Calculate Interest Accrual

This may sound complicated but it s simpler than it looks.

Calculate interest accrual. Accrued interest is a feature of accrual accounting and it follows the guidelines of the revenue recognition and matching principles of accounting. All you have to do is follow these three steps. Accrued interest refers to amount of the loan interest which has occurred previously but not paid by the borrower to the lender. Paying a little more toward your loan may reduce your total loan cost.

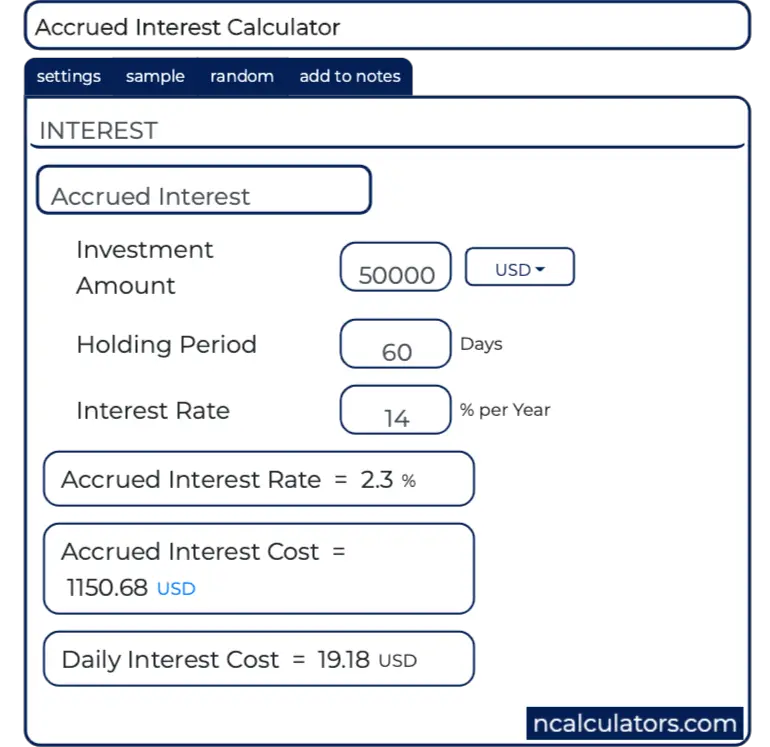

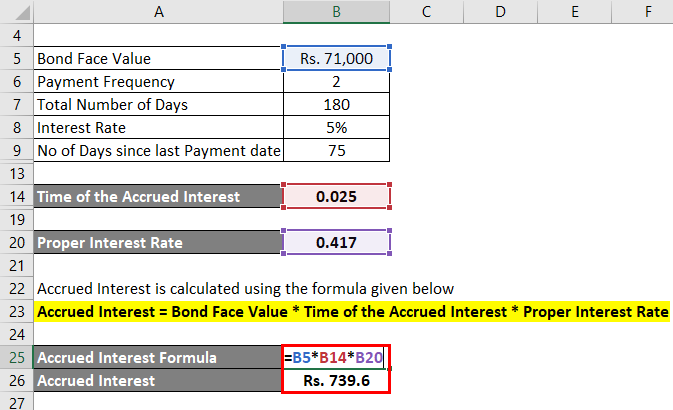

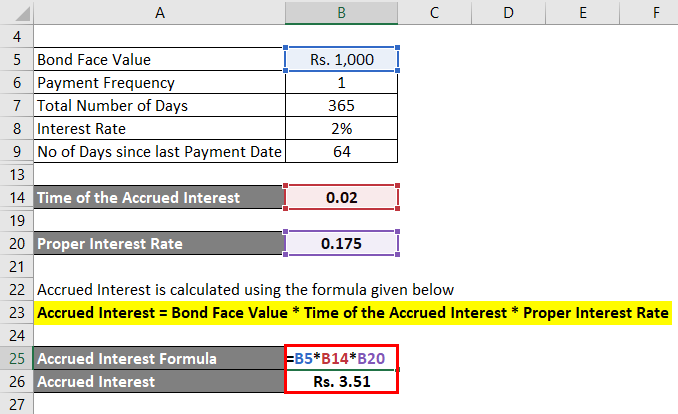

3 steps to calculate your student loan interest. Figuring out how lenders charge interest for a given billing cycle is actually fairly simple. No of days since last payment 30 30 15 75. Accrued interest calculator is an online interest assessment tool to calculate accrued interest rate total interest and daily accrued interest from the given values of investment amount holding period and interest rate.

