Business Factoring Companies

Small business factoring is beneficial.

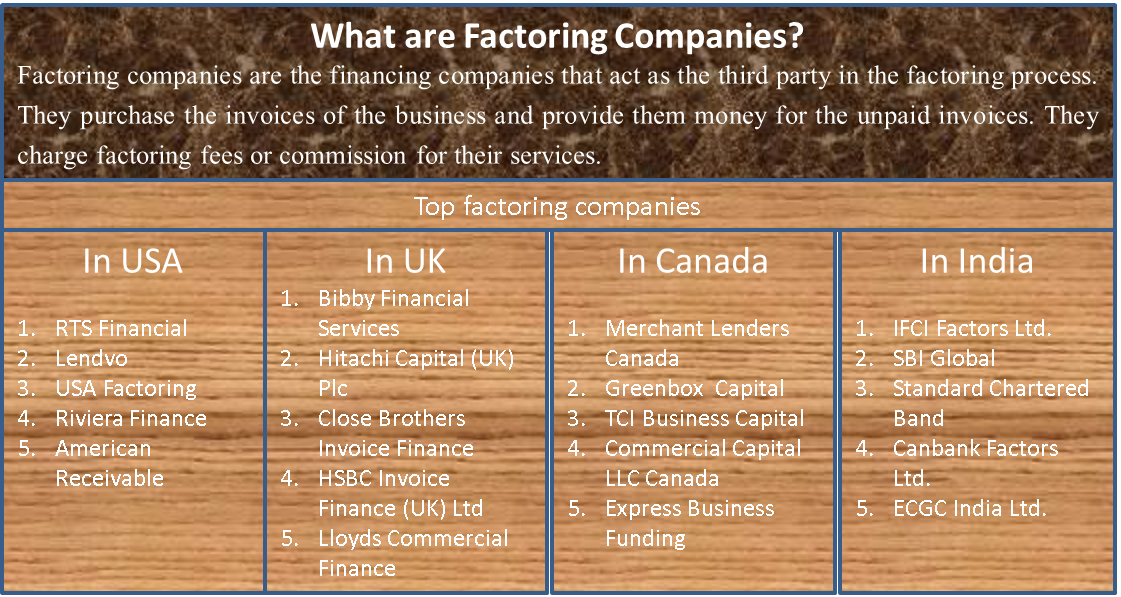

Business factoring companies. Each company selected earns stellar reviews from small business owners. Factoring companies will consider the quality and quantity of your invoices when determining whether to approve your business for invoice factoring. In other words are your customers likely to pay. One of the oldest forms of business financing factoring is the cash management tool of choice for many companies.

