Can You Refinance Your Student Loans

You can refinance student loans as often as you d like.

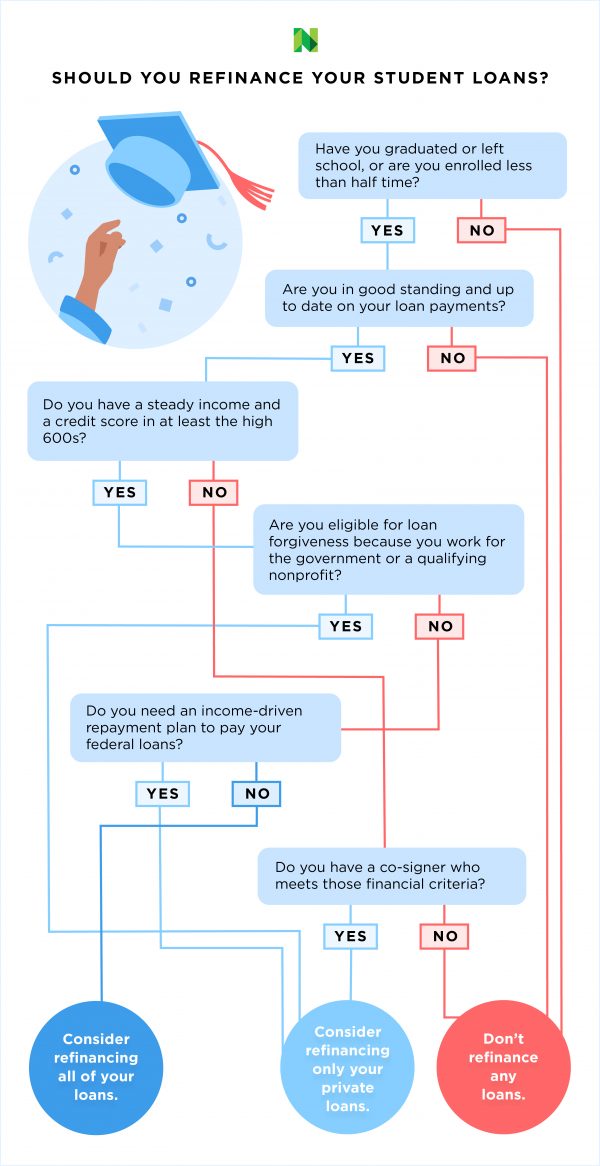

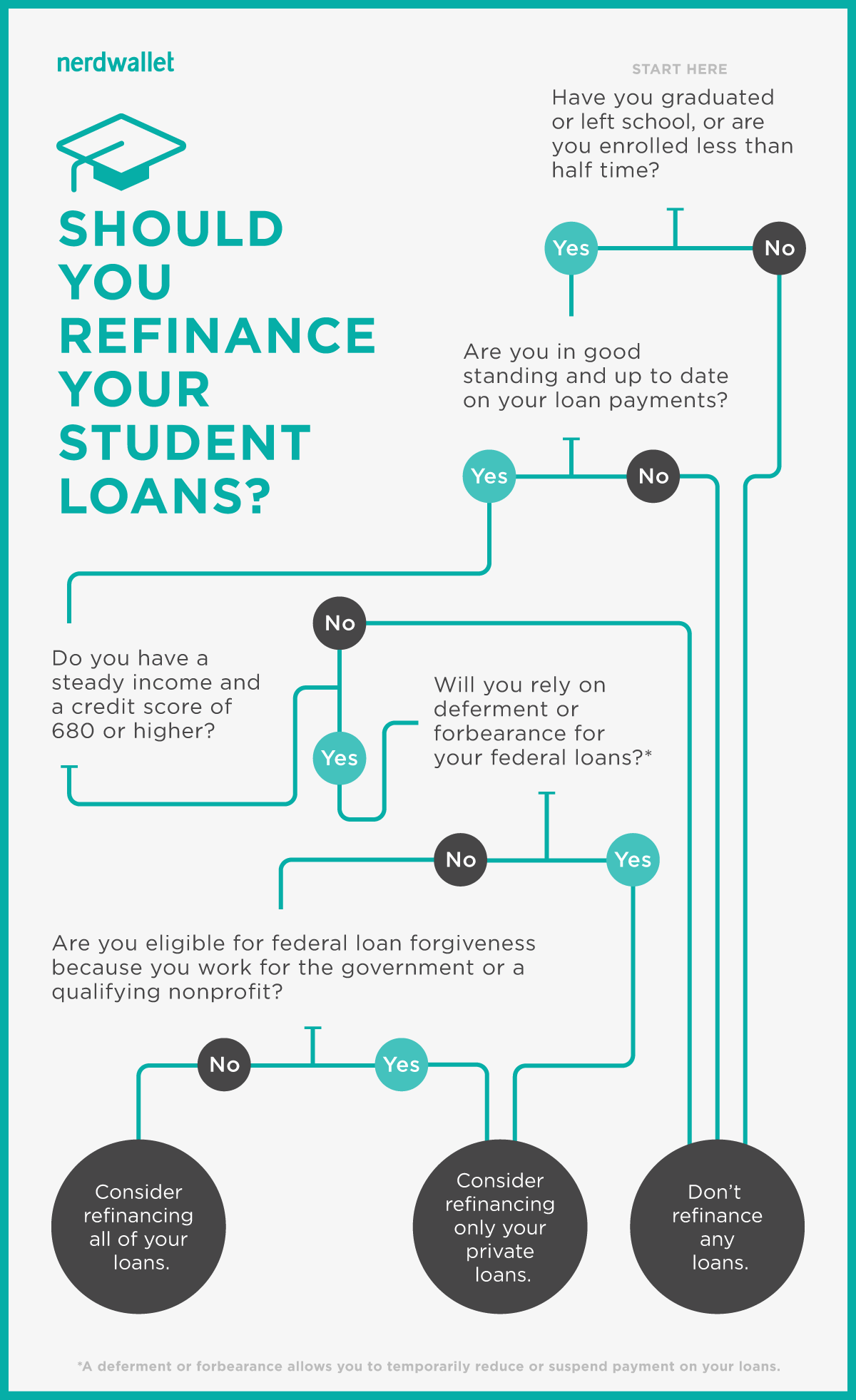

Can you refinance your student loans. 3 questions to determine if you should refinance federal student loans. If you ve already refinanced and your credit has recently improved consider refinancing again to lock in a lower rate. When you refinance your federal student loans with a private lender you forfeit most federal student loan protections. Student loan refinancing can mean big savings in the right circumstances.

A new private company typically a bank credit union or online lender pays off the student. You should not refinance federal student loans if you plan to pursue public service loan forgiveness an. Here s how it works. Student loan debt is a huge crisis for americans but refinancing your loans could help you save thousands of dollars in interest and potentially reduce the amount of time it takes to pay back your loans since more of your payments will go toward the actual.

Student loan refinancing is a great way to make payments more manageable but there are important things to consider before you decide to refinance your student loans. However you cannot refinance federal or. Student loan refinancing can be a smart move if you re facing financial hardship. Through the process of refinancing you are essentially applying for a private loan.

Not only could it lower your monthly student loan payment but it could also reduce your interest rates and. If you have a lot of student loans and are having a difficult time paying them off student loan refinancing is an option worth exploring. The same goes for refinancing a private loan into a new private loan too. A lower rate will save you money over time by decreasing the amount you pay in interest.

While refinancing can be a major financial improvement to those who qualify there s one big caveat. You may be able to refinance your federal student loans into a private loan. Borrowers who choose to refinance can often lower their payments by 253 a month or save 16 183 over the life of the loan.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)