Business Insurance Premiums

Below are examples of insurance premiums that are deductible.

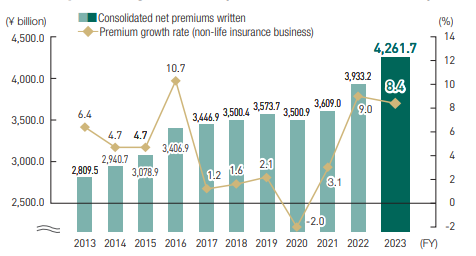

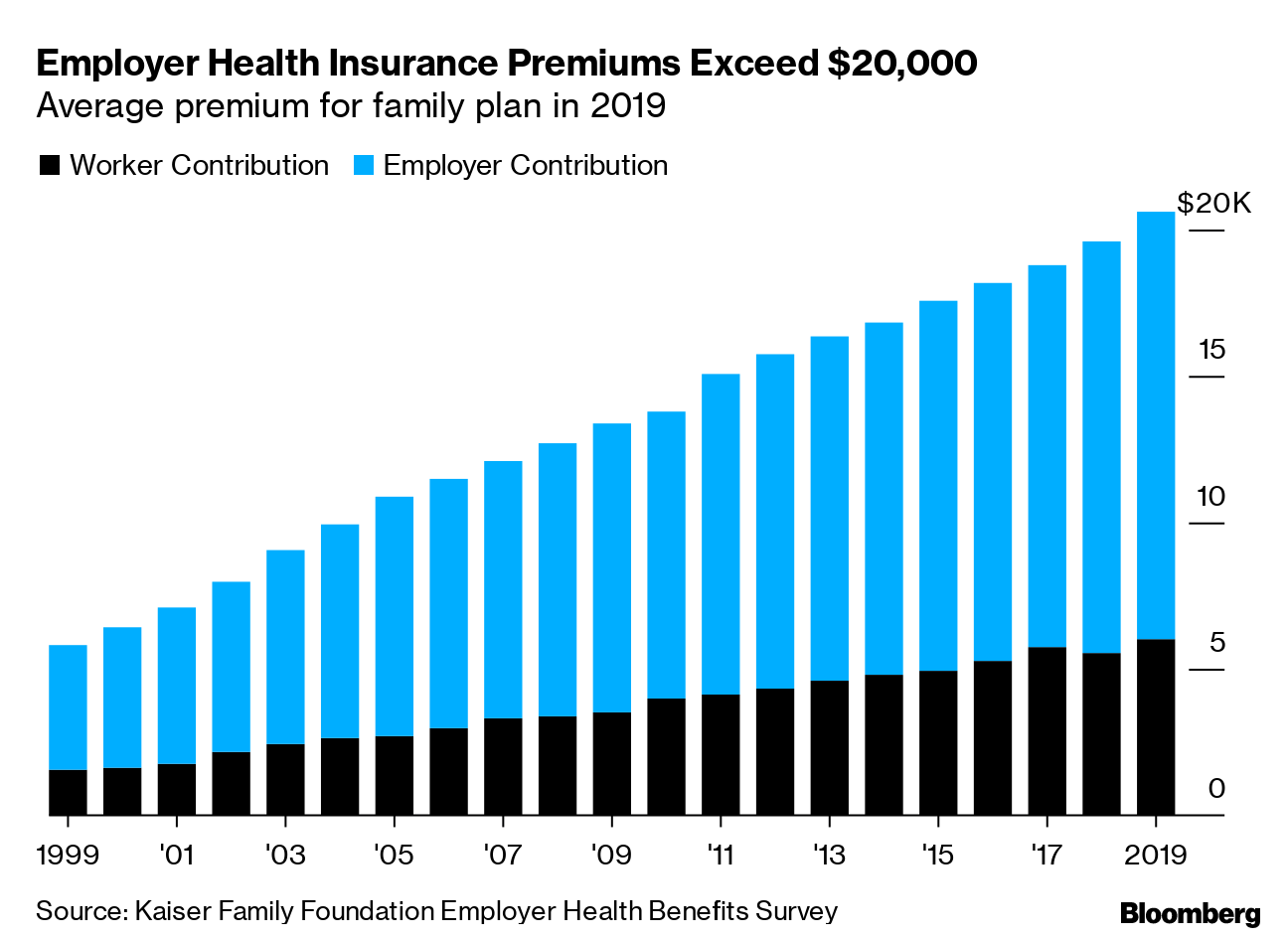

Business insurance premiums. Group term life insurance policy where employees are the intended beneficiaries either because the employees are the named beneficiaries or there is a contractual obligation for the employer to pass the payout to the employees or their next of kin. A premium is the cost of your small business insurance protection you pay it initially when you purchase your coverage and then periodically to keep your insurance active. Most small business owners 48 pay between 300 and 600 annually for their policies and 17 pay less than 300. If you are shopping for business insurance one of the first questions you are likely to ask is how much will it cost insurance premiums can be difficult to predict because they are based on a variety of factors.