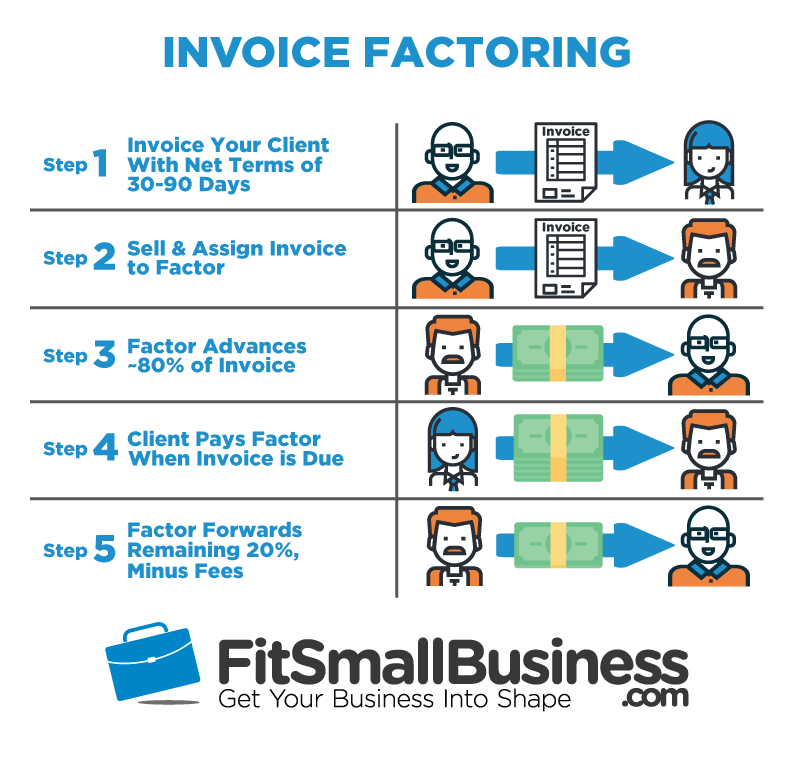

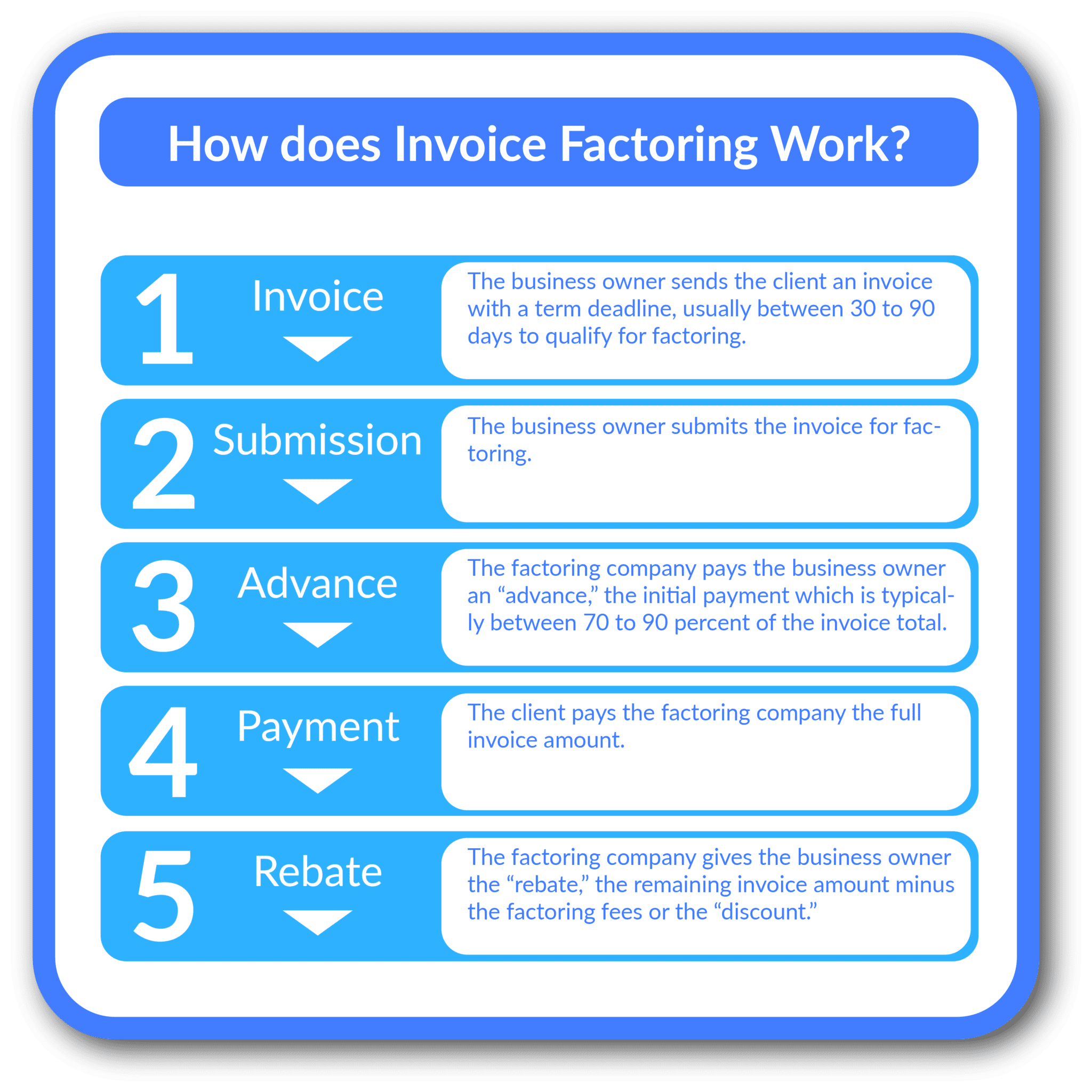

Let us match you with one of our invoice factoring companies in minutes. Get detailed information regarding how to select the best factoring company for your business. Factoring companies typically advance 70 90 percent of the invoice value up front. However there s more to picking the right provider than just choosing the one that provides the lowest fees.

Lastly look at how long your factoring company has been in business. Every business requires steady working capital in order to be successful but slow paying clients can derail even the best financial plan. Rates vary by company but they usually start between 1 and 5 and many freight factoring companies charge a lower rate for invoices that are paid quickly. We reviewed more than two dozen invoice factoring companies to select the six best invoice factoring providers.

