Can A Small Business Have A 401k

No company is too small to invest in a 401 k.

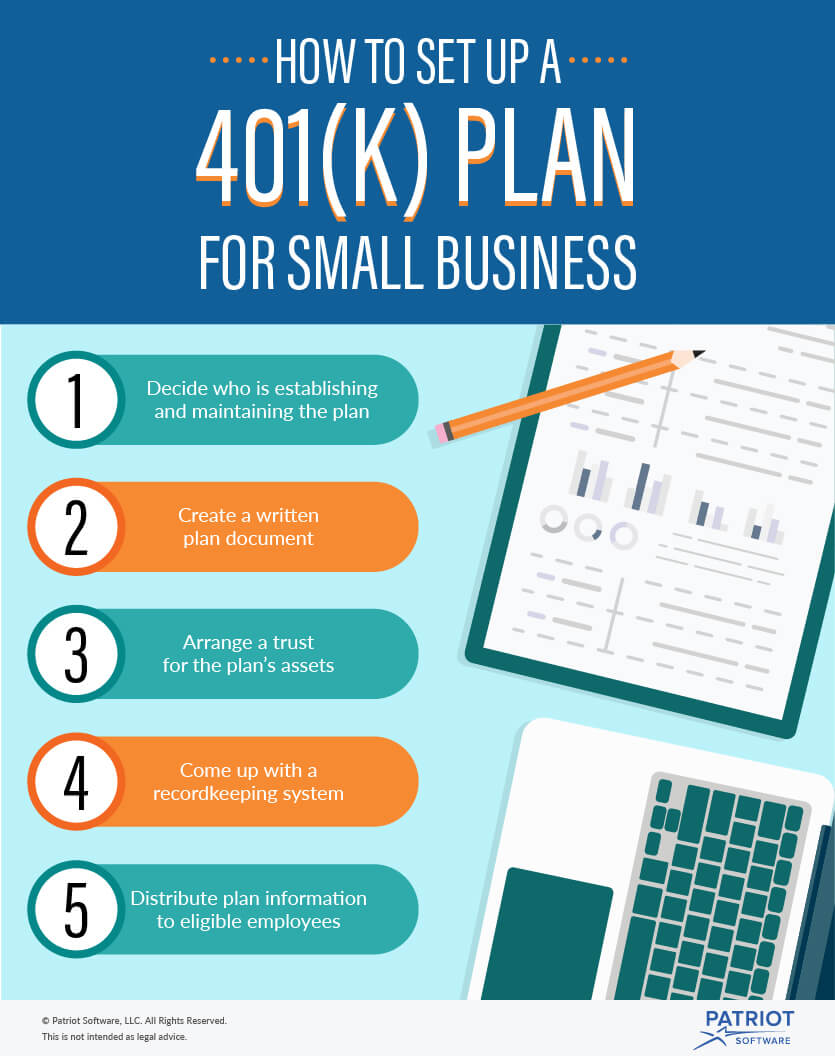

Can a small business have a 401k. For both individual and small business 401 k s businesses can generally deduct employer contributions and plan expenses. A new breed of small business 401 k providers has emerged using technology to offer easy to use low cost 401 k s. Small business 401 k plans can involve a lot of different service providers and advisors. All that s needed is the desire to set up a plan.

Why is there such a distinct coverage gap. You already have a mindset on business like investing and the fruits of your hard work can be put into a 401 k especially geared toward small business owners which lets you sock away a large amount of money each year. Any owner only business can qualify for an individual 401 k often referred to as a solo 401 k robertson said. The p ercentage of employers that don t offer a 401 k by company size.

