Can A Family Trust Own A Company

For example if you run your own company you can set up a trust to hold.

Can a family trust own a company. The trust must submit a tax return every year. A trust is simply a relationship. This benefit of asset protection can extend to a business run through a trust that uses a corporate trustee rather than an individual trustee. Company trading in its own right.

Trustees can own many types of property including liquid cash and property. Smith pty ltd as trustee for the smith family trust. A trust is a vehicle for holding and passing on the family property. I have a client who lives in a trust owned property.

A land tax exemption is available in vic if beneficiary living in trust property with conditions. The trust must pay a high rate of tax on any income that is not distributed before the end of a financial year. In this instance the company is both the legal and beneficial owner of the assets. He rents it fully furnished from the trust and the trust claims expenses private ruling in place.

We wouldn t recommend that you set up a family trust on its own to work with a business partner. Lawyers on upcounsel come from law schools such as harvard law and yale law and average 14 years of legal experience including work with or on behalf of companies like google menlo ventures and airbnb. Can a family trust accommodate a business partner. However this changes when we think about trustees and what they can hold for beneficiaries.

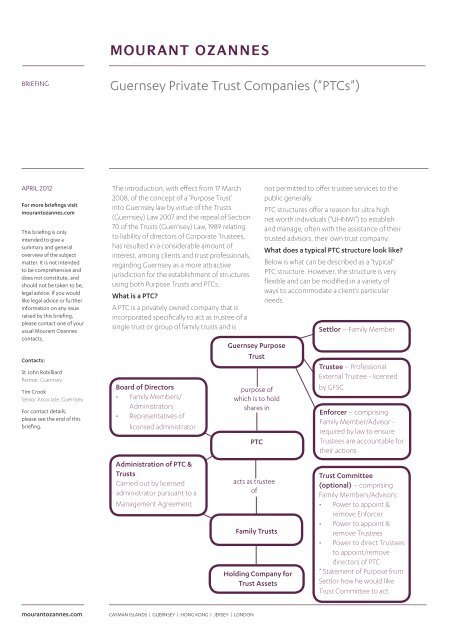

As such it typically serves at least one of two purposes. It can reduce a family s taxes by shifting income to members in. A trust allows the trustee to distribute the income of a business in any way to minimise the income tax liability of beneficiaries. If the shares of an operating company are owned by a discretionary family trust each beneficiary is deemed to own 100 of the shares owned by the trust.

Upcounsel accepts only the top 5 percent of lawyers to its site. The beneficiaries of a trust must be able to be identified. The opposite of a corporate trustee is a company that trades in its own right. If you need help with the question can a trust own an llc you can post your legal need on upcounsel s marketplace.

Any loss generated is offset by other business income. If beneficiaries have companies of their own being a beneficiary of a trust may cause the operating companies to be associated for income tax purposes. There are other options for this such as a company unit trust or even a partnership of family trusts where you can set up the rules of working with the business partner.

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

:max_bytes(150000):strip_icc()/understanding-a-holding-company-357341-v2-5bc64801c9e77c005190650d.png)

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

:max_bytes(150000):strip_icc()/what-is-a-subsidiary-company-4098839_FINAL-8828f4a412d546bfa9c96a19845541a3.png)