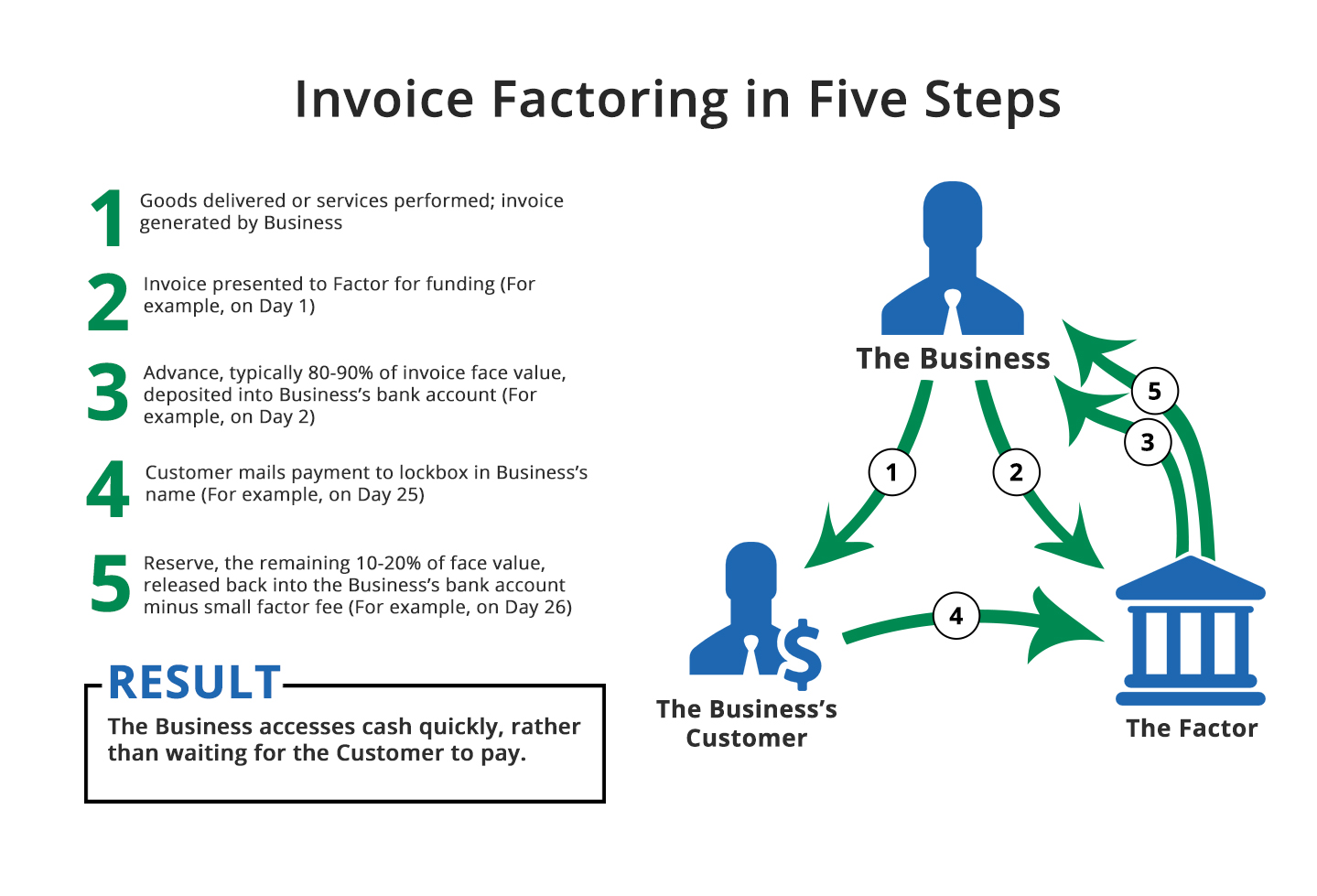

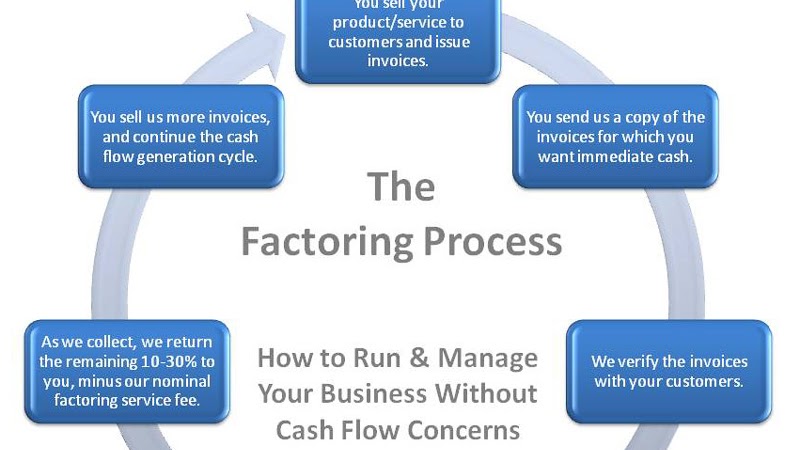

Invoice factoring is a financial transaction in which a business sells its accounts receivables invoices at a discount to an external financing company known as a factor or factoring company. Making the best choice for your business there s no doubt that finding the right invoice factoring solution can make a huge difference to your small business. It is to your advantage to work with a company that has been in business for long time. Are you tired of waiting 30 60 or 90 days for your customers to pay.

We re dedicated to helping small business owners just like you secure the funding necessary for growth. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Factoring is very common in certain industries such as the clothing industry. Because of these financial challenges small businesses maintain consistent working capital by working with business factoring companies.

With invoice factoring a business can convert unpaid invoices into immediate cash through an advance of 80 to 90 of the total amount owed. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Remember that you will be relying on them for cash flow. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.