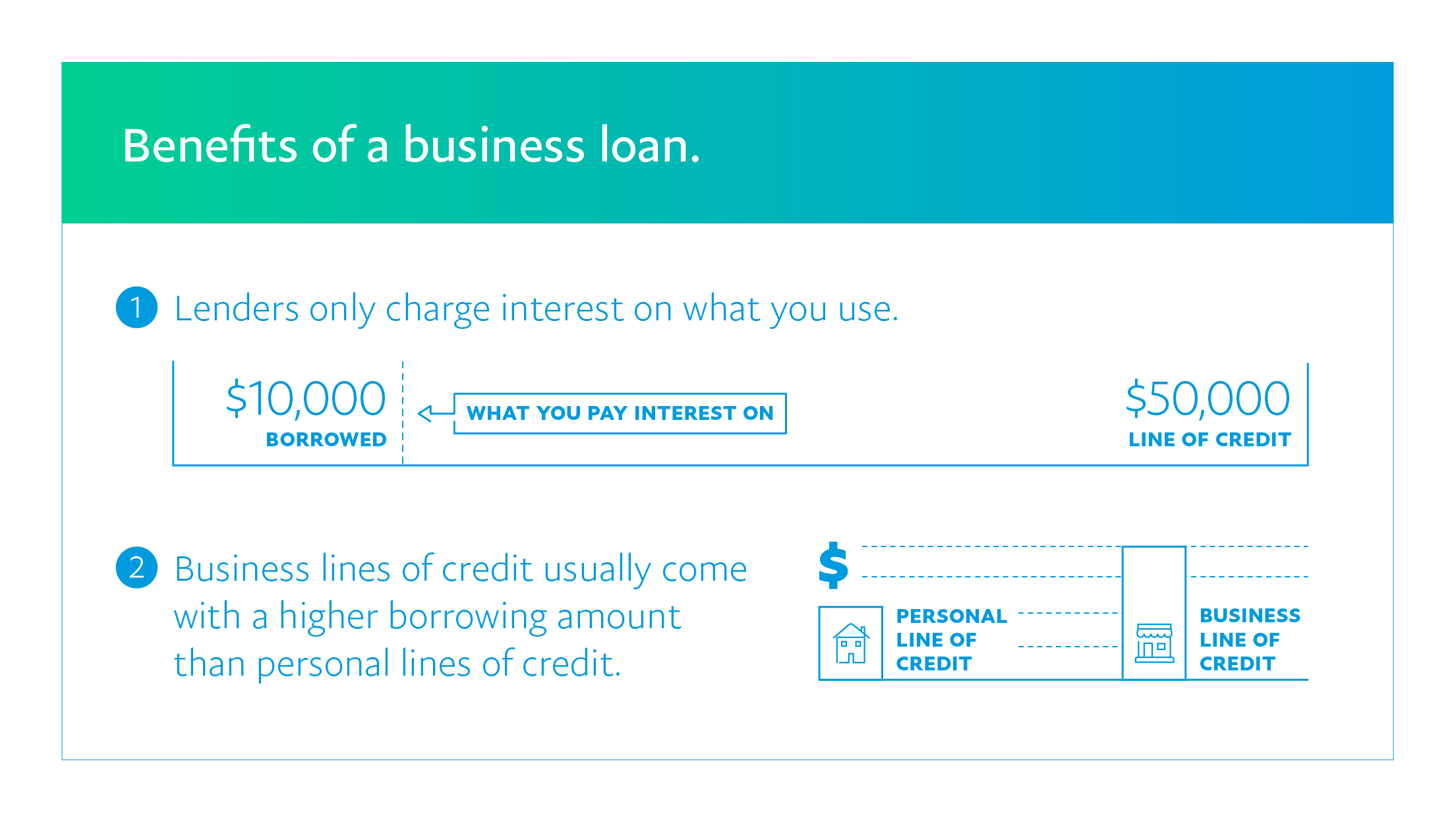

Buisness lines of credit. When considering a business line of credit u s. Business line of credit and term loan interest rate discounts are available to business applicants and co applicants who are enrolled in the program at the time of line of credit or term loan application for a new credit facility excludes specialty lending products that receive customized pricing. With a business line of credit you can borrow up to a certain limit. A business line of credit is a possible option for a small or start up business to get the capital needed to manage cash flow fund day to day operations and take advantage of new opportunities.

Essentially a business line of credit can help small businesses thrive and grow. A revolving line of credit is also a good option to offset fluctuations in working capital when your expenses stay constant. Unlike a traditional business loan you have the flexibility to borrow up to a set amount typically anywhere from 50 000 to 500 000 repaying only the amount you withdraw with interest. 5 year revolving line of credit no scheduled annual review.

A cash flow manager line of credit a business equity line of credit or a business line of credit. These are fees charged besides the interest due on the loan and the amounts vary by lender. A business line of credit gives access to a pool of funds to draw from when you need capital. Interest begins to accumulate once you draw funds and the amount you pay except for interest is again available to be borrowed as you pay down your balance.

A business line of credit is a type of small business loan that provides flexibility that a regular business loan doesn t. A revocable line of credit is a source of credit provided to an individual or business by a bank or financial institution that can be revoked or annulled at the lender s discretion or under. Our picks for the best business lines of credit come with limits ranging from 10 000 to 3 million. Small business administration ideal for businesses in operation for less than 2 years.

Business lines of credit fees. It will give you access to funds to continue to pay bills on time or purchase additional inventory if needed. Credit lines from 5 000 to 50 000. Which line of credit may be right for your business.

A small business line of credit is subject to credit review and annual renewal and is revolving like a credit card. Wells fargo small business advantage line of credit backed by u s.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)