Business Loan Or Line Of Credit

When considering a business line of credit u s.

Business loan or line of credit. Unlike a traditional business loan you have the flexibility to borrow up to a set amount typically anywhere from 50 000 to 500 000 repaying only the amount you withdraw with interest. Many small business experts suggest that first time applicants should start a modest line of credit and pay off the debt quickly as a way of building a credit profile. Lines of credit on the other hand often have variable interest rates based on the prime rate and although interest rates are usually lower for a line of credit versus a loan your payment might go up or down as your interest rate does. What is a business line of credit.

September 2020 how we evaluated the best business lines of credit when evaluating the best business lines of credit we considered rates terms qualifications and funding speed to be equally important. If you re ready to gather together your information and compare potential business loans we re here to help. A business line of credit gives access to a pool of funds to draw from when you need capital. If a business term loan resembles a mortgage a business line of credit is similar to a cash advance on a credit card in that it is a revolving loan.

That means you can access money up to your credit limit whenever and as often as you wish repay the amount under flexible terms and borrow money that you ve paid back as many times as you d like. While most traditional lenders offer better rates they also have higher qualification requirements and slower funding speeds on lines of credit. Maintaining a line of credit in good standing may help build your business credit rating and position you for better loan terms if you seek future financing. Similar to a credit card a business line of credit allows you to borrow up to a set limit.

Commercial real estate financing. The rate you can qualify for will vary depending on the loan amount the type of loan the lender and your business s creditworthiness. Whether you choose a 500k business loan or a 500k business line of credit it is important to take the time to compare lenders before making a decision. Line of credit or a fixed term loan vs.

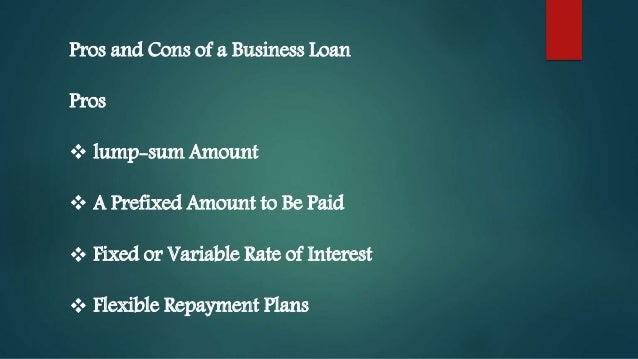

500k is a substantial amount of money so even low interest rates will have relatively high costs. Business loans typically have fixed interest rates. A cash flow manager line of credit a business equity line of credit or a business line of credit. There are obviously many more types of different business loans than there are lines of credit.

Bank has three options you can consider. For example as you refine your search you ll want to carefully consider the specifics of an sba loan vs.