Business Loan Programs

Bnd continues to work through the details for this program based on feedback.

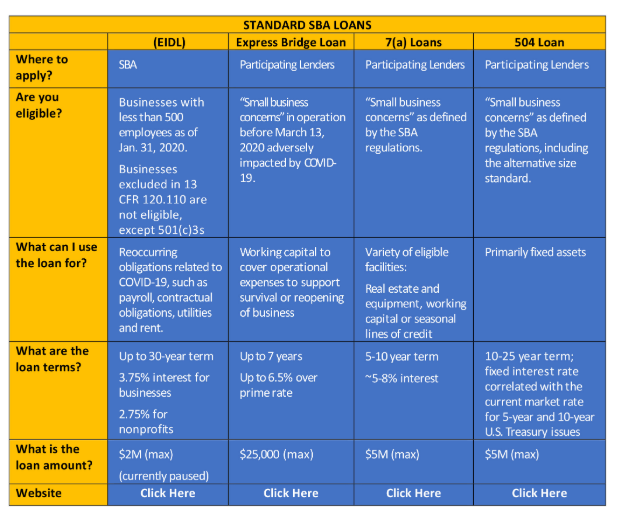

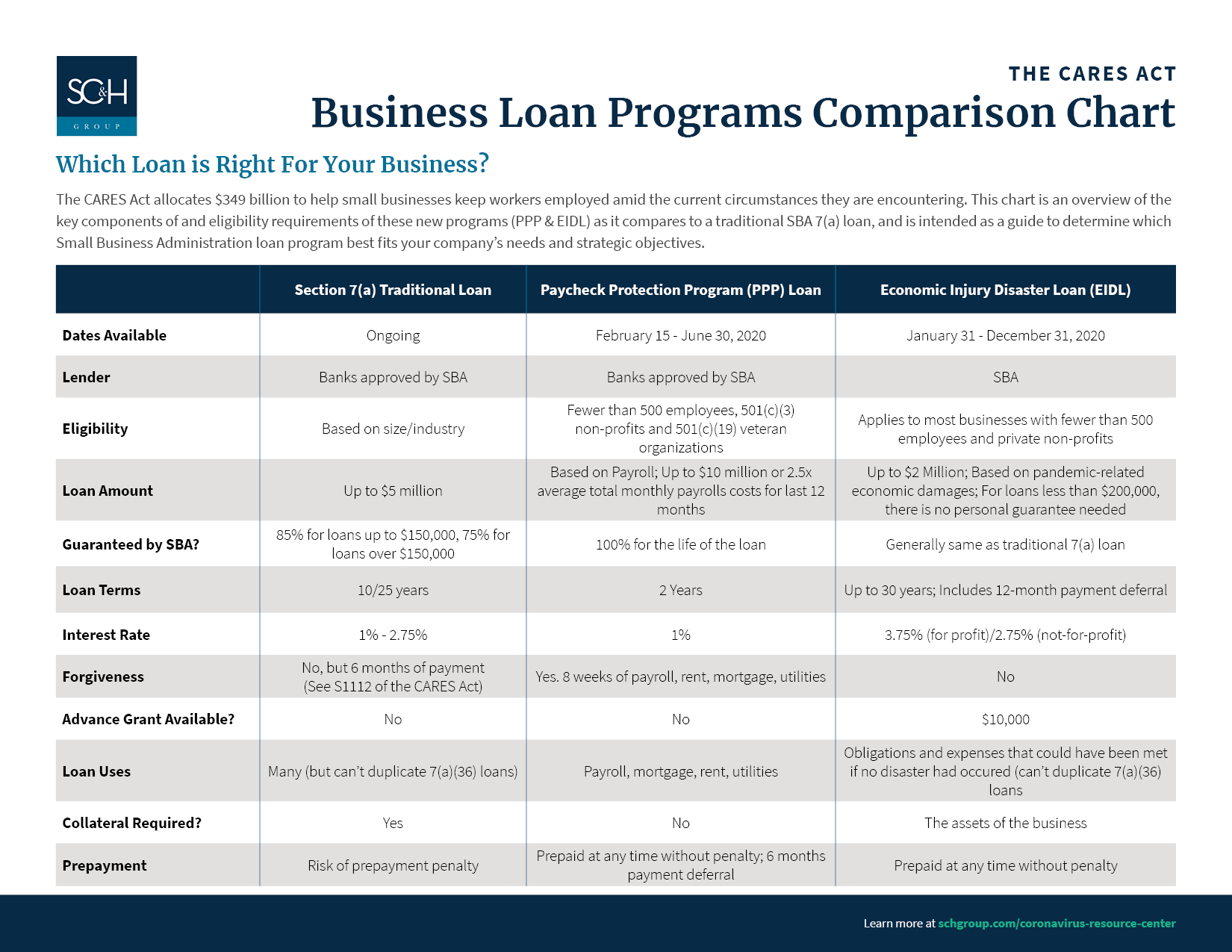

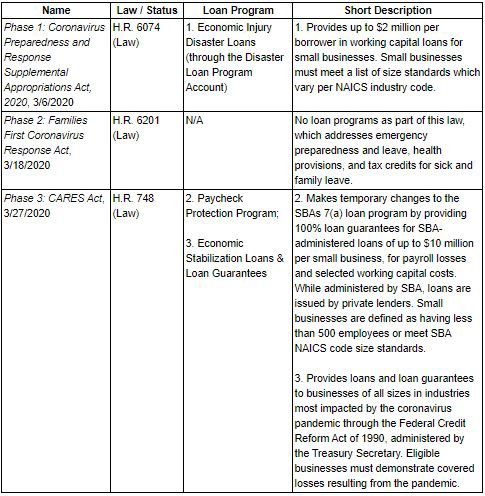

Business loan programs. Meet sba size standards be for profit not already have the internal resources business or personal to provide the financing and be able to demonstrate repayment. The small business emergency loan program offers 2 500 to 35 000 in loans to cover operating expenses. 7 a loans are the most basic and most used type loan of the small business administration s sba business loan programs. All businesses that are considered for financing under sba s 7 a loan program must.

Its name comes from section 7 a of the small business act which authorizes the agency to provide business loans to american small businesses. The sba connects entrepreneurs with lenders and funding to help them plan start and grow their business. We support america s small businesses. The small employer loan fund self assists local financial institutions and certified development corporations cdc s in providing loans to assist very small north dakota businesses in their recovery from the negative impacts caused by the covid 19 pandemic.

Health and government officials are working together to maintain the safety security and health of the american people. The loans have a 0 interest rate and five year terms and they are eligible for forgiveness. Sba provides loans to businesses not individuals so the requirements of eligibility are based on aspects of the business not the owners.