Business Loan Terms And Conditions

You must be an owner of this business and not already have this product.

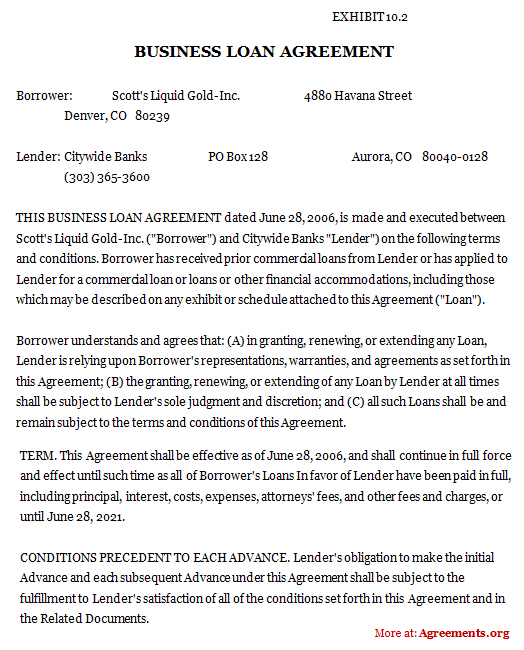

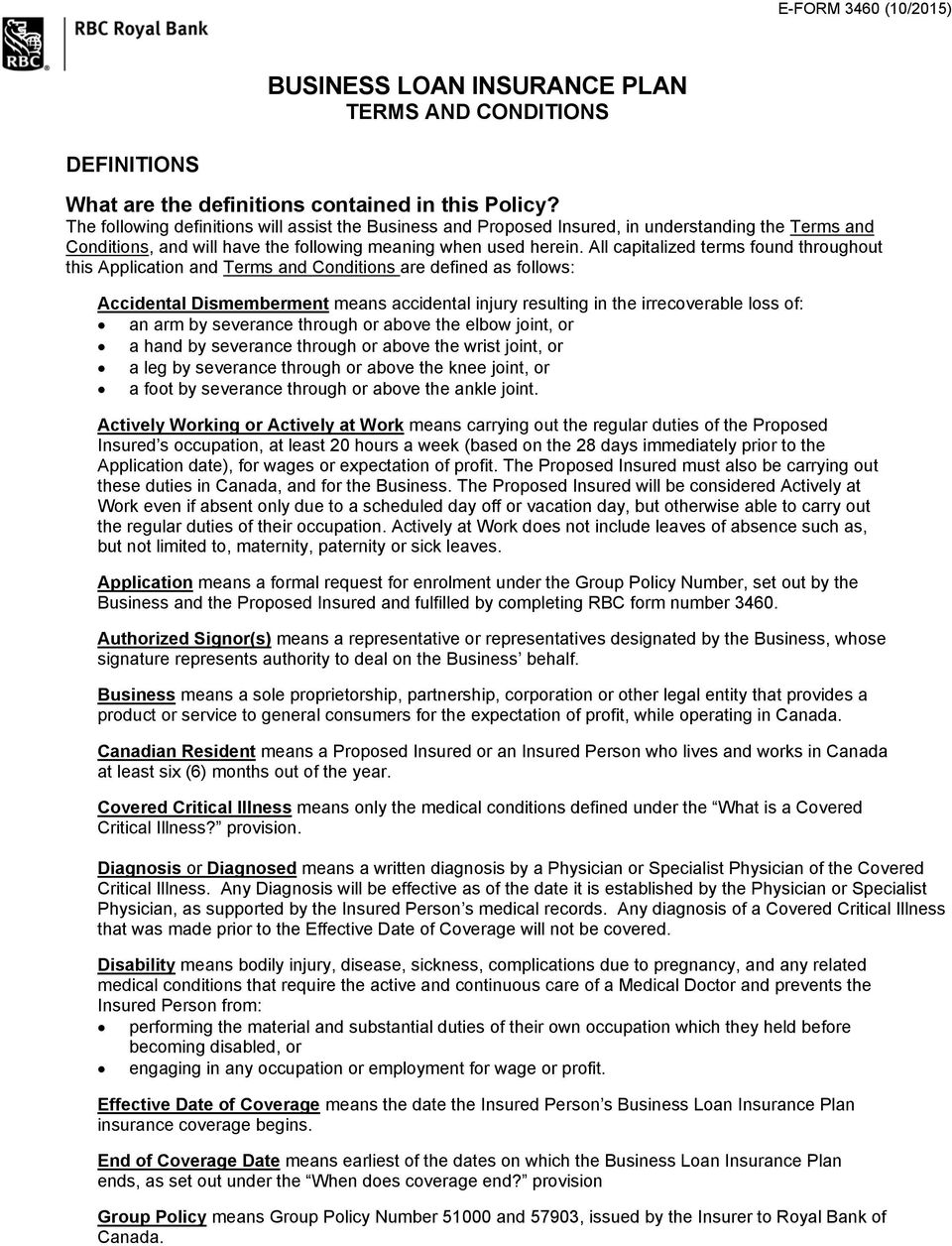

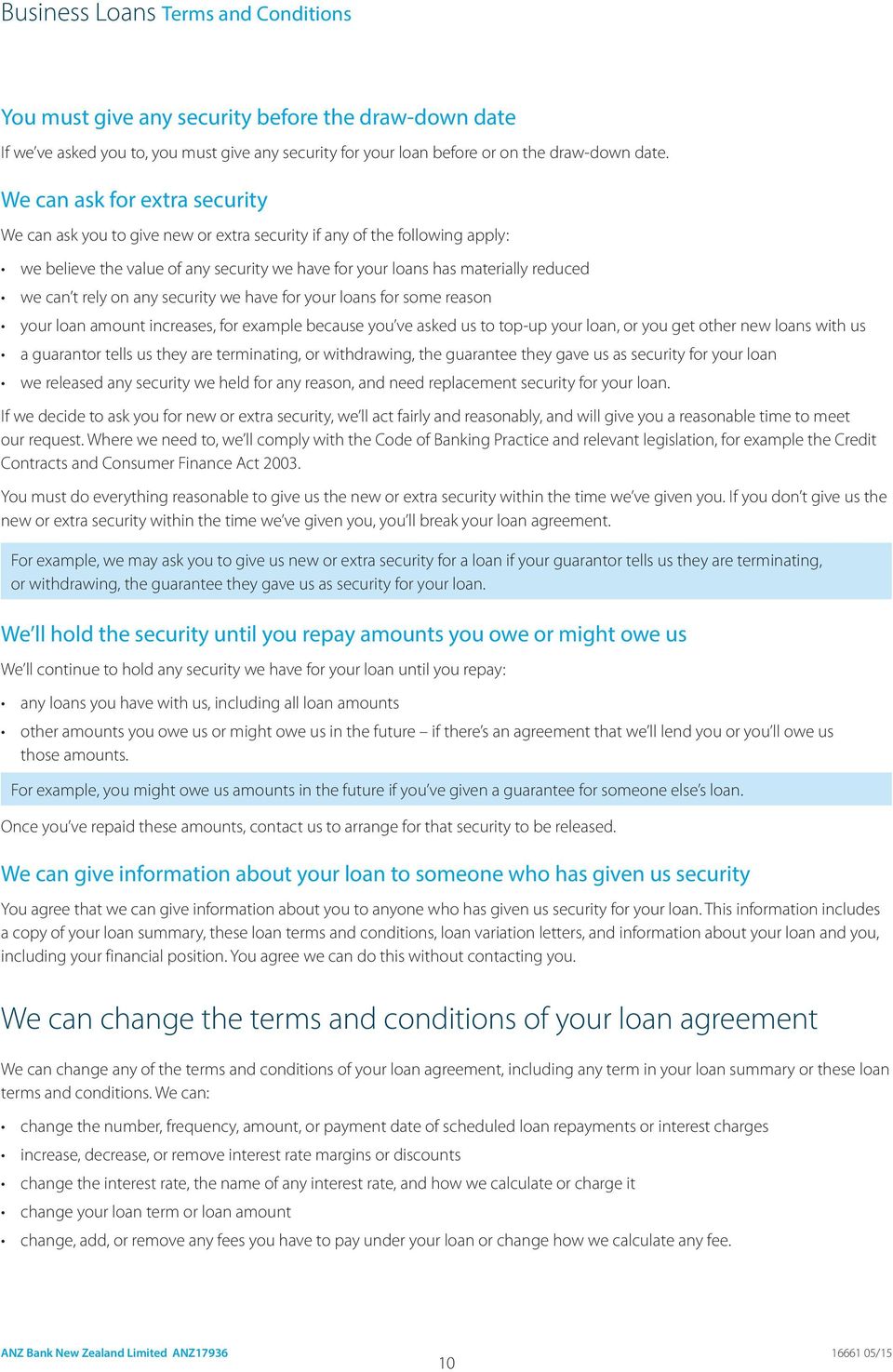

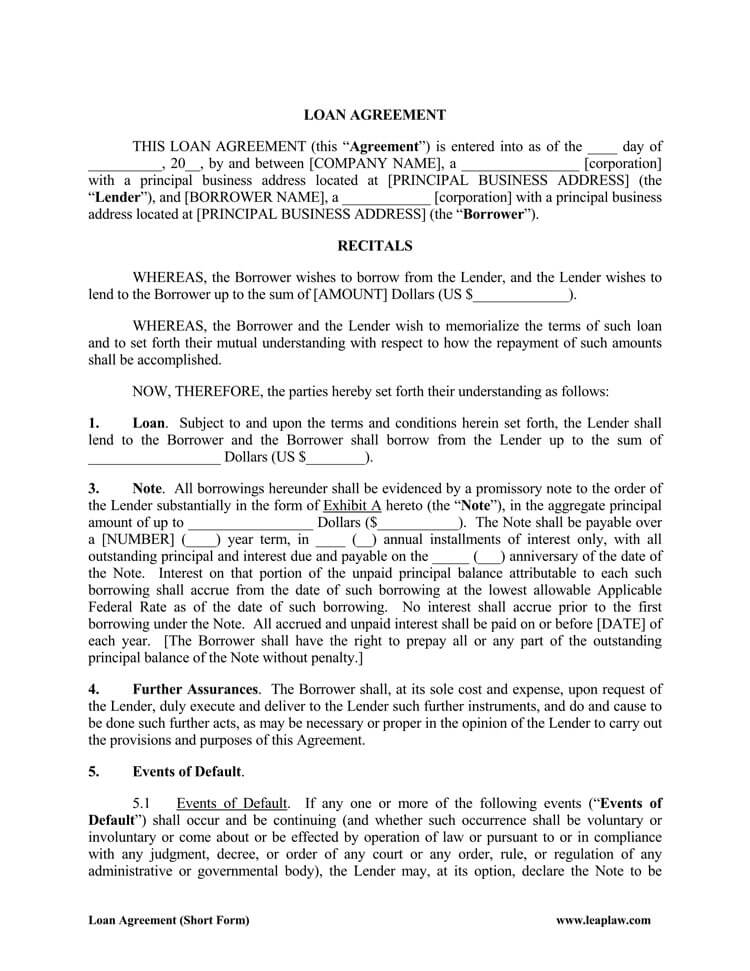

Business loan terms and conditions. The fixed rate discount will apply until the end of your fixed term or until you request us to vary the loan. Terms for credit products are subject to final credit approval of the business and its owners. 4 years in business or 2 years in business for asset backed directors 20 000 in monthly sales healthy credit 100 business purpose. The variable discount is for the life of the loan as long as the loan is retained under a variable business term loan product.

