Can You Cash In An Annuity

Many annuities cannot be passed on to a beneficiary.

Can you cash in an annuity. This is an irrevocable. The distribution phase occurs when you wish to take out cash flows from the annuity while alive meaning you have annuitized the assets in return for an income stream. If you cash out your annuity before age 59 you may owe a 10 percent tax penalty. Any money left in them when you die goes to the.

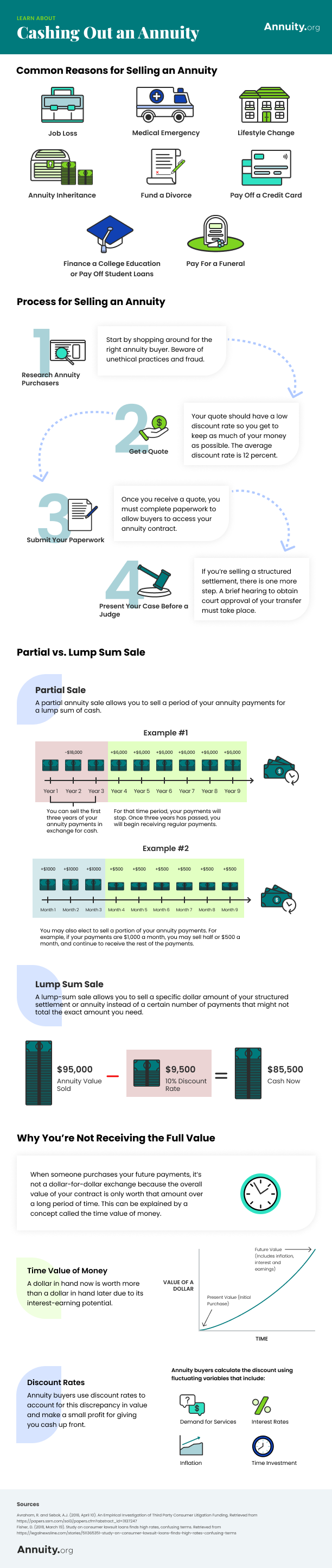

If you re thinking about cashing in your annuity solely to buy another annuity that you think is better keep in mind that the tax laws allow you to make a tax free exchange. To cash out your annuity contact your insurance company or agent. Indeed as already discussed in this article it s rarely possible to cash in your retirement annuity once you ve purchased one and the 30 day cooling off period has passed. An alternative to withdrawing money early is selling future payments to a purchasing company at a discount.

In an annuity the insurer makes certain contractual. However making early withdrawals may incur costly surrender charges and tax penalties. Selling an annuity is perfectly legal as the annuity is considered your property and you may sell all or even a part of it at any time. So if your annuity is very small you could ask if this is an option and how much you would get in return.

Annuities can come with a host of fees and charges that reduce your funds significantly. It is possible to cash in your annuity but only if it s worth less than 10 000 and only if your provider allows you to do this. Insurance products like annuities could also cost you money but if you know what to look for prior to purchasing an annuity you could end up paying no fees at all along with reaping the benefits of tax deferred growth and a lifetime income you can count on for as long as you need it. Yes annuities provide valuable tax deferred growth.

You may also owe surrender charges from the insurance company. This is a great way to cash in an annuity if your insurance company will not allow you to surrender it or you will be faced with steep surrender costs. Again due to the guaranteed element an annuity provides it s rarely possible to cash in your annuity early or after you ve begun to receive an income from it. But for more than any other reason annuities are valuable because of their guarantees.

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)