Can I Contribute To A 401k And Roth Ira

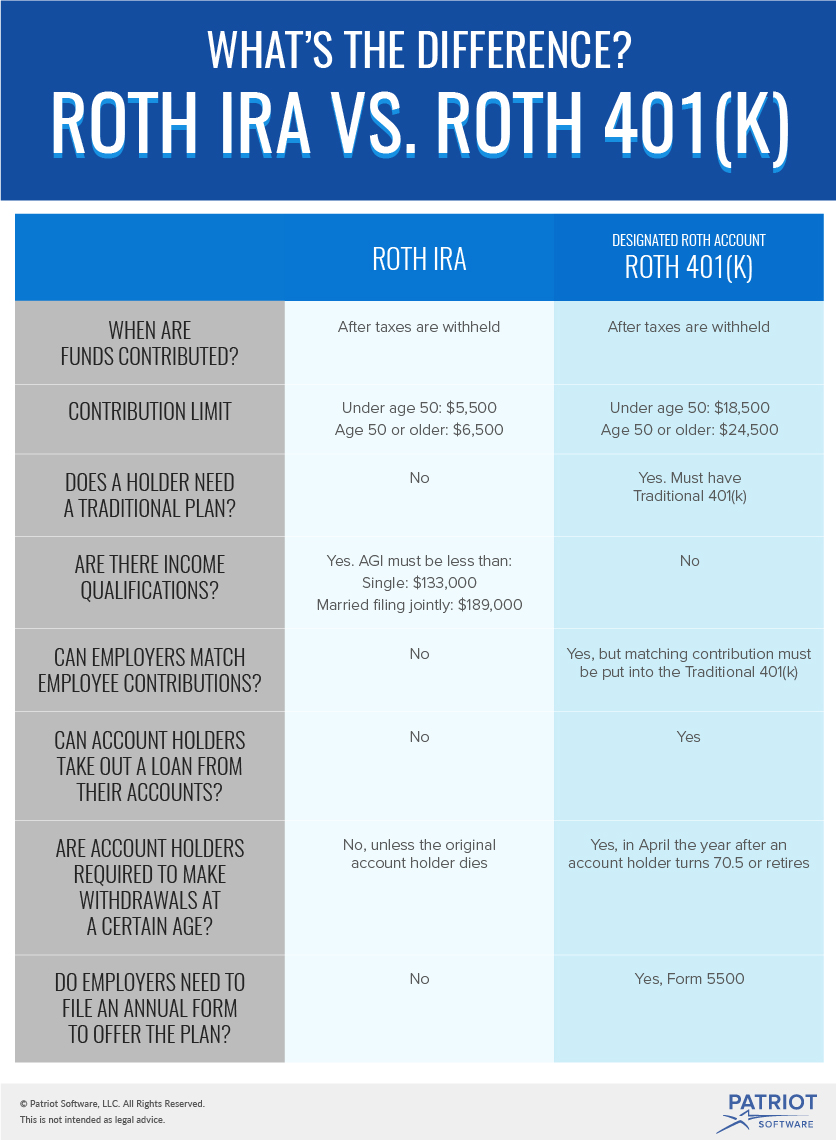

This means that a married couple with magi less than 181 000 can each contribute up to 17 500 to a roth 401 k and up to 5 500 to a roth ira.

