Can I Cash Out A Term Life Insurance Policy

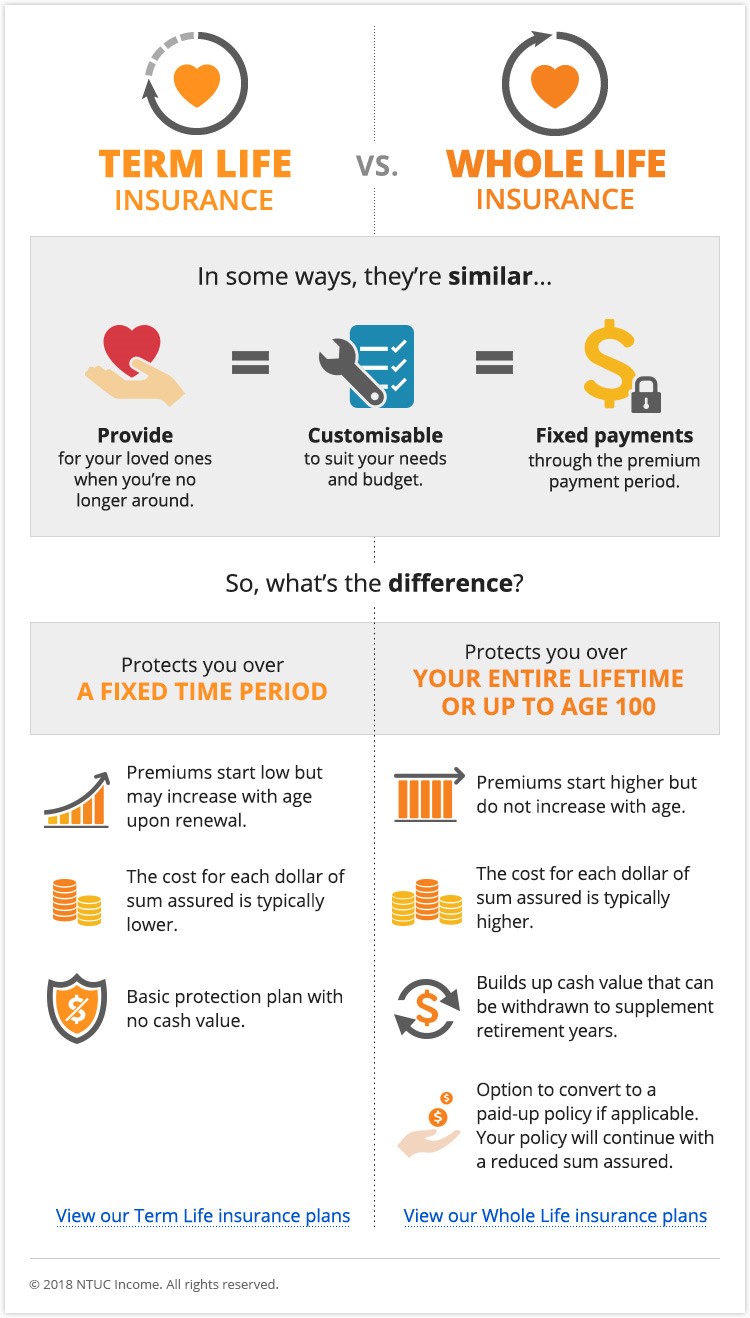

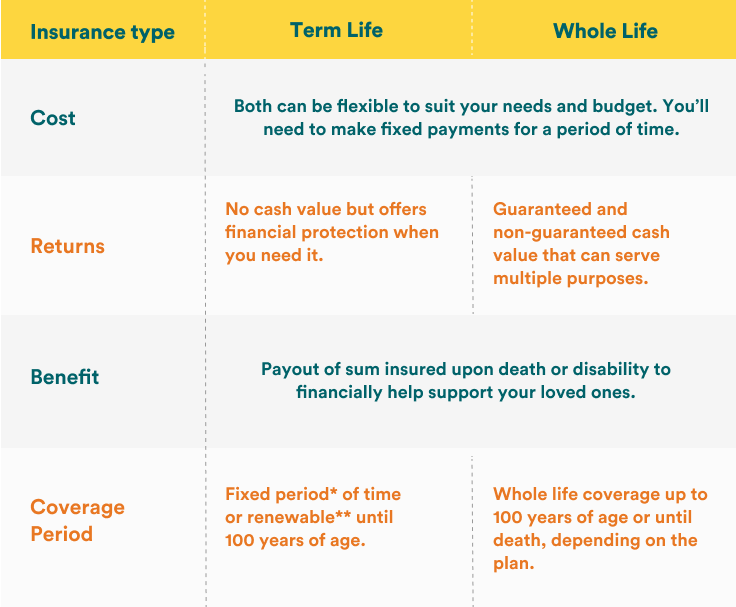

Generally there is no cash value in term life insurance.

