Call Option Profit

Profit loss graph of a purchased call option position.

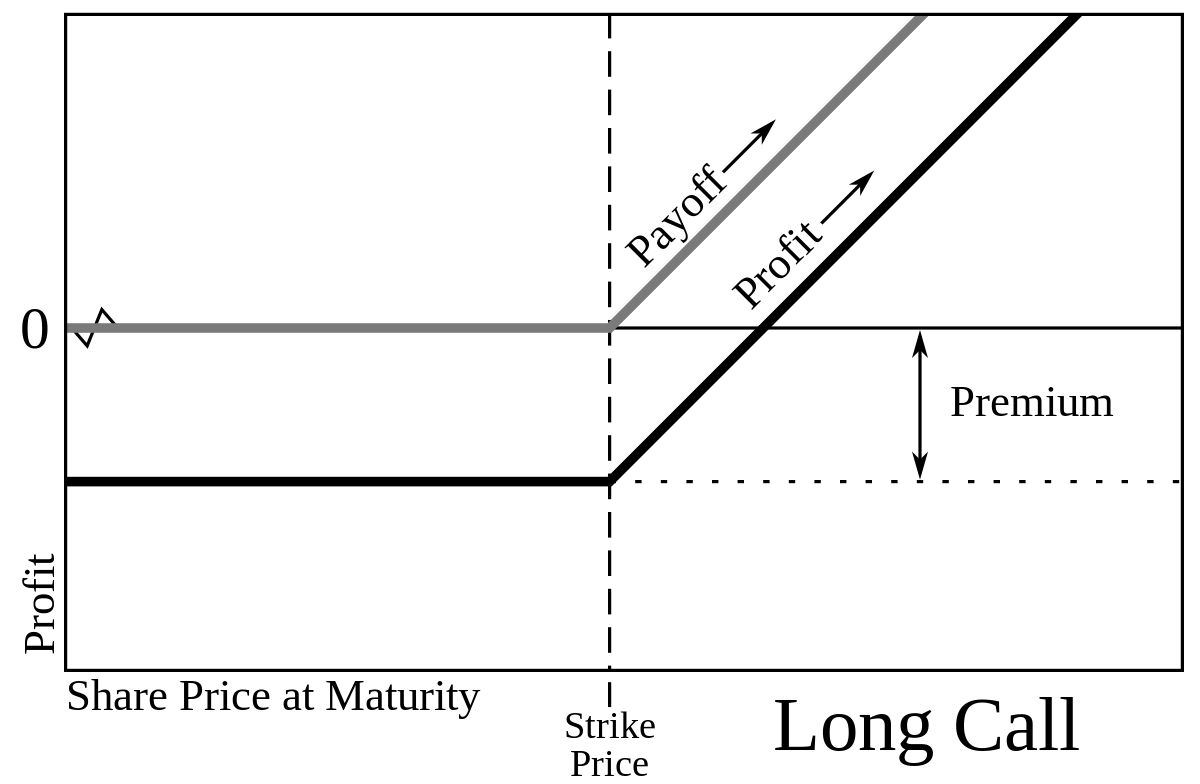

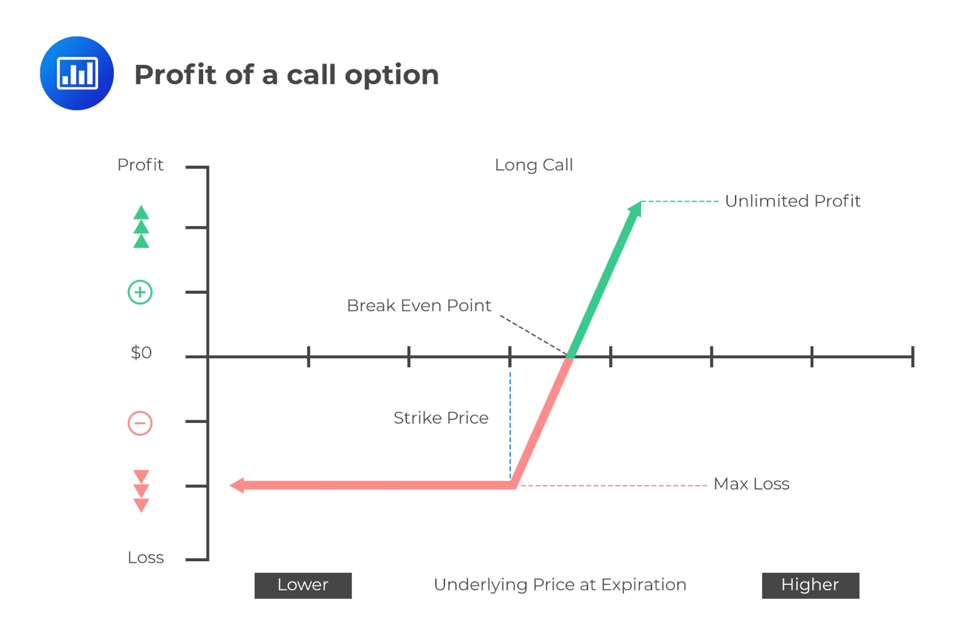

Call option profit. On the other hand the seller of the call option hopes that the price of the asset will decline or at least never rise as high as the option strike exercise price before it expires in which case the money received for selling the option. Visualise the projected p l of a call option at possible stock prices over time until expiry. Calculate the value of a call or put option or multi option strategies. Unlike put options call options are banking on the price of a security or commodity to go up thereby making a profit on the shares by being able to buy them later at a lower price.

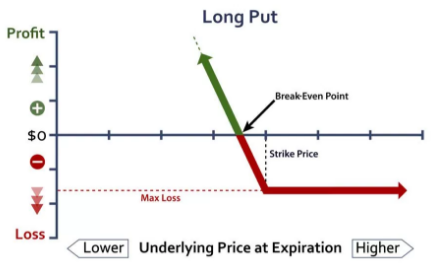

Changes in the base asset price the higher the price the more expensive the call option is. A call option writer stands to make a profit if the underlying stock stays below the strike price. Writing call options is a way to generate income. Now let s look at a long call.

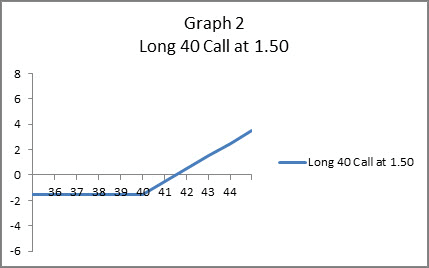

To calculate profits or losses on a call option use the following simple formula. The call writer seller receives the premium. Graph 2 shows the profit and loss of a call option with a strike price of 40 purchased for 1 50 per share or in wall street lingo a 40 call purchased for 1 50 a quick comparison of graphs 1 and 2 shows the differences between a long stock and a long call. After writing a put option the trader profits if the price stays above the strike price.

Free stock option profit calculation tool. However the income from writing a call option is limited to the premium while a call buyer has theoretically unlimited profit potential. Call option profit loss chart. Call option profit loss stock price at expiration breakeven point for every dollar the stock price rises once the 53 10 breakeven barrier has been surpassed there is a dollar for dollar profit for the options contract.

See visualisations of a strategy s return on investment by possible future stock prices. The options writer s maximum profit on the option is the premium. The buyer of a call option seeks to make a profit if and when the price of the underlying asset increases to a price higher than the option strike price.

/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)