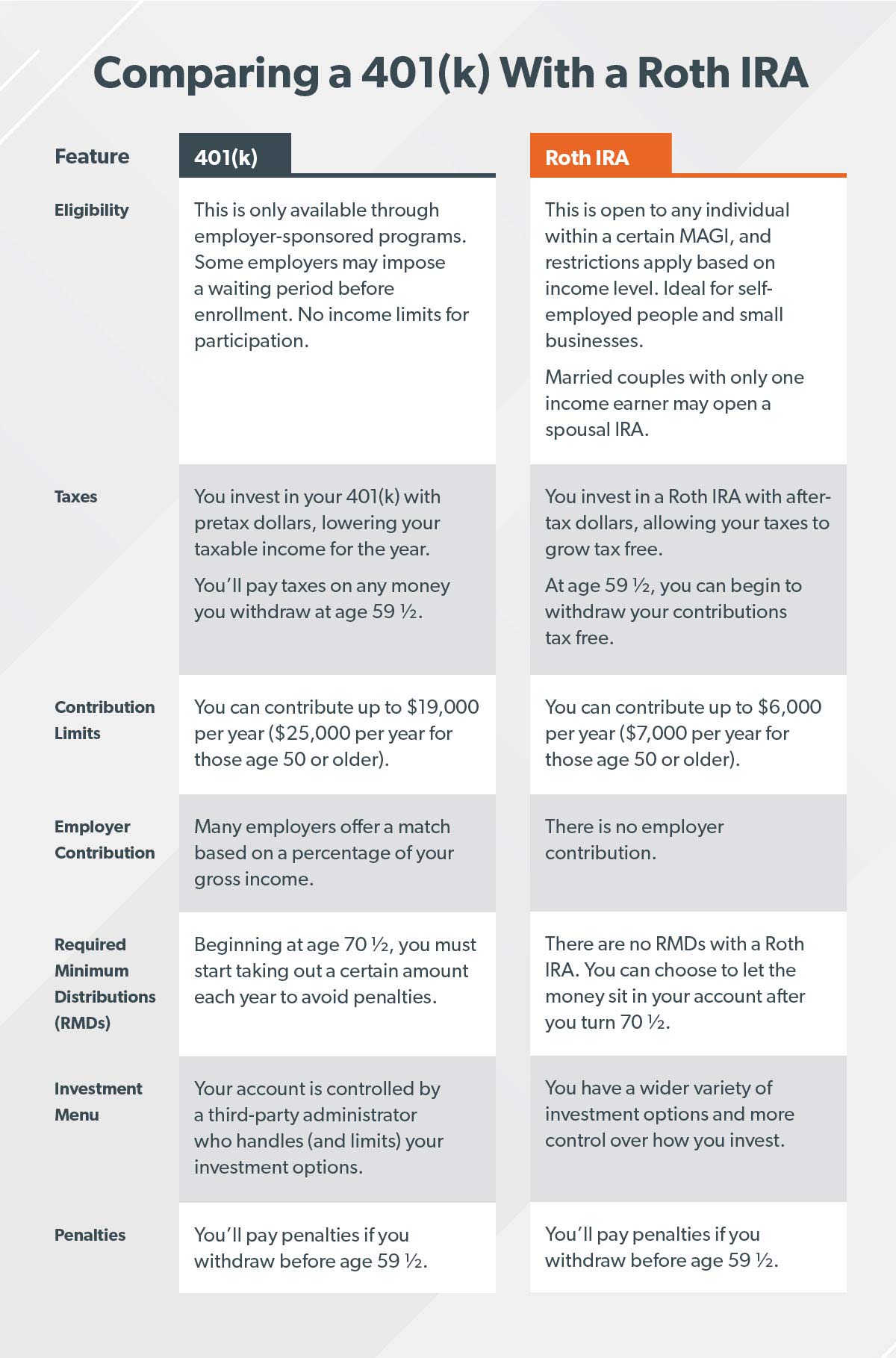

Can i contribute to a 401k and roth ira. If you re aged 50 or older you can contribute an extra 6 500 as a catch up contribution. How much can i contribute to an ira. If you earn less than 124 000 as a single filer or less than 196 000 as a couple filing jointly you are eligible for the full contribution limit in 2020. You can contribute to a roth ira and a 401 k.

Your roth ira contributions may also be limited based on your filing status and income. That s a total of 23 000 each 17 500 5 500. You can contribute a maximum of 19 500 in 2020 to a roth 401 k the same amount as a traditional 401 k. You might not be able to.

The annual contribution limit for 2015 2016 2017 and 2018 is 5 500 or 6 500 if you re age 50 or older. And if they are both age 50 or older they can take advantage of the catch up contributions in both accounts. In 2020 the contribution limits are 6 000 7 000 if 50 for roths 19 500 26 000 if 50 for 401 k s. While not everyone has employer sponsored roth offerings or even a 401 k the opportunity to split your retirement savings in a similar way can be done on your own using a traditional ira and a.

401 k roth 401 k ira roth ira if the many different types of retirement accounts. A roth ira is an individual retirement account and as long as you pay taxes on the income you earn virtually anyone can open one. To contribute to a roth ira your modified adjusted gross income cannot exceed certain levels that are dependent upon your tax filing status. Even if you participate in a 401 k plan at work you can still contribute to a roth ira and or traditional ira as long as you meet the ira s eligibility requirements.

Roth ira contribution limits. The contributions for roth iras and 401 k plans are not cumulative which means that you can max out both plans as long as you qualify to contribute to each.