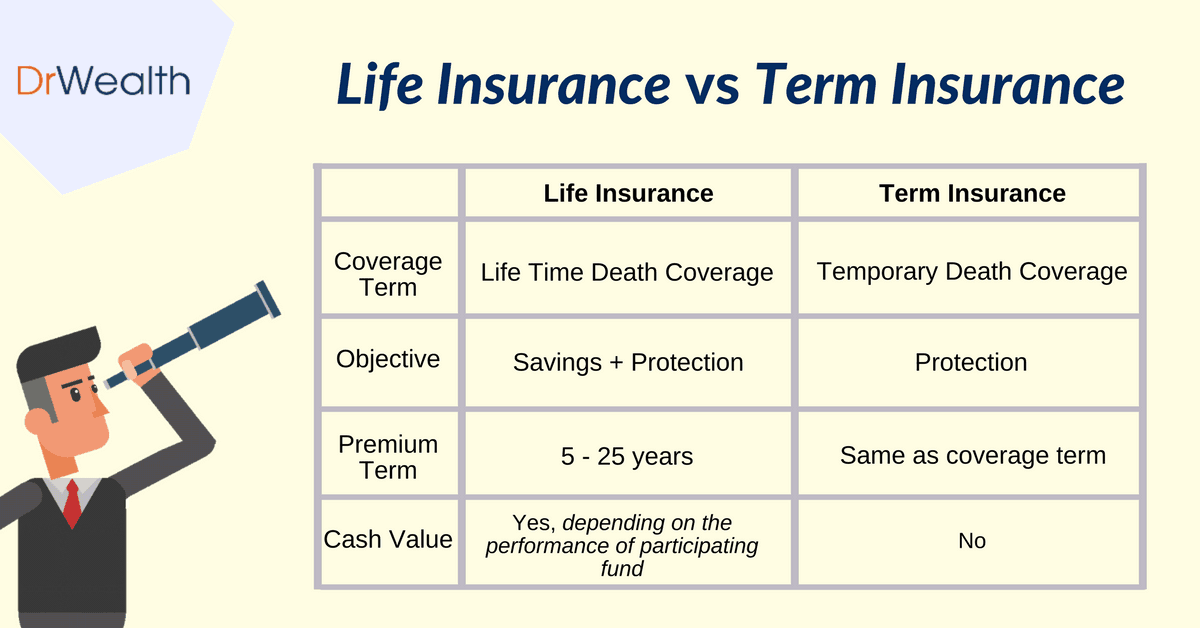

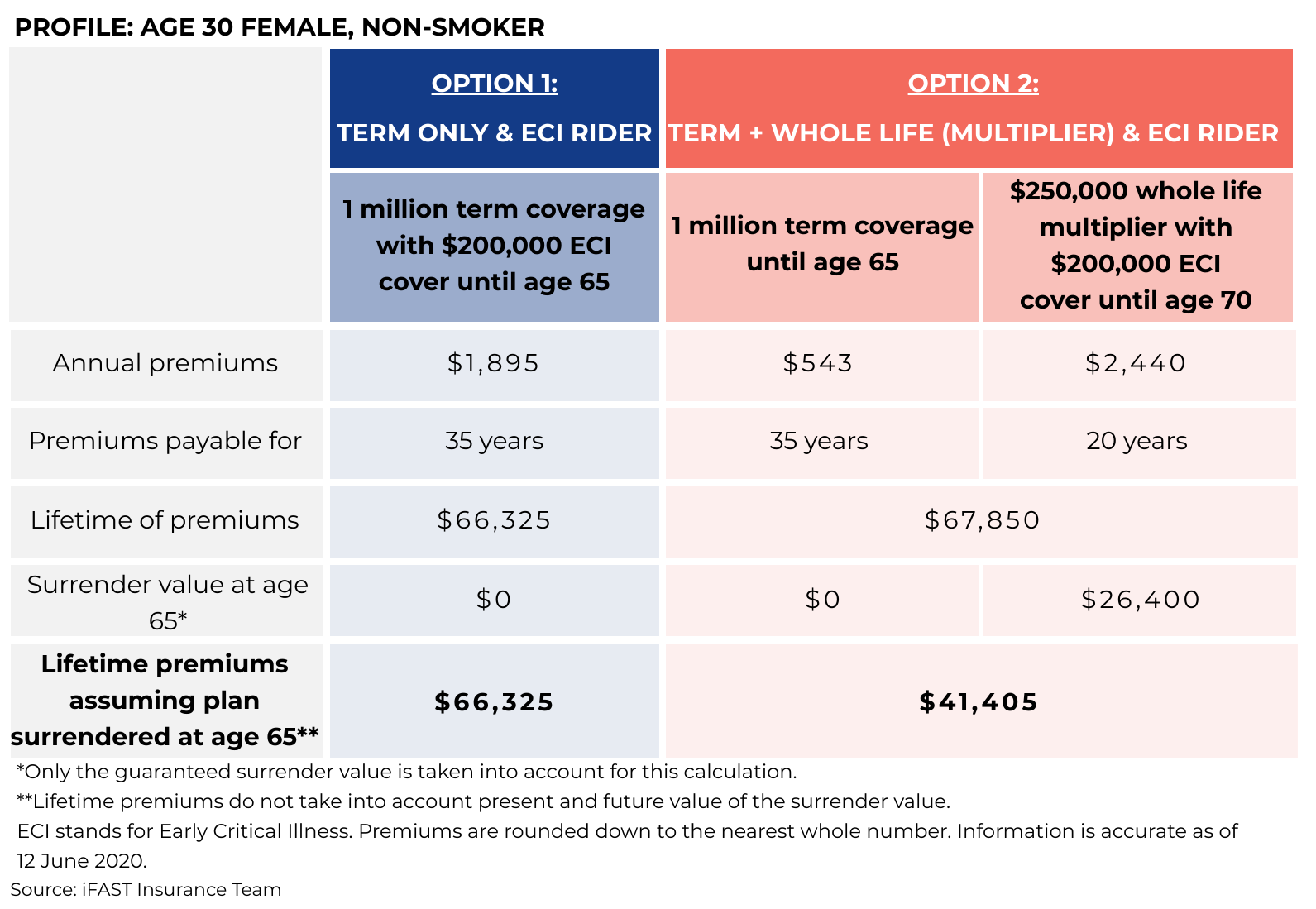

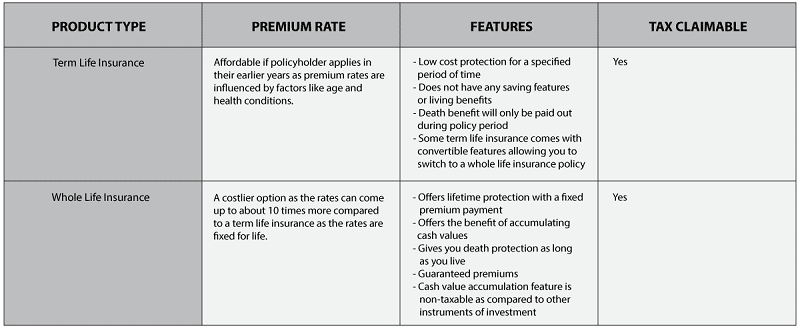

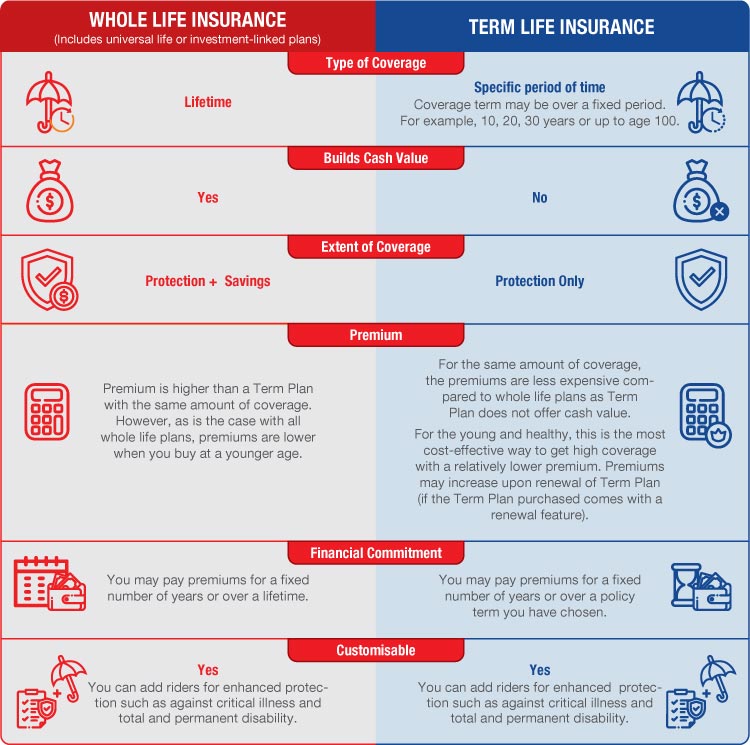

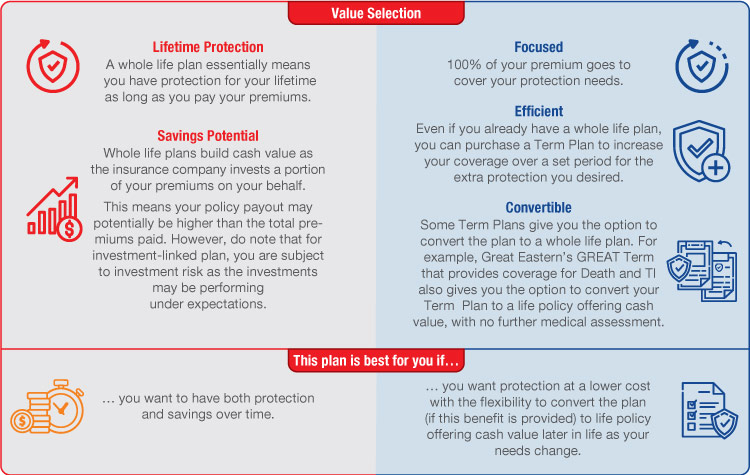

Can i cash out a term life insurance policy. If the term life insurance policy can be converted to a permanent cash value policy it may have value on the life settlement market. Only permanent life insurance such as whole life universal life and variable life has a cash value account that grows over time tax deferred. To cancel it you can stop making payments. However it is not a common method since it requires a lot of work and it is not easy to do.

Life insurance settlements is another method through which people can cash out their life insurance policy. If you cash in your term life insurance policy your coverage ends. There are three options available when deciding to cash out or cash in a whole life policy. After a one month grace period the policy will lapse.

