Cancelling Pmi Insurance

In fact the homeowners protection act more on that below requires that private mortgage insurance be terminated automatically when you reach 22 percent equity in your home based on the original property value if your mortgage payments are current.

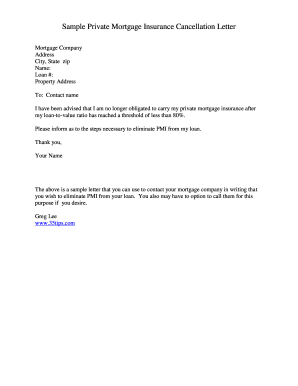

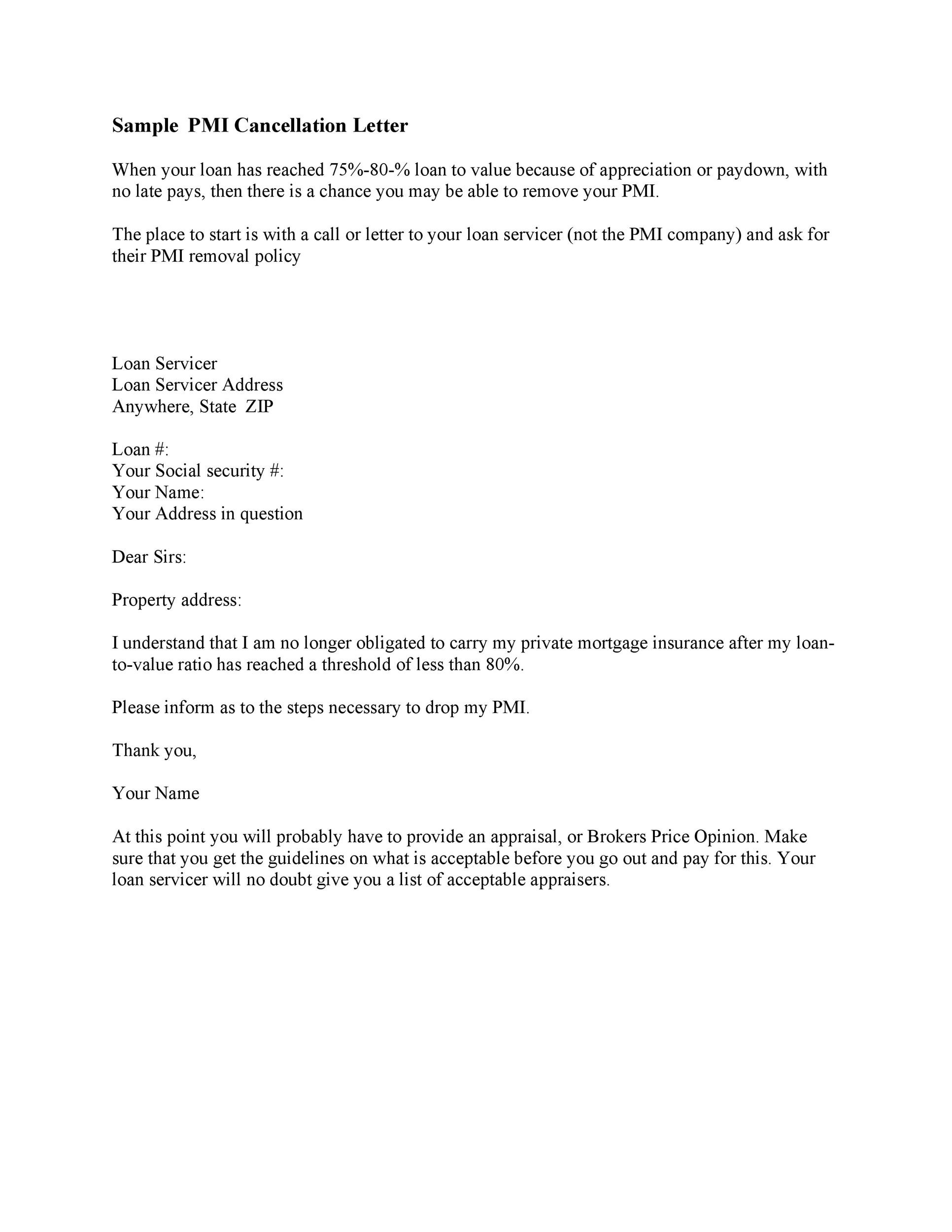

Cancelling pmi insurance. Foreclosure buyouts are typically a refinancing loan which the homeowner obtains to cover the. 1 requesting pmi cancellation or 2 automatic or final pmi termination. Request pmi cancellation you have the right to request that your servicer cancel pmi when you have reached the date when the principal balance of your mortgage is scheduled to fall to 80 percent of the original value of your home. The homeowners protection act of 1998 hpa 1 covers single family primary residences whose sales were closed on or after july 29 1999.

