Buy Stock Limit Order

The investor would place such a limit order at a time when the stock is trading above 50.

Buy stock limit order. A buy limit order will only execute when the price of the stock is at or below. A buy limit order can only be executed at the limit price or lower and a sell limit order can only be executed at the limit price or higher. The stock dips down to 11 but never goes lower before returning to a 14 per share. If that price is not met your order will not be executed.

The investor could submit a limit order. Orders on the hong kong market. Is currently trading at 15 per share and you set your limit order to buy at 10. A buy stop order is triggered when the stock hits a price but if its moving faster than expected without a limit price you may end up paying quite a bit more than you anticipated when you first.

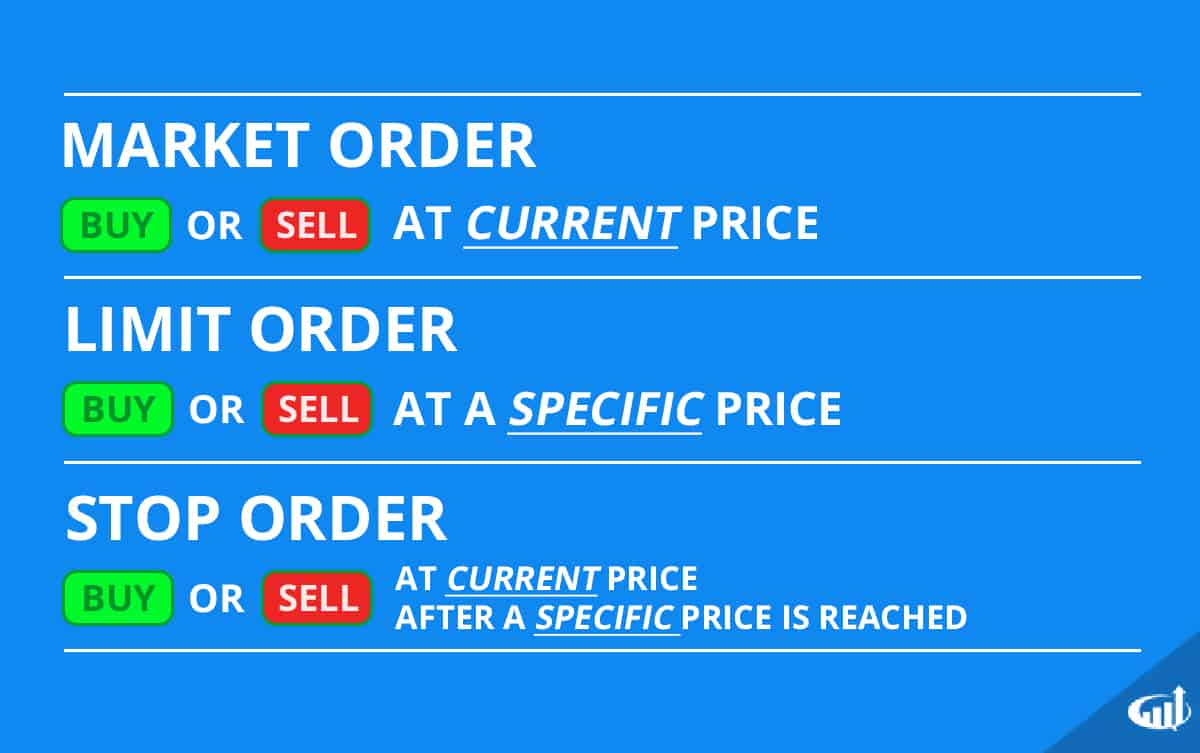

A limit order gets its name because using one effectively sets a limit on the price you are willing to pay or accept for a given stock. Let s say widget co. A limit order is an instruction to the broker to trade a certain number shares at a specific price or better. A limit order guarantees a price but does not guarantee an execution.

A lit buy order trigger could be placed at 16 40 and a limit price could be set at 16 35. A limit order is an order to buy or sell a security at a specific price or better. For example for an investor looking to buy a stock a limit order at 50 means buy this stock as soon as the price reaches 50 or lower. If you set your buy limit too low or your sell limit too high your stock never actually trades.

If the price moves to 16 40 or below the trigger price then a limit order will be placed at 16 35. When you place a limit order you are stating the price at which you wish to buy or sell a stock. Downsides to limit orders. It will not be executed until the price.

For example a buy limit order could be placed at 2 40 when a stock is trading at 2 45. A buy limit order allows investors to pick a specific price and assures that they will only pay that price or better. The biggest advantage of the limit order is that you get to name your price and if the stock reaches that price the order will probably be filled. A limit order can be executed at a better price than the limit price you set.

Make trade when the price is right. An investor wants to purchase shares of abc stock for no more than 10. Limit orders can be set for either a buying or selling transaction. If the price dips to 2 40 the order is automatically executed.

For example assume a stock is trading at 16 50. They serve essentially the same purpose either way but on opposite sides of a transaction.

/blur-1853262_19201-485cc15952974d8ab3af724fc5636238.jpg)