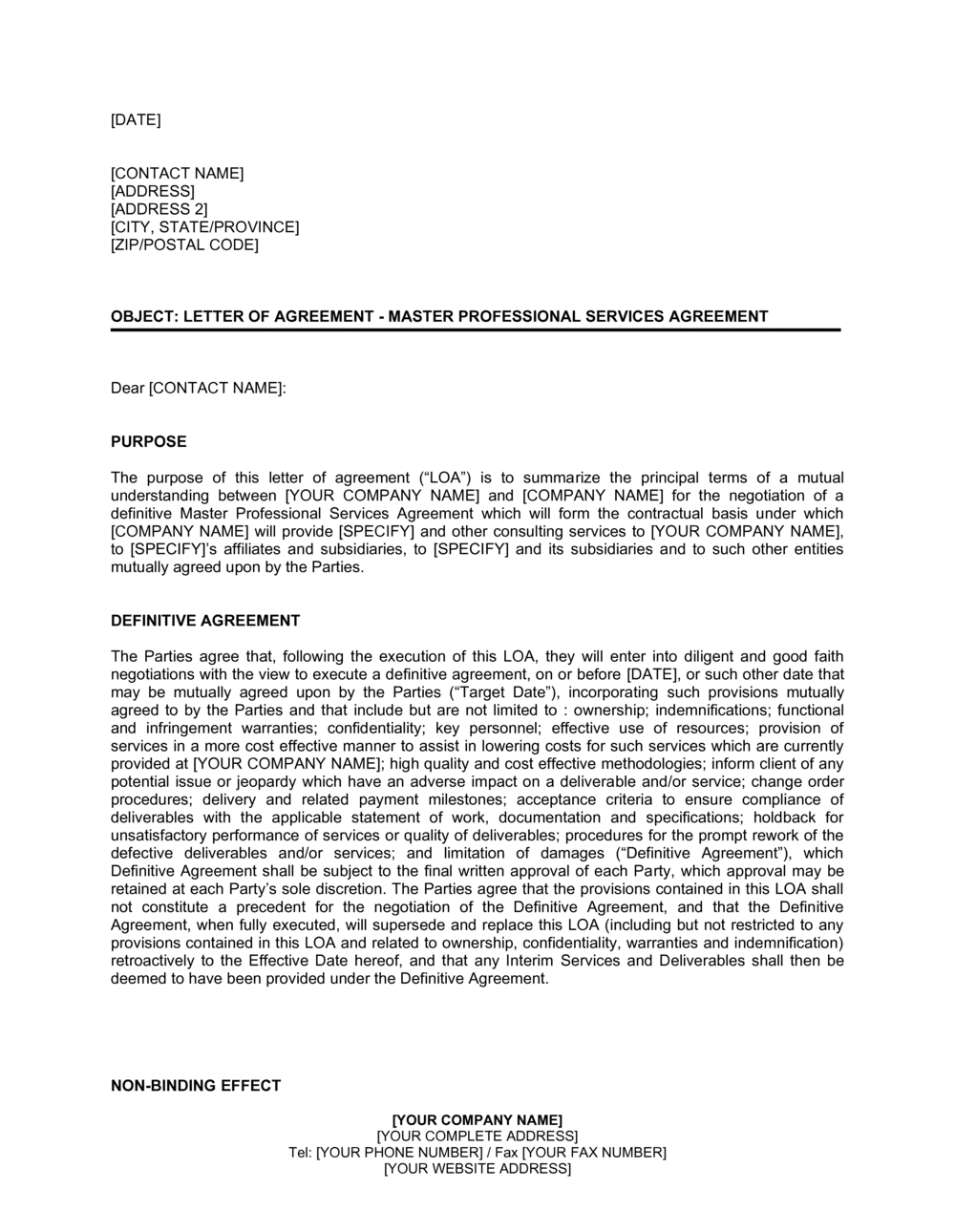

Business Loa

Apply for business loans online of upto 50 lakhs without collateral from tata capital.

Business loa. Business loan online avail bank loan for business with quick approvals and flexi repayment tenure of upto 48 months. The business loan for doctors is a loan scheme that is designed for doctors who are in need of funds to either open their own clinic or upgrade an existing clinic. Showing only business finance definitions show all 119 definitions. Get flexibility in how you structure your loan have multiple loans within one facility that has an overall limit.

The business loan for women is a unique loan product that has specially been designed to cater to the financial needs of women entrepreneurs. Business credit cards grow your business potential with one of our business credit cards. If your business needs money to help with cashflow or to help with growth a business loan could help. Search for loa in online dictionary encyclopedia.

Business accounts accounts and term deposits to help you manage your cash flow and earn interest. The loan amount approval can be given in 1 business day. What documents are needed. The loan application process takes less than 5 minutes when you connect to myinfo singpass or myinfo business corppass.

A business loan is a way to borrow a set amount of money which you pay back to the lender with interest. We have 136 other definitions for loa in our acronym attic. The uob business loan aims to help smes expand their business and gain access to working capital financing to support their day to day business operations. Uob business loan is a bundled loan facilities which combines sme working capital loan temporary bridging loan offered jointly by enterprise singapore and uob bizmoney.

A highly flexible loan with transparent pricing to support your business to grow and repayment options to meet your cash flow cycle. Loans and overdrafts check out our flexible loans and cash flow options to seize your next business opportunity. Business loans come as either secured or unsecured loans and allow businesses to borrow from 5 000 to 1 000 000 though some lenders do not have limits on their borrowing amounts. If your application is done via myinfo singpass or myinfo business corppass.

Business loans are designed to suit the needs of a business rather than an individual.