Business Revolving Line Of Credit

Revolving credit and line of credit loc are two types of financing arrangements available to both business and personal clients.

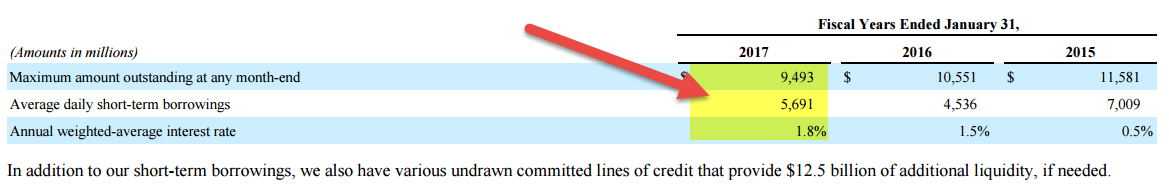

Business revolving line of credit. No business owner can predict an emergency such as a crucial piece of machinery breaking down for example. The best revolving line of credit for business kabbage. Interest begins to accumulate once you draw funds and the amount you pay except for interest is again available to be borrowed as you pay down your balance. Getting revolving credit can enable your business to pursue opportunities quickly even when you don t have funds available to invest.

A business line of credit is a possible option for a small or start up business to get the capital needed to manage cash flow fund day to day operations and take advantage of new opportunities. Kabbage may be an option if you need a business line of credit and your credit isn t in the best condition. A revolving line of credit provides access to funds when they are most needed and without the delay involved in completing an application. It comes with a free rewards program and your choice of rewards points or cash back.

Please view details for more information on rates fees and features. A small business line of credit is subject to credit review and annual renewal and is revolving like a credit card. It is also commonly used to take advantage of unexpected opportunities or investments. Our picks for the best business lines of credit come with limits ranging from 10 000 to 3 million.

A company may have their revolving line of credit secured by company owned assets. Another term for revolving line of credit is a small business line of credit. A revolving line of credit can be beneficial in terms of taxes. A business line of credit is a revolving line of credit that you can draw against as you need it.

Best for low credit score. It is typically used for short term working capital to help improve cash flow or to finance unforeseen expenses. It s no secret that finding a lender when you have a less than perfect credit score can be a challenge. The business platinum credit card is a revolving credit option for everyday business expenses for businesses with annual sales up to 2 million and needing fewer than 100 cards.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)