Business Factoring Loans

Factoring is very common in certain industries such as the clothing industry.

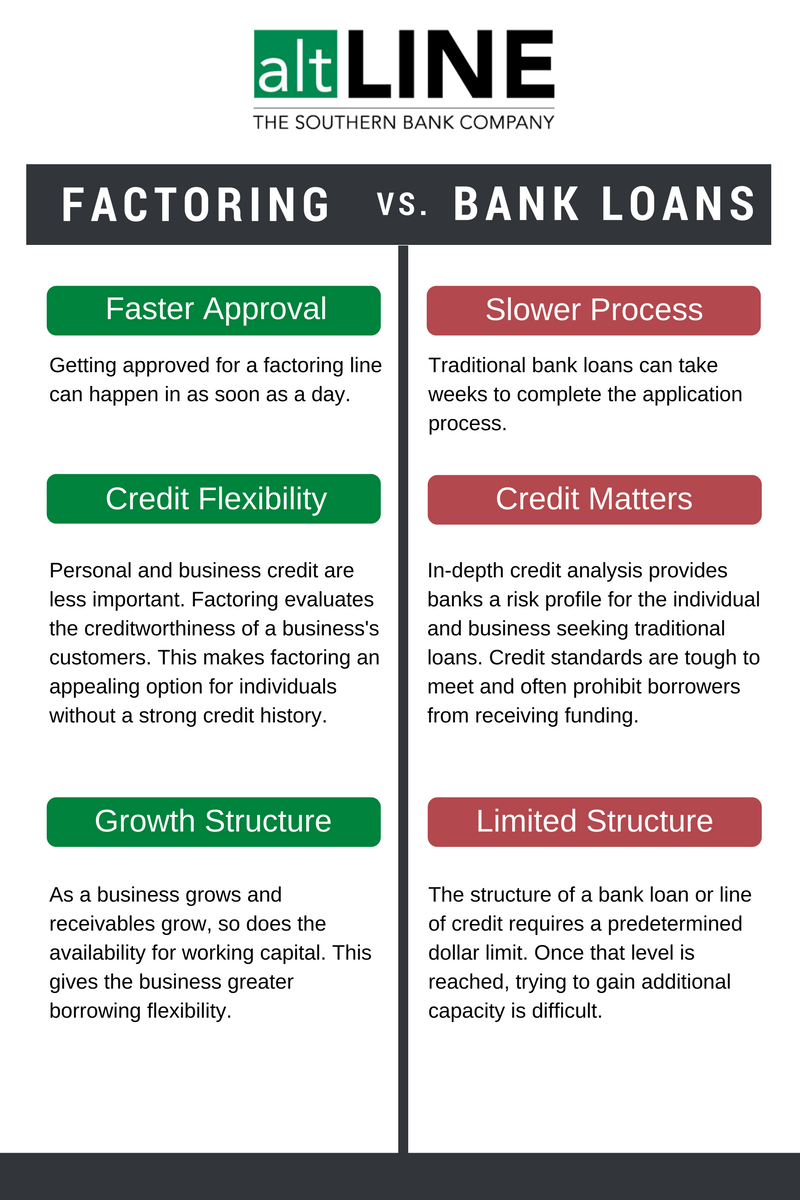

Business factoring loans. Your business loan isn t just a way to get financing for your business. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Receivables financing allows for strong cash flow and our advance rates up to 96 against all open invoices simply cannot be beat. Interested business owners can contact a factor there are several independent factoring companies searchable via the commercial finance association or any bank that offers the service.

