California Car Insurance Rate

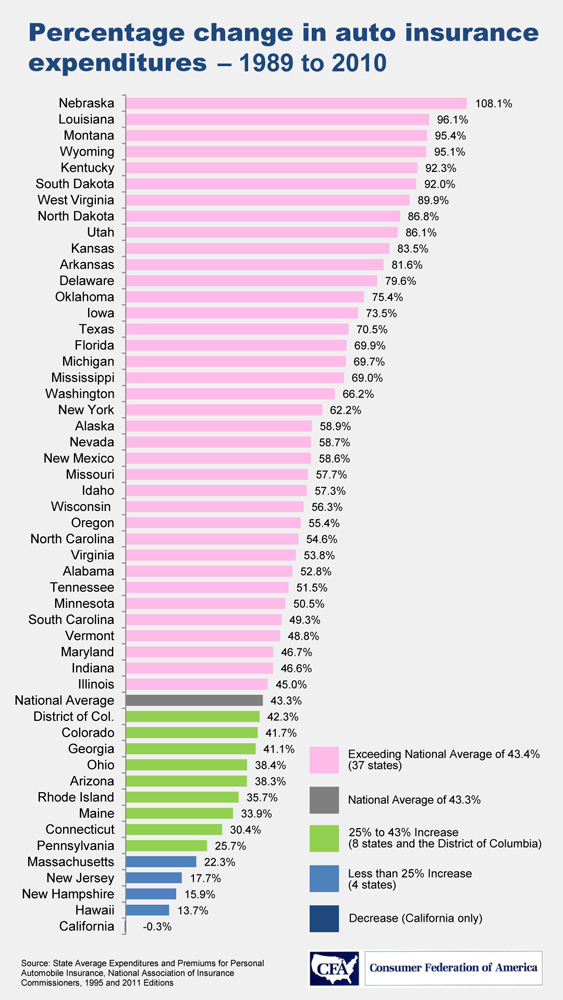

The 18 average statewide increase pales in comparison to the 54 increases in georgia and 47 increases in michigan.

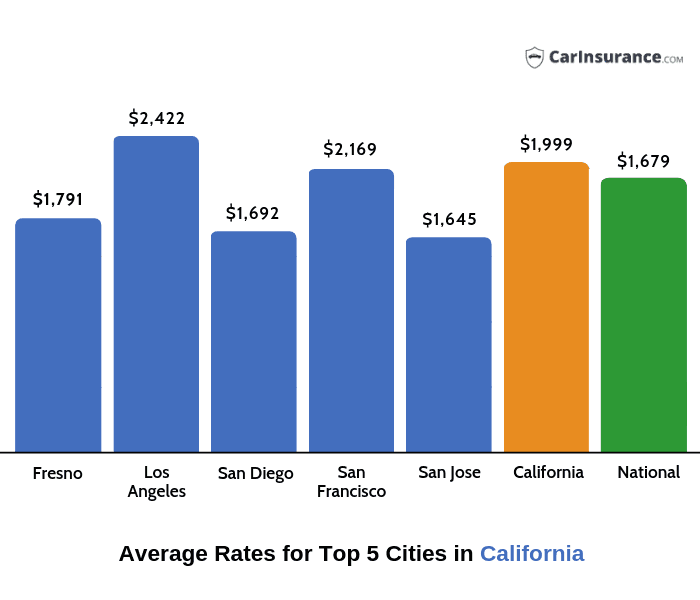

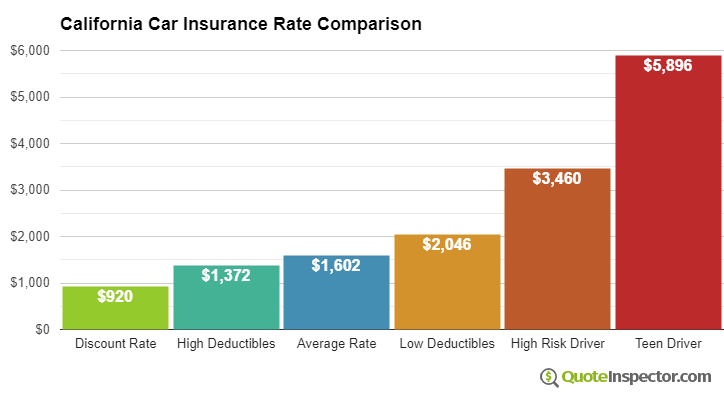

California car insurance rate. Getty images one of the admittedly minor upsides to many people being. Annual premium rates are a bit higher for home insurance california policyholders than other auto insurance companies but the one on one service from a state farm may make the slight upcharge. In california drivers who own their home will usually pay around 159 40 per month while drivers who rent usually average in around 155 23. California car insurance rates near you by zip code you can see average car insurance rates for nearly all zip codes in california by using the tool below.

