Can You Use A Home Equity Loan For A Downpayment

How to use land equity as a down payment to build a house.

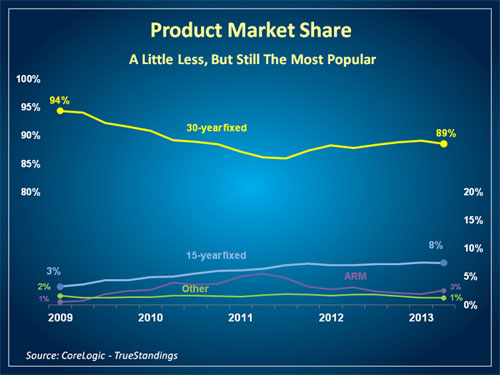

Can you use a home equity loan for a downpayment. When you buy your first home lenders sometimes want to see that you re using your own money as a down payment. While variable rate helocs offer flexibility for borrowers who wish to draw on them again home equity loans are ideal for down payments on rental properties that don t need any work. A vacation home will generally require 10 to 20 for the down payment so depending on the amount of equity you have you can buy a home outright or use the equity in your primary home as the. If you re using your first home as a source of a down payment to buy another home.

Home equity loan can be down payment for rental property. That being said it is entirely possible to use a home equity line of credit to either subsidize or completely pay the down payment on a second home. If you own land outright or you have a significant amount of equity in land you can use it just as you would use any other tangible. While most mortgage programs don t allow you to borrow a down payment some forms of down payment financing are allowed under certain programs.

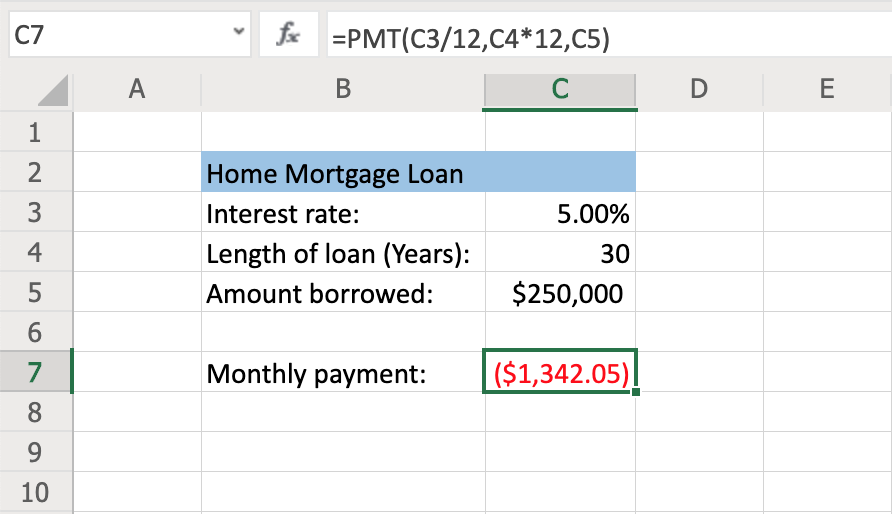

Qualifying for a 15 down payment generally requires borrowers to have a credit score of 720 or higher. In most cases you ll need a 15 to 20 down payment for a single family home you don t plan to live in. A personal loan is not tied to any property. The fees on home equity loans are similar to what you see on helocs.

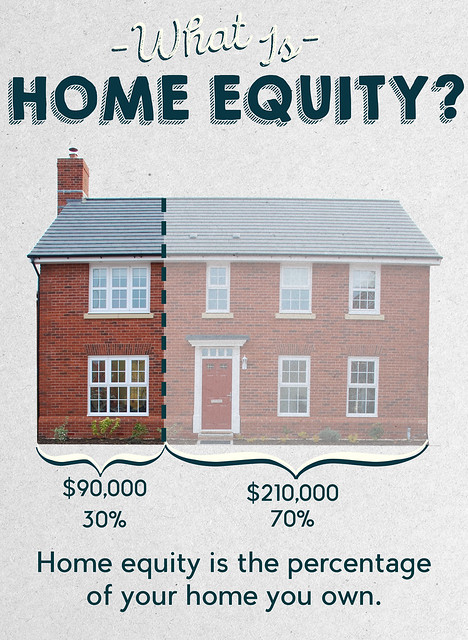

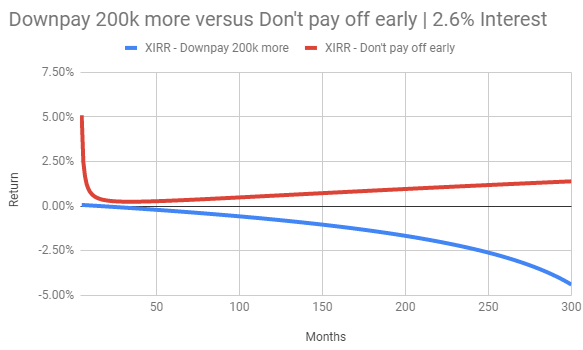

So in this scenario the 50 000 piece of land that you own is the down payment on the 350 000 final value of the home. The benefit of second mortgages is the predictability of their repayment schedules. That s a little more than 14 down put simply if you already own land the equity that you have in that land can be used as your down payment for your construction loan. If you can come up with a 10 down payment taking out a hel or heloc on the home you re buying to come up with another 10 of the down payment will help you avoid pmi on a conventional mortgage.

This frees you up to sell your. Understanding how to leverage a home equity line of credit or heloc for a down payment on a second property is a powerful skill to have. For conforming mortgages fannie mae and freddie mac home equity loans are acceptable sources for a down payment. This is called a piggyback loan.

/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9.png)

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)