Can You Have A Traditional And Roth Ira

Married couples filing jointly can make a reduced contribution at 196 000 and the ability to have a roth ira disappears once a couple s income reaches 206 000.

Can you have a traditional and roth ira. Or your taxable compensation for the year. The major distinction between roth iras and traditional iras is the money you contribute to each. For example if you make 100 000 per year and your spouse does not have earned income you can make a contribution of 6 000 to a roth ira account for both you and your spouse for a total of. Company retirement plans generally have higher contribution limits than either a traditional or a roth ira.

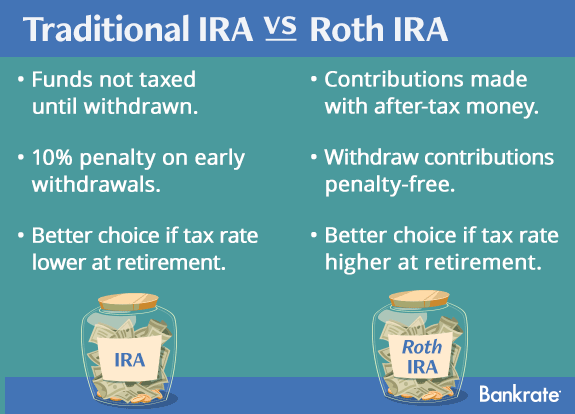

For 2018 5 500 or 6 500 if you re age 50 or older by the end of the year. You can own and fund both a roth and a traditional ira assuming you re eligible for each. You can t put 6 000 in each account. You can put a total of 6 000 into traditional and roth iras.

