Can I Cash In An Annuity

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Buying an annuity is an irreversible decision unless the value is less than 10 000.

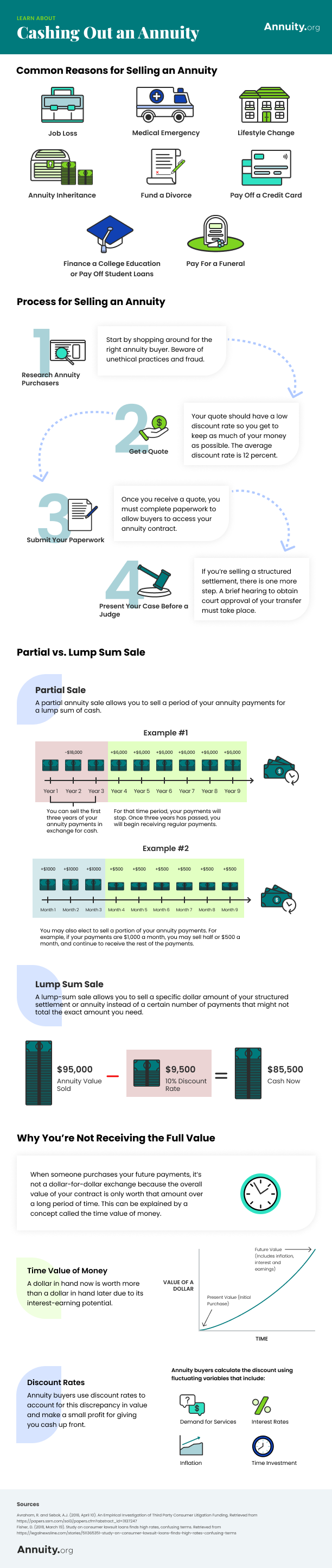

Can i cash in an annuity. Secret law that says you can cash in your annuity but surprise surprise insurers are refusing to pay up. To cash out your annuity contact your insurance company or agent. A partial annuity sale allows you to sell a period of your annuity payments for a lump sum of cash. If you cash out your annuity before age 59 you may owe a 10 percent tax penalty.

