Can You Refinance A Loan

Not only could it lower your monthly student loan payment but it could also reduce your interest rates and the.

Can you refinance a loan. But if you wait several years before refinancing you restart the interest cycle and amortization process described above and you pay interest for several more years. You won t lose important benefits because private loans do not come with similarly generous protections. Since refinancing can cost between 2 and 5 of a loan s. Special loan programs like federal housing administration loans may have varying time requirements for when you re able to refinance based on the type of refinance.

If you ve lost your job or have reduced income you may be. There are many reasons why homeowners refinance. You can now refinance into a conventional loan without a cash out one year after getting a texas cash out refinance loan if you use your land for agricultural purposes you can now qualify for a. Your income decreased and you need lower monthly payments.

If you have private loans however you can refinance those separately from federal loans. You can refinance ahead of time to avoid this style of personal loan. So if you re weighing forbearance as a precaution but haven t pulled the trigger yet. You will also need a credit score of above 700 unless you are dealing with a credit union in which case you might get by with a slightly lower score.

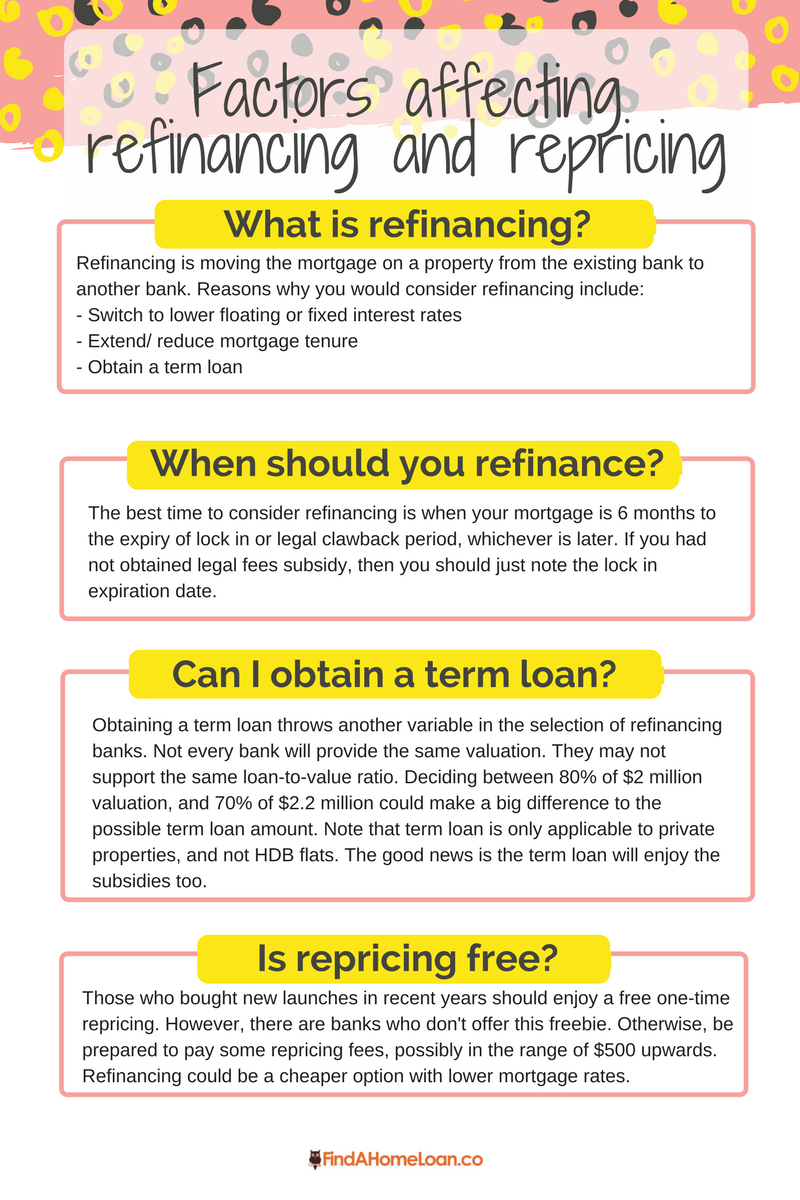

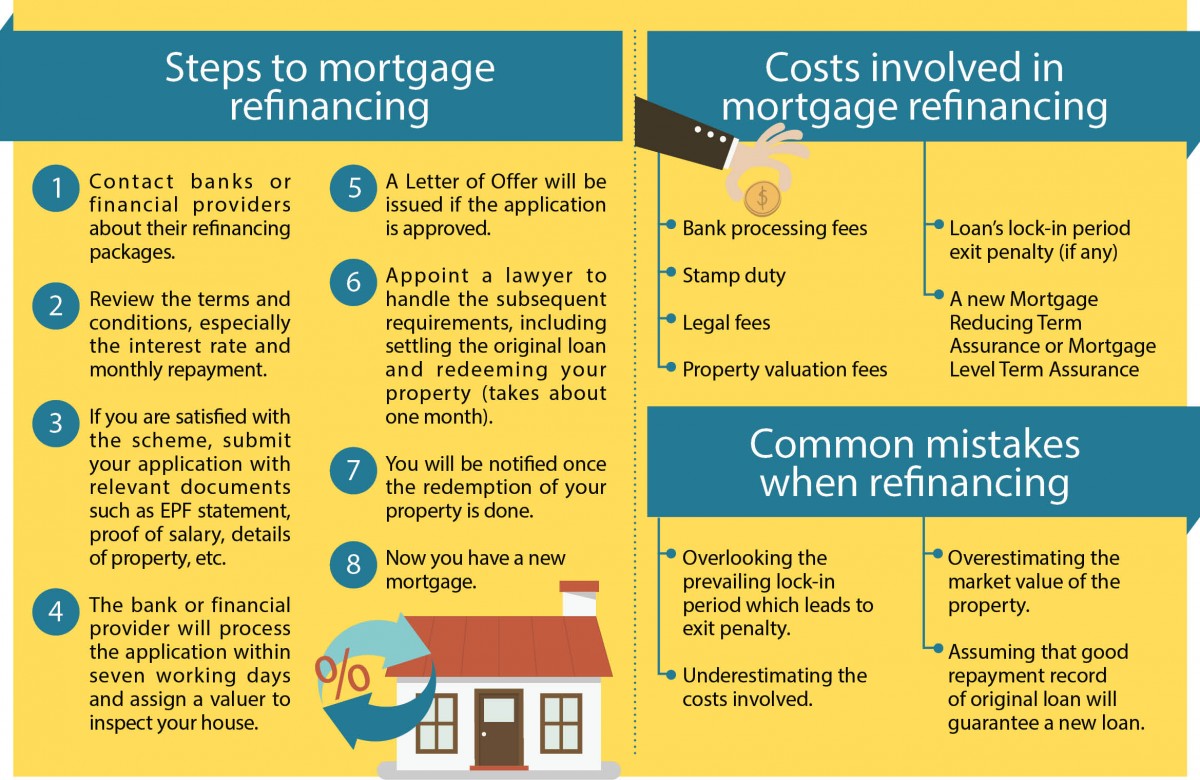

To see what you d pay on a private student loan refinance either with or without a cosigner you can visit credible today to view a rates table that allows you to compare fixed and variable rates. Student loan refinancing can be a smart move if you re facing financial hardship. Now you can refinance your current mortgage or purchase a new home once you ve made three consecutive mortgage payments either after your forbearance plan ends or under a repayment plan or loan modification. Refinancing a mortgage means paying off an existing loan and replacing it with a new one.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

/pros-and-cons-of-refinancing-a-car-loan-1a117a027ee14bd583fd1abdef935b9d.gif)