No term life insurance pays a death benefit to your beneficiary if you die within the policy s term. There may be return of premiums at the end of the contract if that rider was selected. In this method you will be selling all the rights of your insurance policy including death benefits to a. Life insurance policies that build cash value can be complex but many allow the policyholder to borrow against the policy or to withdraw cash permanently a surrender or to use the cash value.

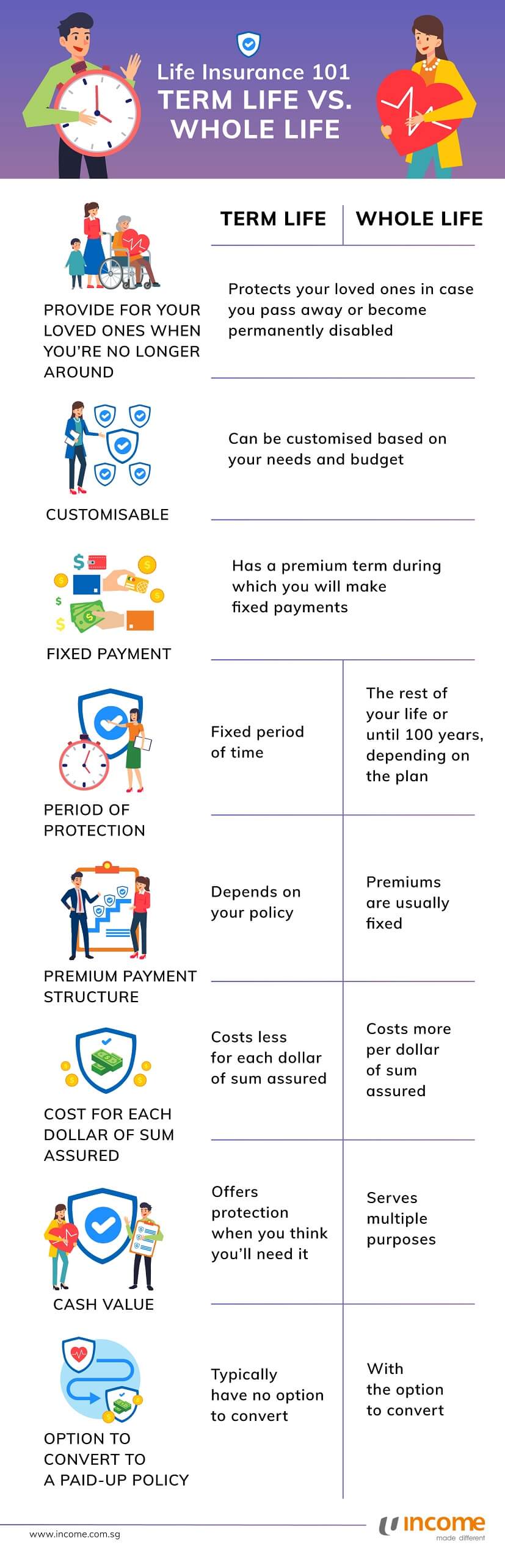

Cash value life insurance policies such as whole life or universal life include a cash accumulation account within the policy where excess premium payments and earnings are held. If you have term life insurance you may be allowed to contact your life insurance carrier and convert your term coverage into a lesser amount of paid up coverage. To cash out a term policy you simply cancel it as there is usually no cash value in a term policy unless you have rop term. The cashing out options.

A life settlement is the process of selling your life insurance policy to a third party company or investor for cash. Or you can call the insurance company to cancel your policy. The average payout in a life settlement option is 22 of the policy s face value that said it can range between 10 and 50 depending on various factors including your age life expectancy and policy details. Otherwise it does not have any cash value.

Surrendering the policy for the cash value means that the policy will be canceled immediately upon cashing out. Then you can access the cash value in the policy using one of the methods listed here. Continue reading below but before you decide to cancel your policy take some.

/Depositphotos_6587906_m-2015-56a28e565f9b58b7d0cc1354.jpg)