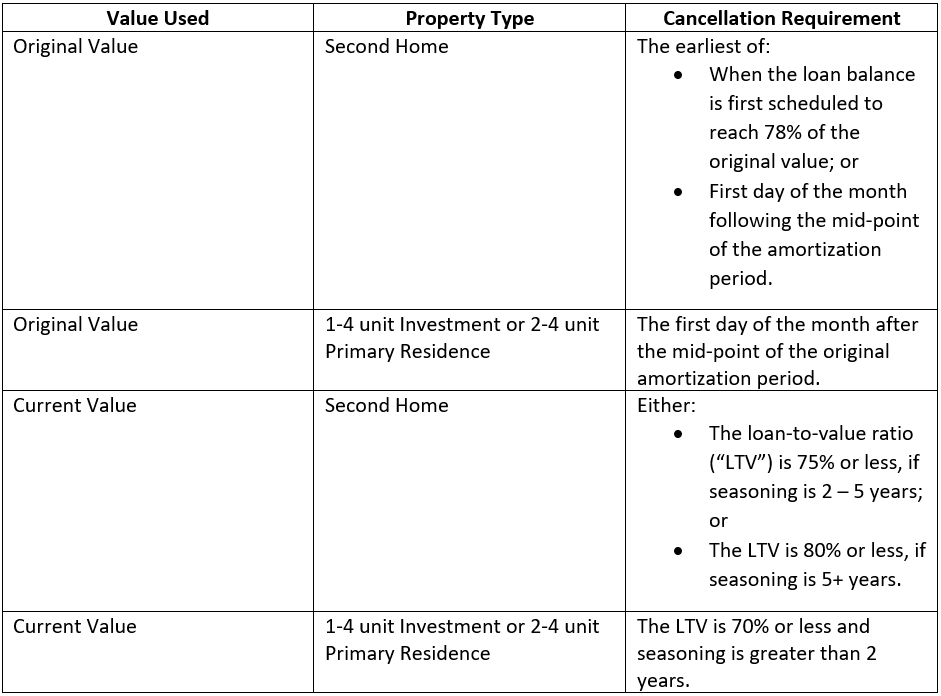

Mortgage insurance pmi is removed from conventional mortgages once the loan reaches 78 loan to va l u e. Cancelling mortgage insurance using original value. But removing fha mortgage insurance is a different story. A refinancing program that allows a homeowner to avoid foreclosure on their home.

The hpa addresses homeowners difficulties in canceling private mortgage insurance pmi coverage. Fha loans typically have mortgage insurance that lasts for the life of the loan unless you ve made a down payment of at least 10 in which case you can remove pmi after 11 years. Determine the mortgage insurance rate. 7 ways to cancel your p m i.

For conventional loans the homeowners protection act of 1998 also known as the pmi cancellation act set mandatory guidelines for mortgage lenders so that consumers can understand when they can stop paying pmi. This is an added annual cost about 0 3 percent to 1 5 percent of your. One of the benefits of private mortgage insurance pmi is that you can typically cancel it when you build up enough equity in your home. Et seq also known as the pmi cancellation act was signed into law on july 29 1998 became effective on july 29 1999 and was amended on december 27 2000 to provide technical corrections and clarification.

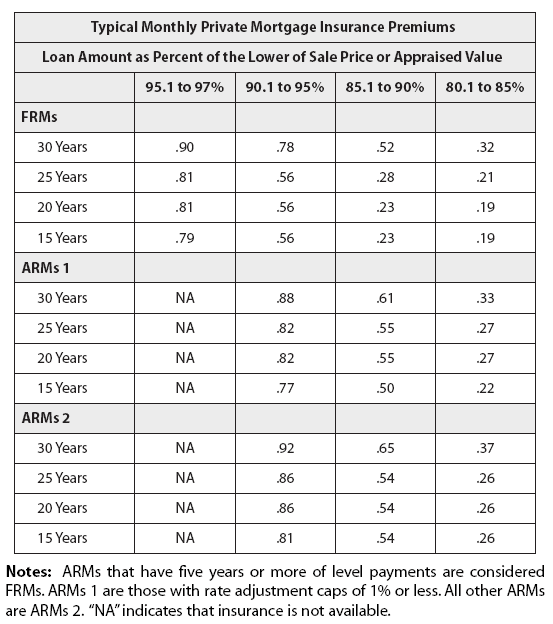

Pmi fees vary depending on the size of the down payment and the loan from around 0 3 percent to 1 15 percent of the original loan amount per year. Private mortgage insurance first if you have paid down your mortgage to 80 of the original loan you can call your lending institution and request that the pmi be canceled. Can pmi be removed from fha loans. Homebuyers with a down payment of less than 20 percent are usually required to get private mortgage insurance or pmi.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance3-371bab72617d42d28def5f93c622d6e5.png)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)