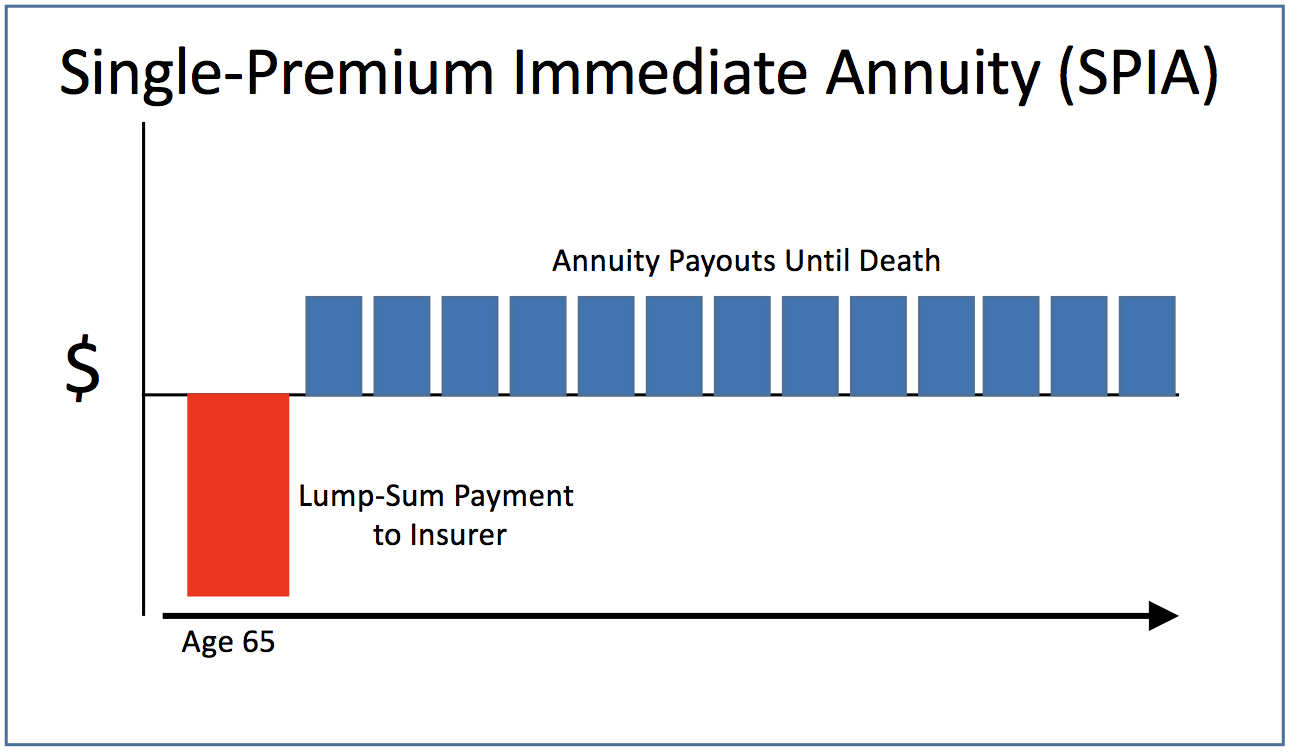

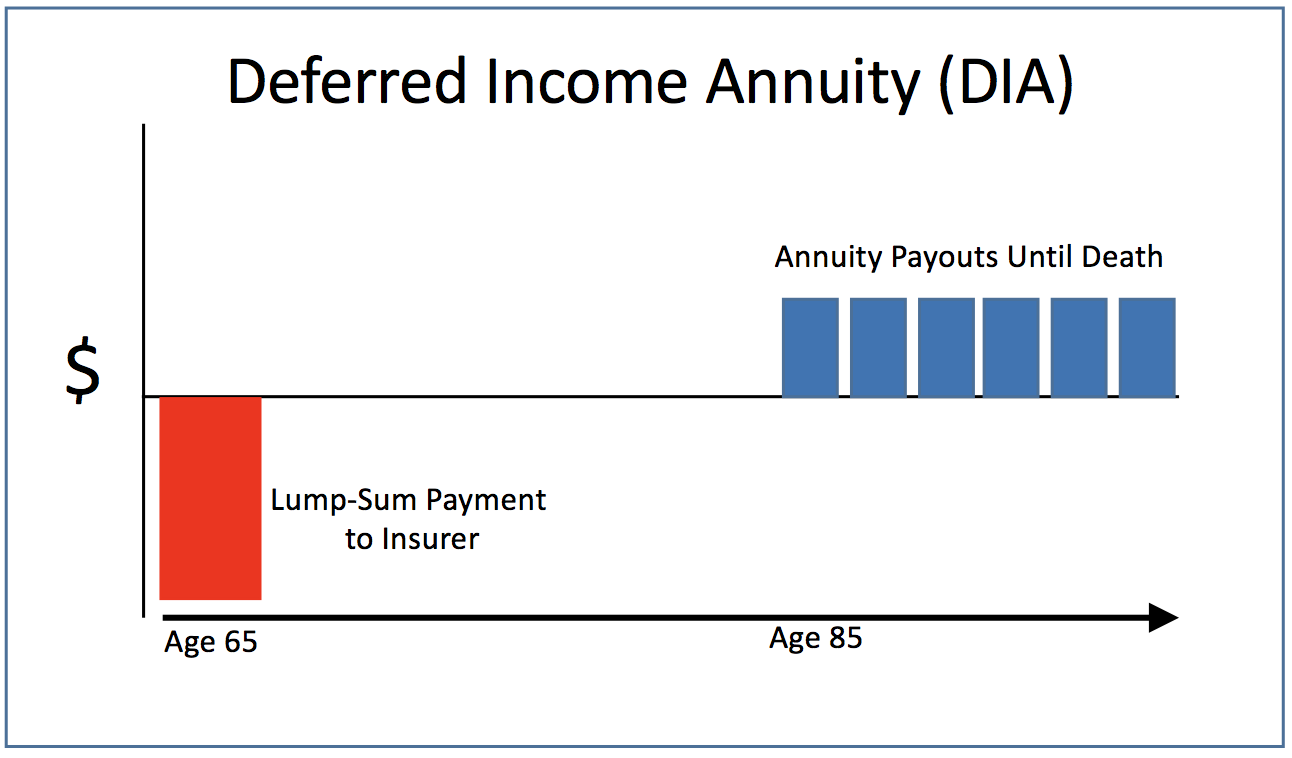

While there are many types of annuities an immediate annuity starts paying you immediately as opposed to some time in the future. More understanding 403 b plans. Because cashing out an annuity is the same as cashing in an annuity the answer is also the same. This compares the annuity market based on the different annuity features and options and helps you to find the best deal.