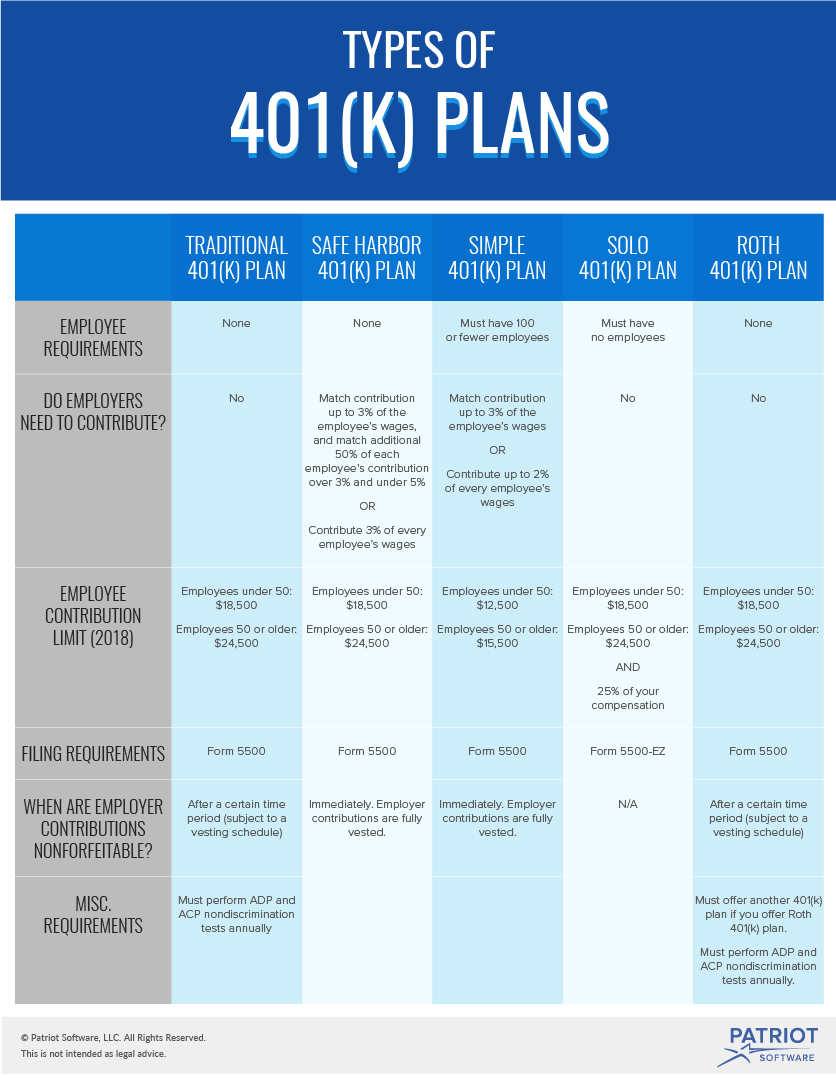

A 401 k is how most americans save for retirement but small and medium sized business smb owners and their employees are 11 times less likely to have access to a 401 k than those at large corporations. Pre tax salary contributions and any earnings are not subject to federal income tax until they re withdrawn and roth post tax contributions may be withdrawn federal income tax free after five years have passed since the first day of the year of the participant s first. However many small businesses assume they do not have the option to offer a 401 k retirement savings plan. When setting up your plan you can choose to take an a la carte approach with several different providers.

Sep accounts are less well known and are generally used by self employed individuals and small businesses. It can be any size. Focused on the unique needs of the small business market these 401 k providers strive to make high quality low cost retirement plans accessible to all not just fortune 500 companies. It doesn t matter whether or not the person is self employed or how many employees the company has.

That misconception is understandable thomason told co because cost and complexity had once put 401 k s out of reach for companies with lean resources. The employer side of the solo 401 k contribution is limited to 25 of total business income for the year. A person who works for one company in which they have no ownership and participates in its 401 k can also establish an sbo 401 k for a small business he or she runs on the side funding it. Small firms may have a new way to offer 401 k plans to their workers published mon sep 30 2019 9 55 am edt updated mon sep 30 2019 10 07 am edt sarah o brien sarahtgobrien.

/what-does-it-mean-to-be-vested-in-my-401-k-2385773-v2-5bbe03414cedfd0026d7f4a4.png)

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png)