Can I Sell My Annuity For A Lump Sum

If you are 55 or over you can release up to 100 cash lump sum from your pension the first 25 of which is tax free and the rest of it would be taxed at your normal marginal rate of tax.

Can i sell my annuity for a lump sum. You have full control over spending and investing your money. Of course you can. However for three years the annuity payments will stop. The earliest you can take your pension lump sum is age 55 but the state pension age is currently 65 for men and women.

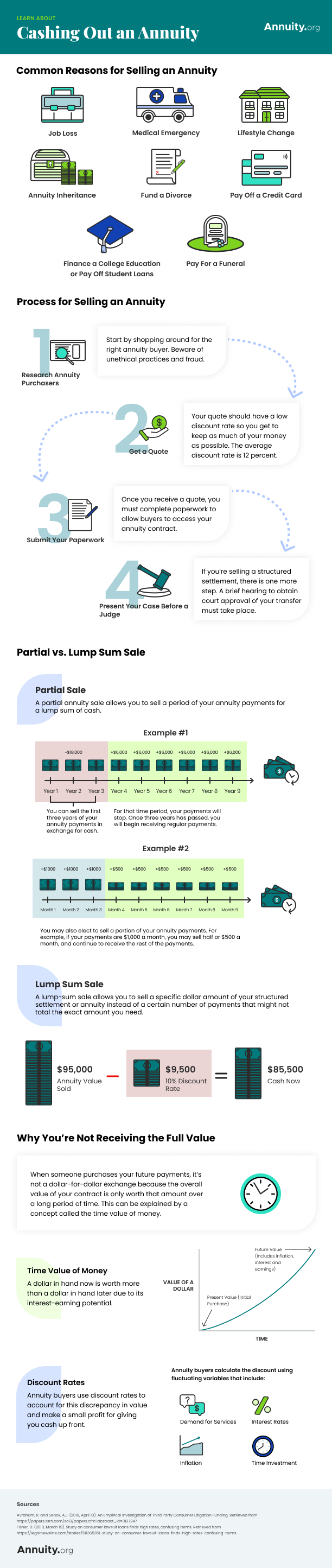

After the four years have passed periodic payments will resume. For example you can sell years one through four of your annuity payments for a lump sum. If an annuity owner has a 10 year contract but needs money for a new car now he can sell his annuity from years one to three in exchange for a lump sum. Before you decide to sell a single payment consider the costs associated with selling your annuity payments the options for selling and how they stack up against the financial consequences of withdrawing funds.

Withdrawing funds from your annuity can come with expensive fees and other penalties. If you only want to sell a portion of it say 50 000 that. Is selling your pension in your own best interest. Retirees with pensions can sell their pension benefits for a lump sum to third party companies that act as middlemen between pensioners and investors.

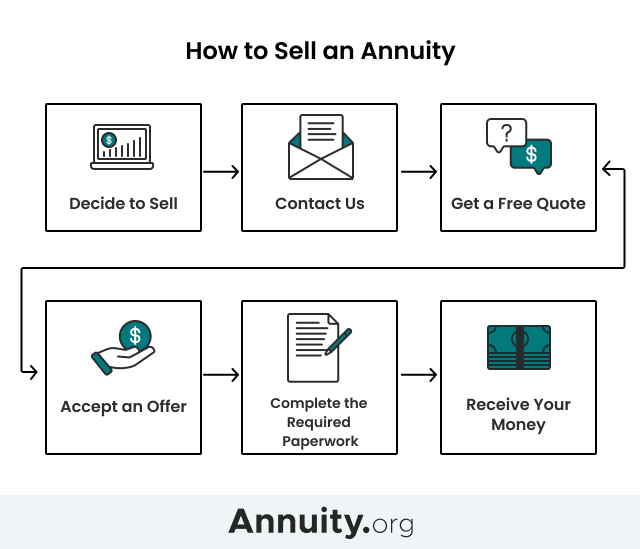

You don t have to sell your entire annuity to get a lump sum. Complete the form above by providing your contact information and then a description of the payments you wish to sell. If you are thinking about selling your pension you can take part or all of your pension as a cash lump sum. In the event you need immediate cash you can sell some payments in exchange for a lump sum.

Sell my pension advanteges. The companies advertise themselves as. You get a big fat lump sum check. The short answer is yes you can sell your pension today and receive a lump sum payment in return for turning over your future payments to somebody else.

Let me point out some pros and cons of selling your pension to your employer the way i see it at least. Sit back and relax while ssq shops your annuity payments to its certified funders the most reputable funding companies in the industry thereby creating a competition to get you the highest price available for your future annuity payments. Of course whether you can convert your pension to a lump sum is a different question as to whether it is a good idea. So you could still have a decade of work before you fully retire.