Can I Open A Roth 401k On My Own

A roth ira is an individual retirement account and as long as you pay taxes on the income you earn virtually anyone can open one.

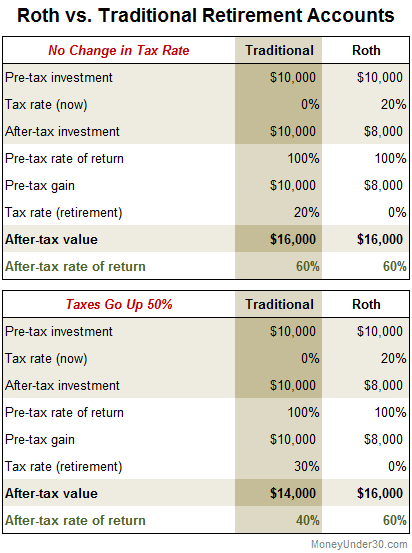

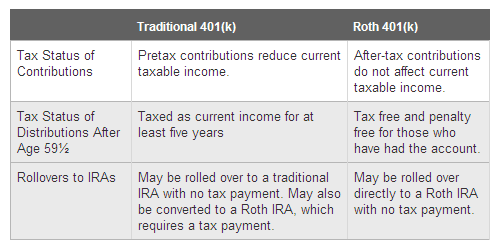

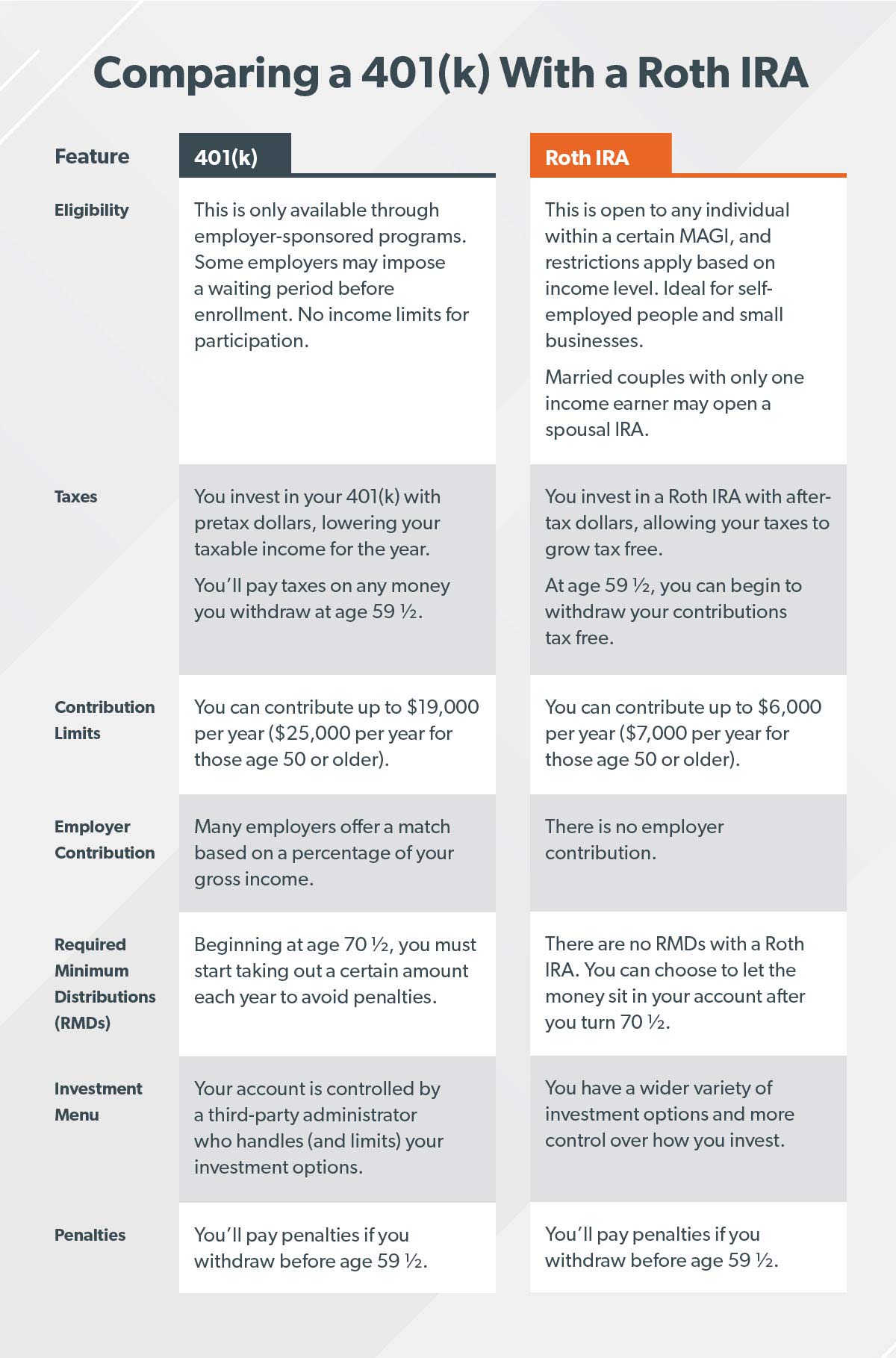

Can i open a roth 401k on my own. The contributions will be eligible if your child has a part time job or earns money from babysitting. With a roth 401 k you don t get a tax break for your contributions but your withdrawals can be tax free. Then you will be on your way to starting your own plan. Unlike roth iras there are no income limits on roth 401 k s so anyone can open one.

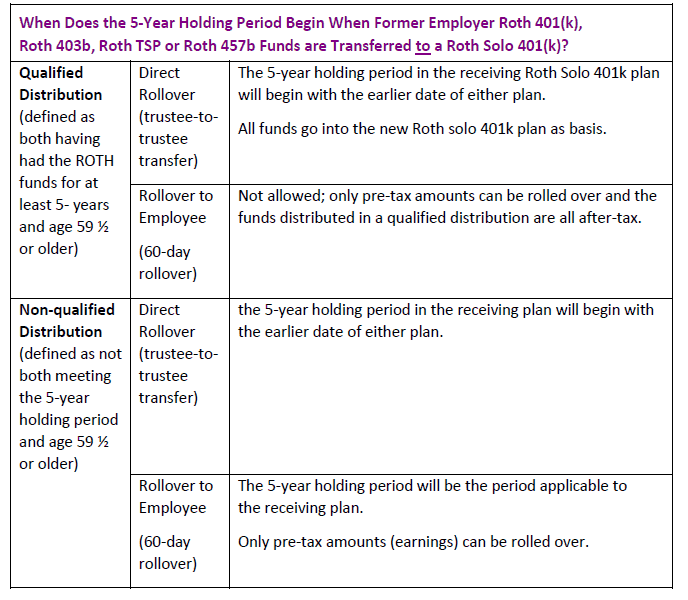

A roth solo 401k adds even more flexibility to your potential retirement savings. In other words a roth ira is not tied to your employer like a. Find a provider with a lot of experience in supplying self employed individuals with private 401k s. With so many acronyms like ira and 401 k your local farm bureau agent can help you understand what s best for you.

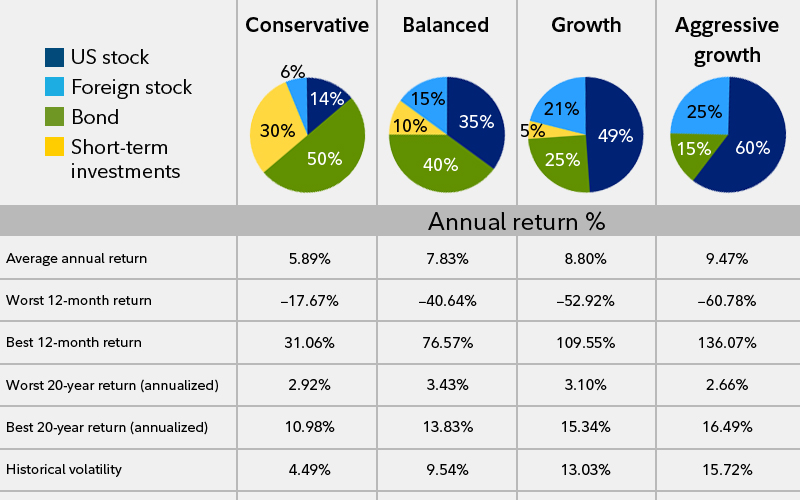

Contribution limits are higher than for traditional 401 k s because you can make contributions as. Always go roth might not be advice worth heeding. A solo 401 k is simply a 401 k that a self employed person can open for themselves. If your bank doesn t offer roth ira accounts you can open one with a brokerage firm.

If any of your children have earned income you can open a custodial roth ira for that child. But you don t have to handle the process on your own. All too often that s not the case. Most large firms also offer online access to start the account application.

But you still have options. Start your own retirement plan when your employer doesn t when you re an employee you can only use a 401 k plan if your employer establishes a plan and you re eligible to contribute. Since you want to open a solo 401k your provider must understand your concerns. It might surprise you to discover your roth ira or roth 401 k can hurt your chances to retire in comfort.

In fact the best way to start a roth ira is to talk with your investment professional. But filling out the paperwork to open a solo 401k can be tedious and time consuming. Unlike companies who open traditional 401k s you want to focus on your own personal growth.

/shutterstock_240823573.Roth.IRA-6dcbb04f7e3448418aff7b09c4f6ab6d.jpg)

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)