Can I Borrow From My Annuity

Contact your annuity administrator and ask if there is an annuity provision available.

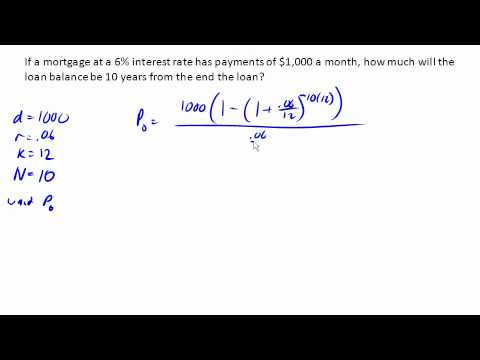

Can i borrow from my annuity. You will need to know the existing interest rate the amount you are allowed to borrow from the annuity and how long before it needs to be repaid in full. The rules of pension ra or preservation funds regulate that you can take up to one third of the funds in cash but the other two thirds must be invested into a living annuity or life annuity that. Normally you can borrow up to 50 of your vested account balance or 50 000 whichever is less. If there is inquire as to what the terms are.

Previously if you wanted to withdraw cash from your 401 k or traditional ira before age 59 and a half you d face income taxes and a 10 penalty on. If you stick to that window. No 10 penalty on. The bill also makes it cheaper to take early withdrawals from your retirement accounts and increases the amount you can borrow if you still need more cash.

Under normal circumstances owners of certain workplace retirement accounts including 401 k s 403 b s and 457 plans are allowed to borrow up to 50 000 or 50 of their vested balance. During that time you can request a loan from your annuity. You can borrow from your annuity to put a down payment on a house but you should be prepared to pay an assortment of fees and penalties in fact when figuring a way to fund your down payment. New retirement rules under the relief bill.

Annuity borrowing once your annuity is set up it will continue to grow for years or decades until you convert it to a retirement income. The senate bill also doubles the amount you can borrow. Loans from your annuity can often be inexpensive and flexible on repayment but they have an upper limit. Taking money out of the annuity also slows the growth of your retirement funds.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

:max_bytes(150000):strip_icc()/retirement-date_137950287-5bfc2b3b4cedfd0026c10a04.jpg)

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)