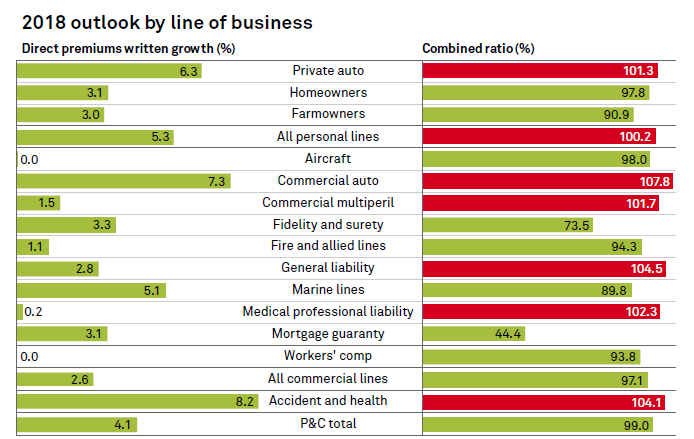

Your business insurance premiums will depend upon your company s individual requirements and the insurer s assessment of the risk associated with your business. Primary and excess cyber renewals are now averaging premium increases in the 5 to 10 range. In your inbox every business day. Business interruption insurance that pays for lost profits if your business is shut down due to a fire or other cause note that workers compensation premiums paid by a partnership to insure its partners are deductible as guaranteed payments to partners.

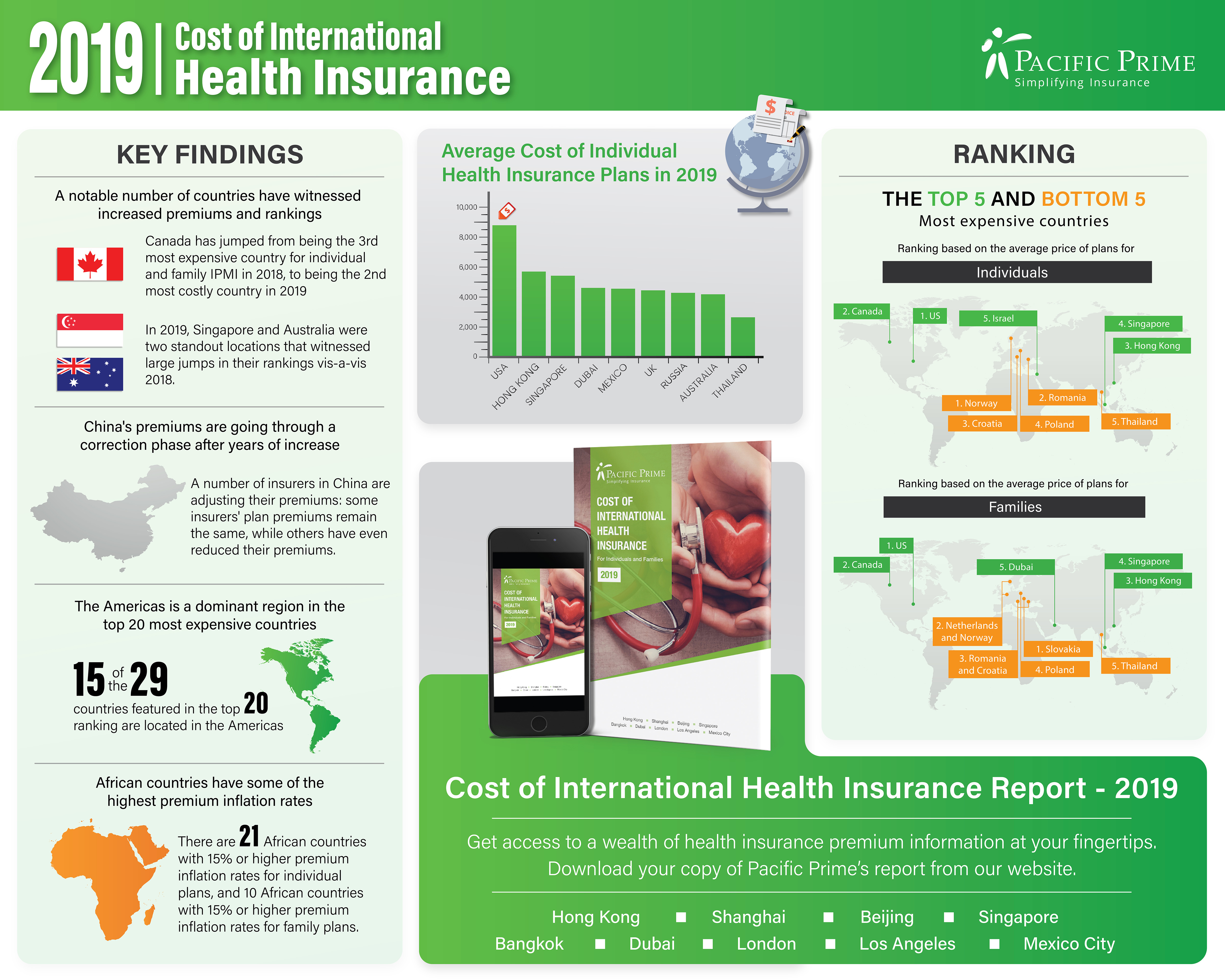

An insurance premium is the amount of money an individual or business must pay for an insurance policy. Nevertheless you can estimate your cost using data that is available online. Typically this premium is the amount paid by a person or a business for plans that provide auto home healthcare or life insurance. For example a retail business will probably have different insurance needs compared to a construction company or an administrative company.

How insurance premiums work insurance premiums usually have a base calculation and then based on your personal information location and other information you will have discounts that are added to the base premium that reduces your cost. Premiums can be paid in full when you start your policy or through recurring monthly payments. Money asked life insurers what the insurance premium would be on a r2m life policy for a 33 year old man working in admin and how it would differ if he was a smoker.

.jpg)

.jpg)