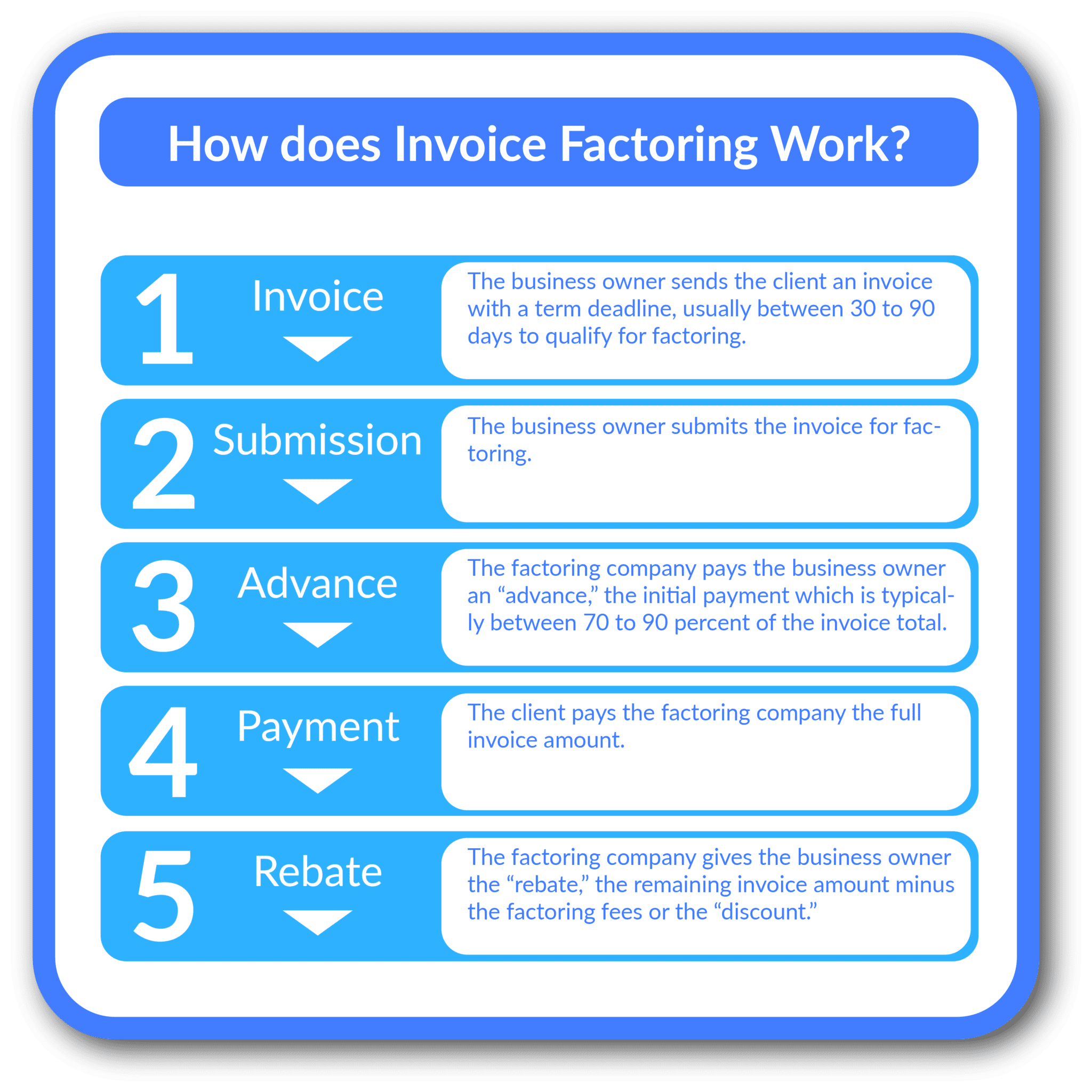

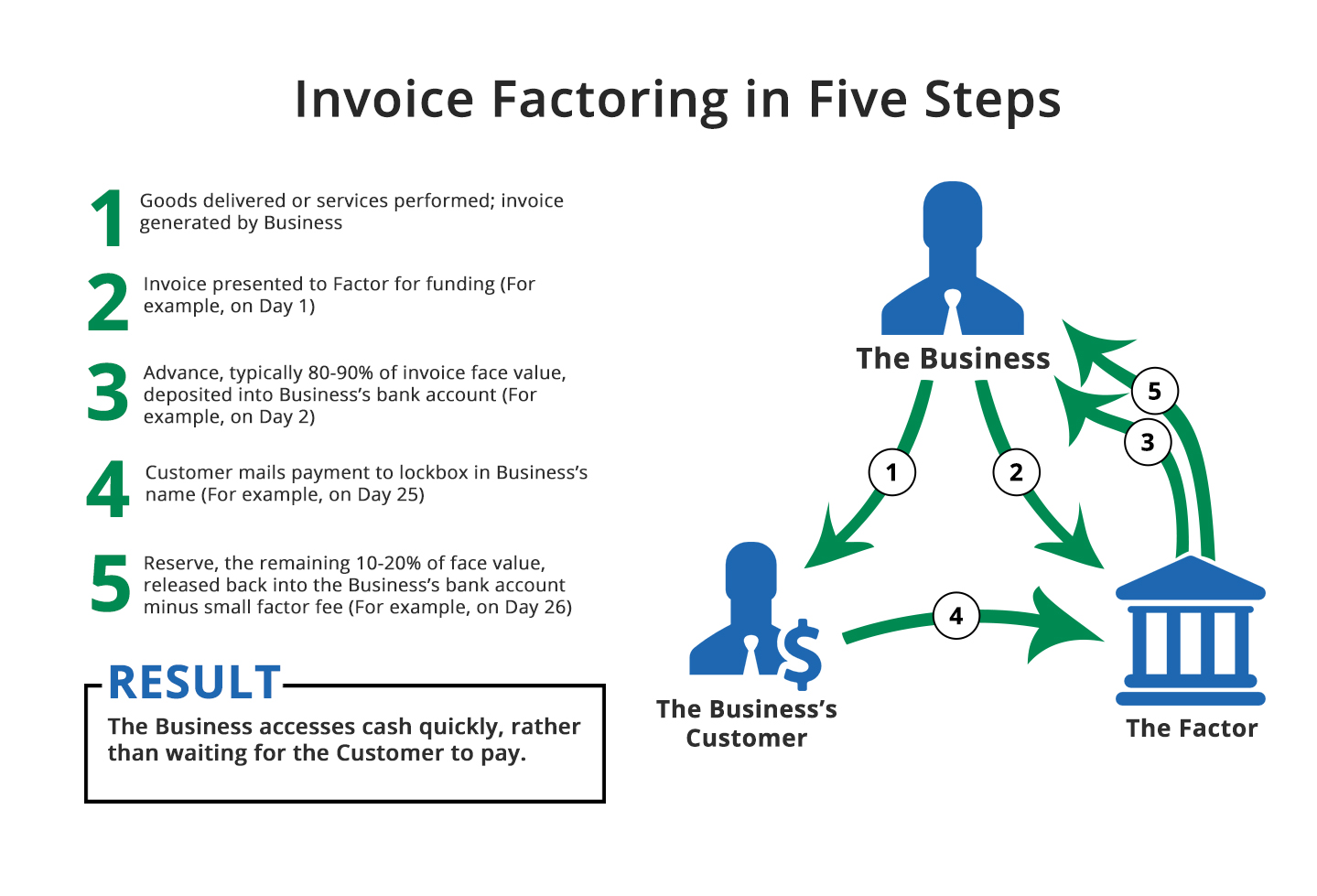

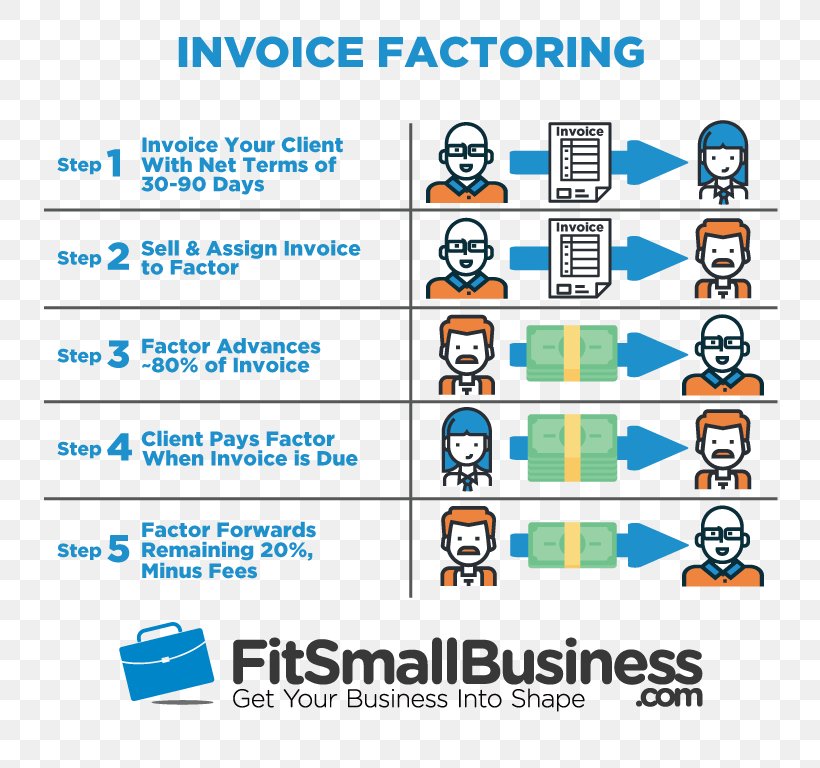

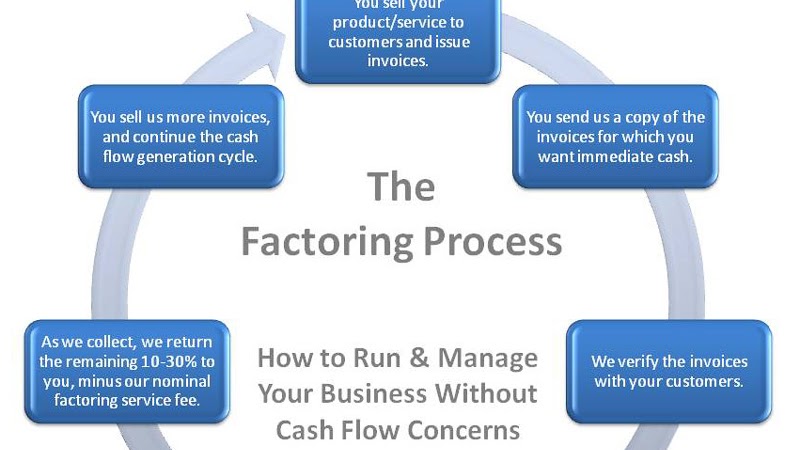

Factoring is not a business loan it s the sale of an asset the invoice. Essentially the factor is purchasing the right to collect on an invoice when it s paid minus a discount of 2 to 6. Factoring allows a business to obtain immediate capital or money based on the future income attributed to a particular amount due on an account receivable or a business. Invoice factoring is one of two types of invoice financing.