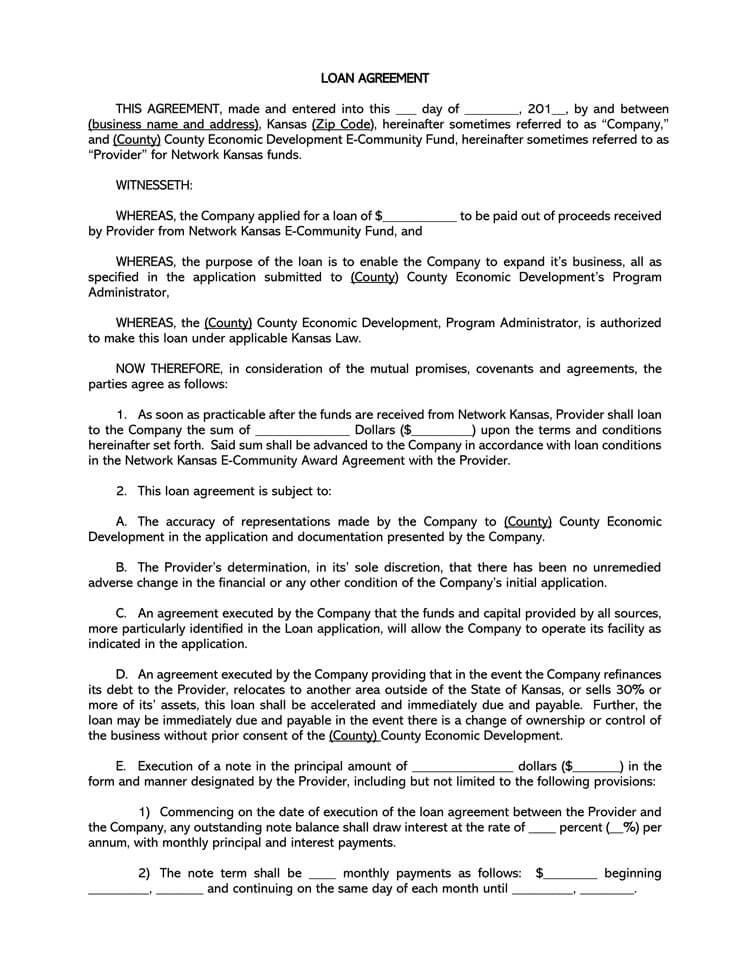

The annual interest rate will be 3 beginning from the date of the loan being provided. Repaying the balance of the loan on or before december 31 2022 will result in loan forgiveness of 25 percent up to 10 000. Business accounts accounts and term deposits to help you manage your cash flow and earn interest. Eligible businesses and organisations are entitled to a one off loan.

Interest will not be charged if the loan is fully paid back within one year. A lender may consider paying the funds into a personal current account if no business bank account is held if the business has been satisfactorily evidenced. The terms of the loan are covered by the scheme. A physical address is required to receive a wells fargo business credit product.

Merchant and payments from eftpos machines to online payments we have. If a business receives an sba guaranteed loan for 5 million the maximum guaranty to the lender will be 3 75 million or 75 percent. As of june 26 2020 businesses eligible for ceba now include owner operated small businesses that do not have a payroll sole proprietors receiving business income directly as well as family owned corporations remunerating in the form of dividends rather than payroll. The business loan cost example is based on the following business scenario.

Lendingkart group nbfc has the right to recall the loan facility if the loan proceeds are used for any purpose other than the declared purpose. The guaranty percentage varies depending on the loan amount and program type. Is the loan available under the bounce back loan scheme a personal loan or business loan. A loan under the scheme is a business loan.

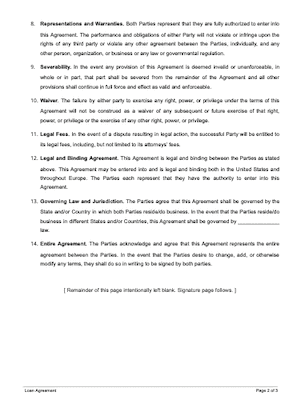

Business credit cards grow your business potential with one of our business credit cards. Other specific terms and conditions may apply to lending facilities in accordance with the relevant letter of offer or other agreements in writing between mfi and the borrower and to the extent if any that the specific terms and conditions conflict with the general terms and conditions then the specific terms and conditions will apply. The sba s maximum exposure is 3 75 million 4 5 million under the international trade loan. The maximum amount loaned is 10 000 plus 1 800 per full time equivalent employee.

The proceeds of the loan shall be utilised only for the purpose mentioned hereinabove and in compliance with the terms and conditions prescribed by lendingkart group nbfc.