The interest is computed on the cpf principal amount withdrawn for housing on a monthly basis at the current cpf ordinary account interest rate and compounded yearly. The borrower needs to pay more accrued interest if it takes longer time to repay his loan. Multiplying by the average daily balance gives us monthly accrued interest of. Calculate the accrued interest that it is to be paid.

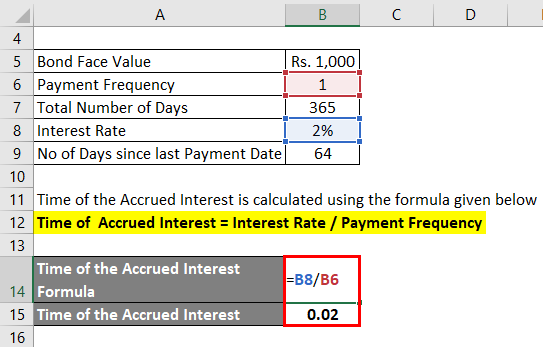

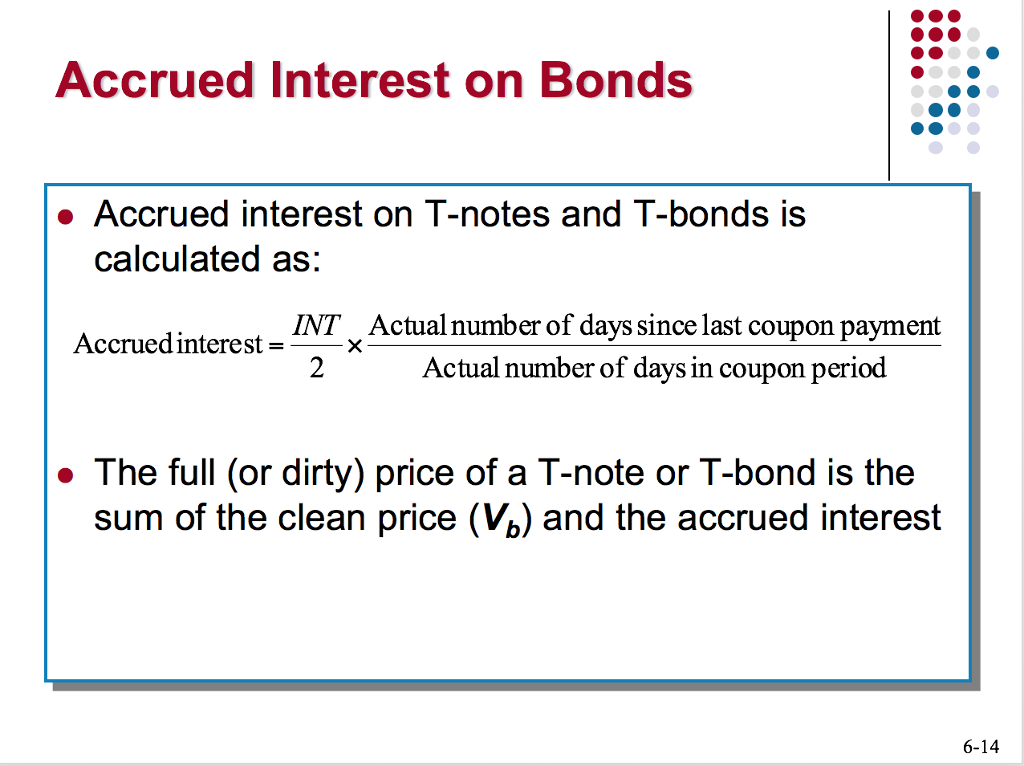

See how accrued interest could affect your loan balance. Accrued interest formula calculates the interest amount which is earned or which is payable on the debt over one accounting period but the same is not received or paid in the same accounting period and it is calculated by multiplying the principal amount with rate of interest and number of days for which debt is given or taken and then dividing it with total number of days in a year. Total no of days in payment since nothing is specified it is 180 days. Even if you re not currently making loan payments interest continues to accrue grow.

To calculate bond accrued interest manually you ll need to know the equation a p c f d t. It is a part of cost borrowing money. Accrued interest is the interest amount that you would have earned if your cpf savings had not been withdrawn for housing. If your interest rate is 18 we can calculate your monthly interest rate and convert it into a decimal as follows.