Can You Cash In An Annuity Early

A partial annuity sale allows you to sell a period of your annuity payments for a lump sum of cash.

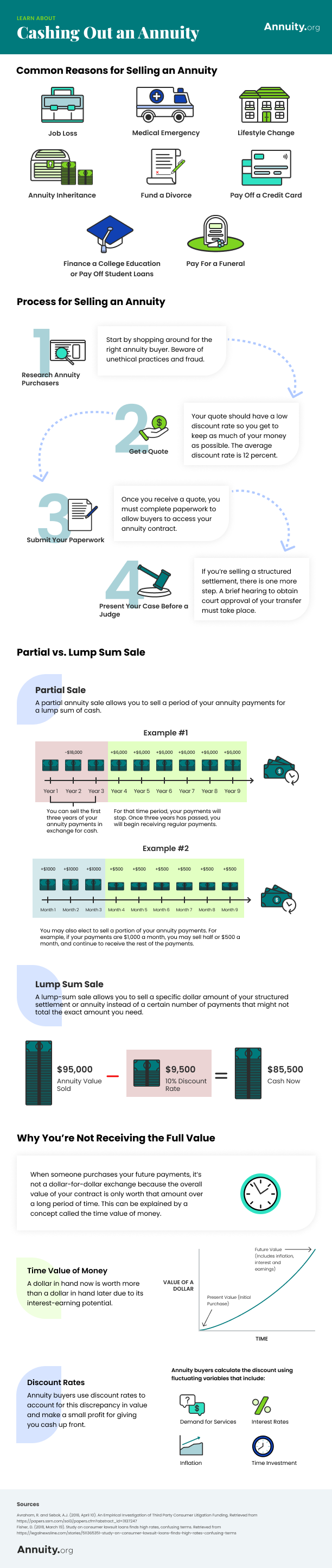

Can you cash in an annuity early. You can begin taking an income at age 59. For example if you bought a 15 year period certain annuity but you need enough money now for a down payment on a house you can sell your payments from years one through three in exchange for cash. You can borrow from your annuity to put a down payment on a house but be prepared to pay an assortment of fees and penalties. Taking money early the other major tax consequence has to do with the retirement related nature of annuities.

Annuities are tax deferred which means you aren t taxed on the money the annuity gains until you withdraw it. Annuity owners can contact the insurance company that issues payments for their annuity to request withdrawals. For example you can sell the first three years of your annuity payments in exchange for money you want for a down payment on a new home. Payments may be a better option.

For those three years you won t receive payments but they will resume when the period ends. For that time period your payments will stop. How to cash out an annuity early. You can can out an annuity by taking withdrawals or selling.

However they tend to lock participants in for a long term period. Annuities can provide a tax free way to set money aside. In addition if you are not yet 59 1 2 years old you may be assessed a 10 percent tax penalty for cashing out early according to the internal revenue service. If you take your money out early you ll pay a surrender charge to the annuity company which will be deducted from your withdrawal.

If you withdraw money before age 59 in addition to paying taxes on the gains you may be subject to a 10 percent early withdrawal penalty. However if you are in a financial emergency and require immediate cash you might have to cash out an annuity early. If you have any questions about cashing in your retirement annuity pension then it can be a good idea to speak with a pensions advisor. When you cash in an annuity you have to be aware of the potential tax consequences.

Annuity holders can cash in an annuity with some exceptions. You can cash out of an annuity during the surrender period but may be assessed a penalty in doing so. Typically you face a 10 tax on any money you withdraw early.