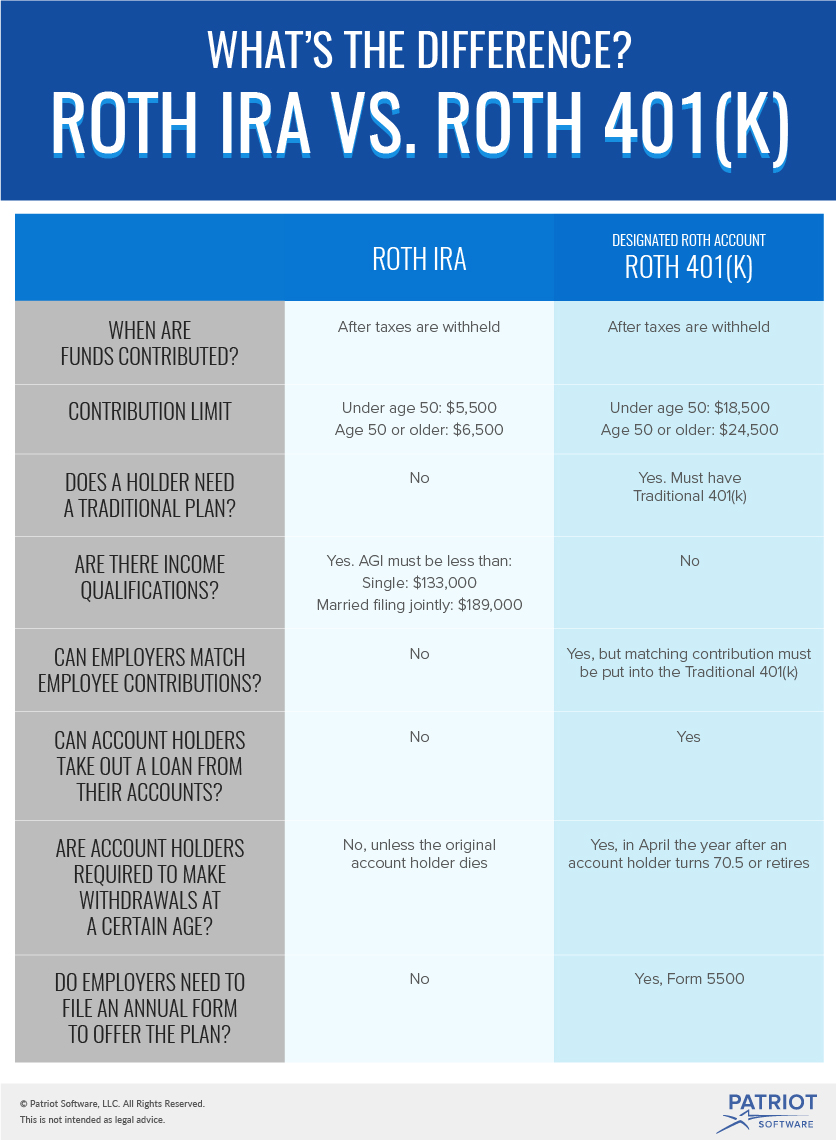

The most you can contribute to all of your traditional and roth iras is the smaller of. Doing so entails paying the taxes but not any penalties on the savings and growth you. In other words a roth ira is not tied to your employer like a. Employee 401 k contributions for 2020 can increase by 500 to 19 500 while the.

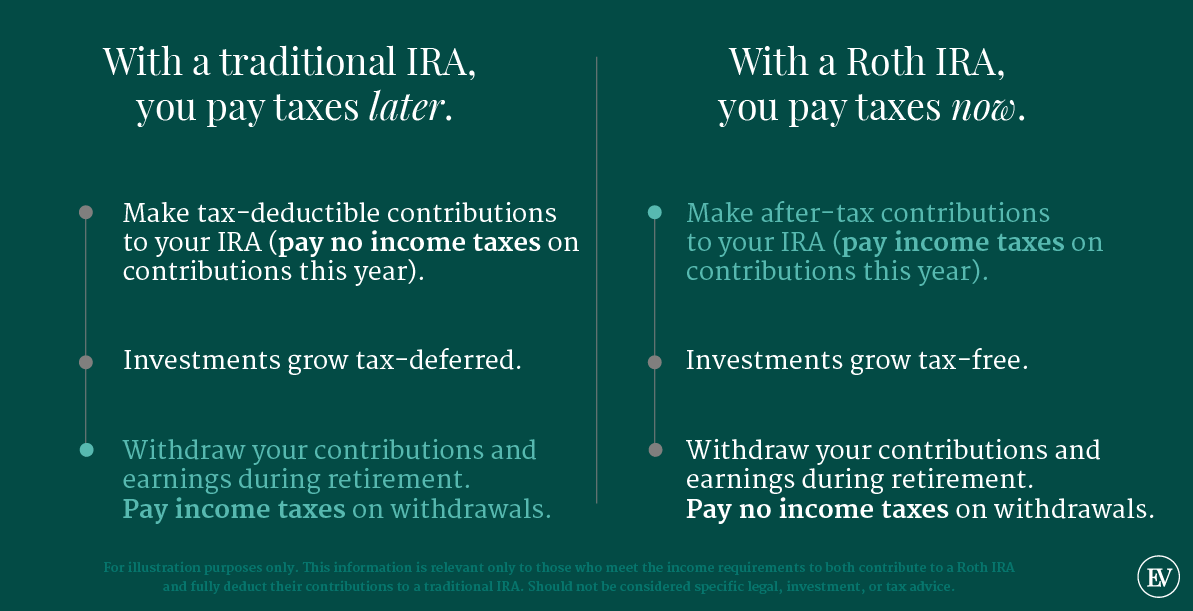

Individuals who make more than the phase out limits can t have both a 401 k and a roth ira only a 401 k. The ira contribution limit is a combined annual maximum. Roth contributions are made with after tax dollars whereas traditional ira contributions are typically made with post tax dollars. Many taxpayers can claim a tax deduction for the amount of their traditional ira contributions.

If you do choose to open two ira accounts you will have to consider the irs s maximum annual contribution which applies to both roth iras and traditional iras. A roth ira is an individual retirement account and as long as you pay taxes on the income you earn virtually anyone can open one.