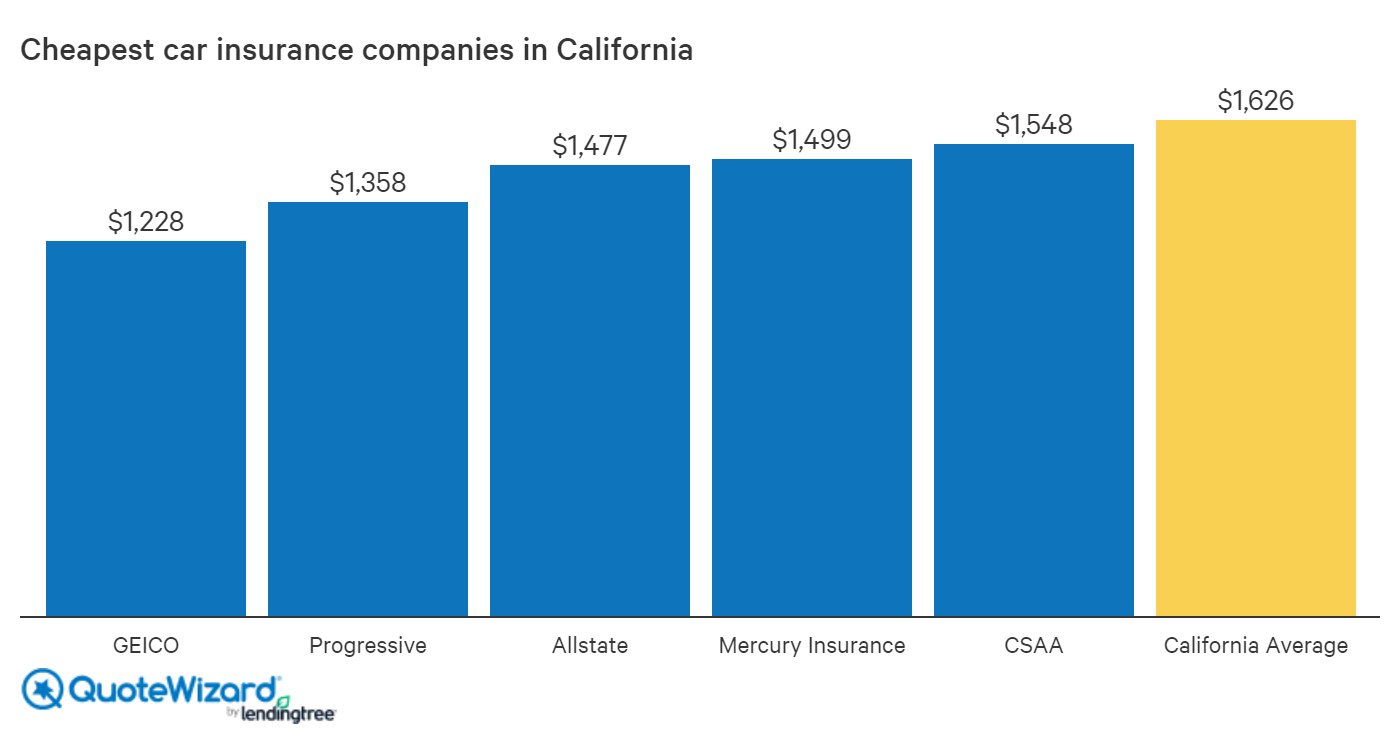

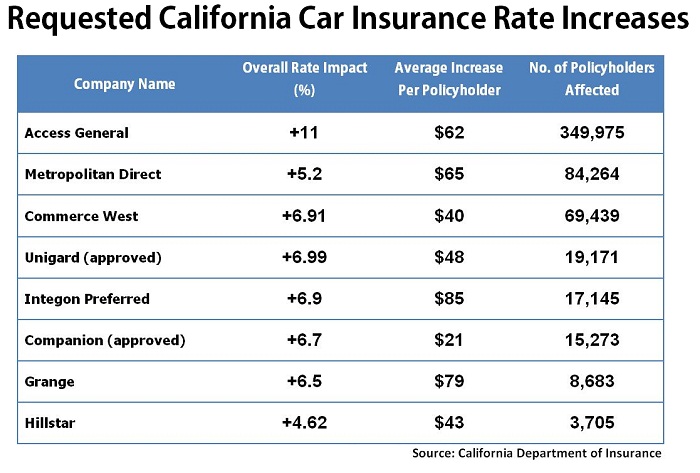

The top 10 largest car insurance companies in california which account for more than 80 of the auto insurance premiums written in the state have raised base rates for drivers by approximately 5 since the beginning of 2018. We also looked at the cheapest car insurance companies in california as well as california car insurance requirements and discounts. Drivers in california must show financial responsibility usually this means drivers must carry proof of car insurance. California auto insurance rates by homeownership.