Revenue based loans and loans in general can be structured in many different ways depending on the lender market trends the industry and the financial situation of the borrower. How a factor works. Unlike traditional loans with restrictive use covenants you can use receivable factoring proceeds to re invest in your business and expand marketing and operations the way you see fit. Like accounts receivable factoring invoice financing allows you to access financing based on the value of your receivables.

Invoice factoring is a financial transaction through which a business sells unpaid invoices at a discount to a factoring company also called a factor for immediate cash. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. It is the purchase of future receivables. Technically factoring is not a loan.

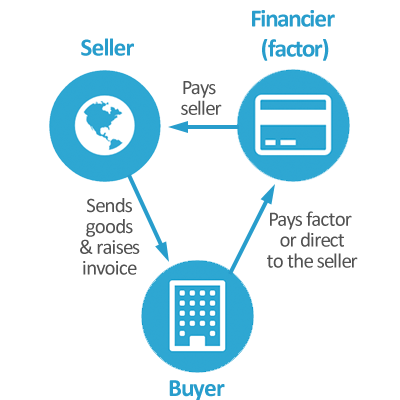

A third party known as a factor purchases a company s invoice s or purchase order s at a discount giving a business owner access to a percentage of that invoice or purchase order now instead of when the invoice or p o. The factor will pay around 75 of the invoice up front followed by the remainder once they ve collected on the invoice. From there you can research a variety of factors and choose the one that is the best fit for your situation. One of the oldest forms of business financing factoring is the cash management tool of choice for many companies.

Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their.