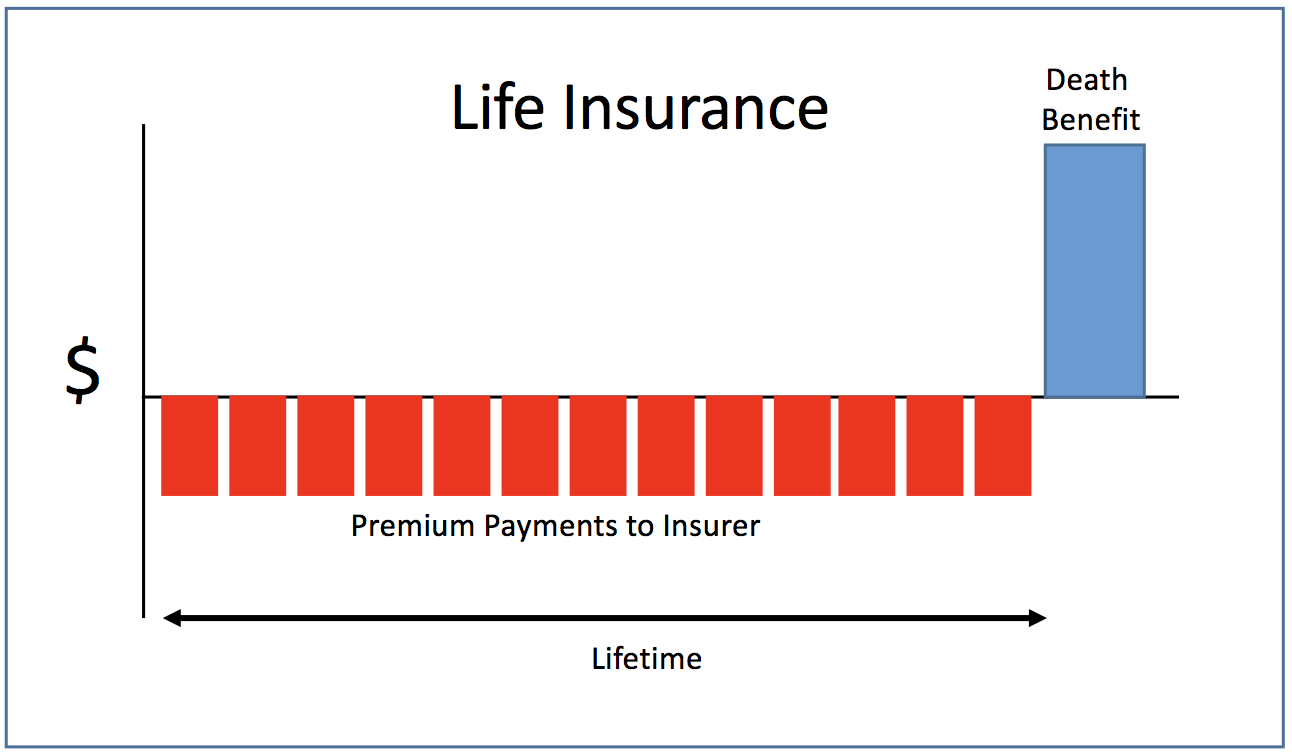

A variable annuity is a type of annuity that can rise or fall in value based on the performance of its underlying investment portfolio. An annuity is a contract between you and an insurance company where you pay a lump sum and in return the insurance company makes periodic payments to you in the future. You may also owe surrender charges from the insurance company. An annuity is a tax deferred retirement product sold by insurance companies.

In the majority of cases you cannot cash out your retirement annuity pension early in the uk. If you have any questions about cashing in your retirement annuity pension then it can be a good idea to speak with a pensions advisor. To find out more use the money advice service annuity comparator. Can i sell my annuity in the uk.

Below you ll get a quick look at how various situations can affect your taxes. A cash refund which will give your beneficiary the balance of your. It can allow people to access funds without going through the process of cashing out their annuity which may leave them exposed to taxes and penalties. Rules should allow small annuities to be cashed in by savers.

It is not possible to sell your annuity. For that time period your payments will stop. You can protect against this unfortunate occurrence by purchasing an income annuity that includes a death benefit a k a. For example you can sell the first three years of your annuity payments in exchange for money you want for a down payment on a new home.

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)