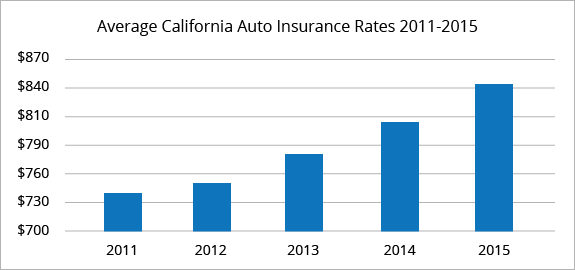

Information on the ca workers compensation rate comparison online rate comparison for the top 50 workers compensation insurers. California has had below average rate increases in the past half decade. For drivers with a recent accident here are the cheapest car insurance companies and their average rates in california. Insurance that you may need when you are not able to do some of the basic activities of daily living 2020 medicare supplement insurance also known as medigap insurance.

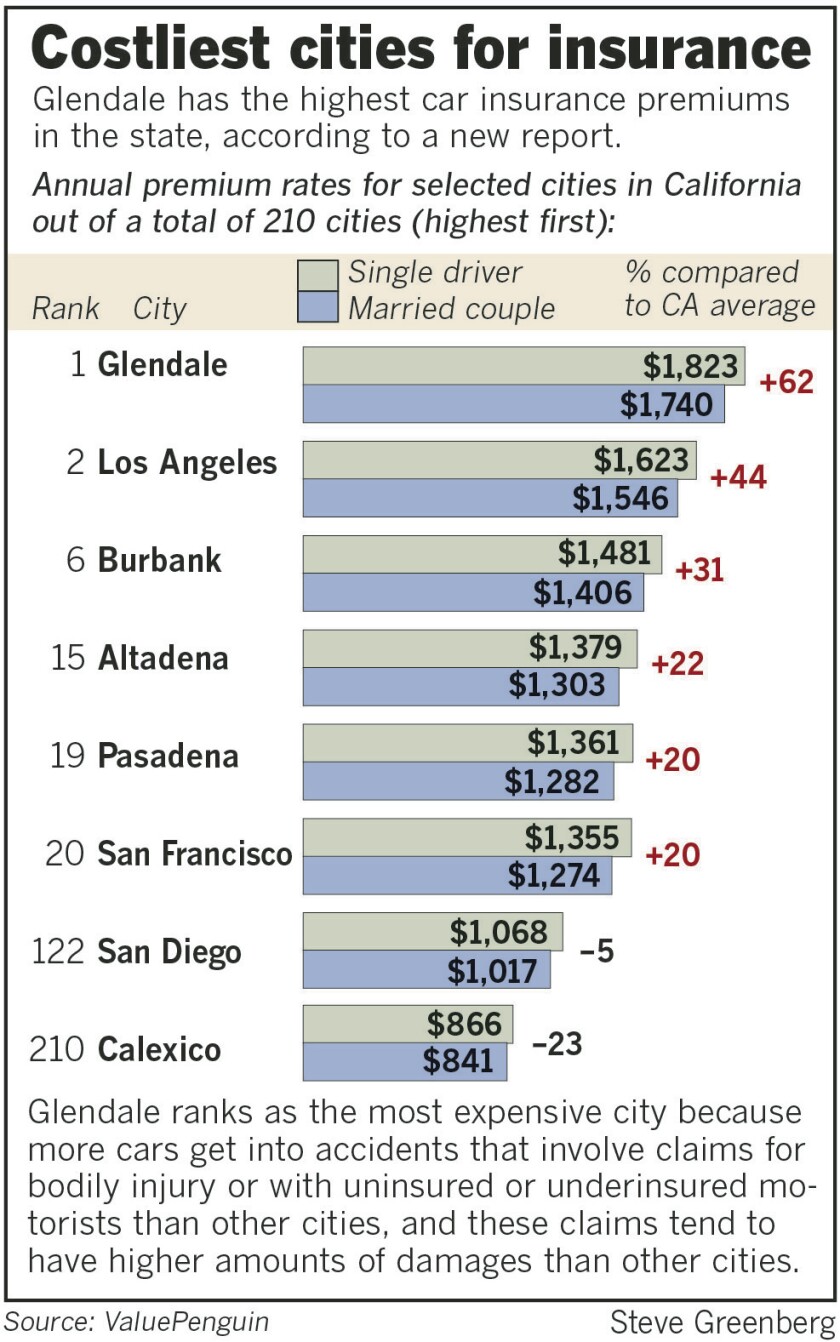

California auto insurance rate increases. California insurance commissioner ricardo lara has ordered all insurance companies to refund premiums for march and april. In california this proof can also take the form of a 35 000 deposit with the dmv a 35 000 surety bond or a dmv issued self insurance certificate. Insurance companies will also take homeownership into account when factoring the rate you pay for insurance.