Capital Business Loans

We provide funding solutions up to 250 000 delivered by a best in class team.

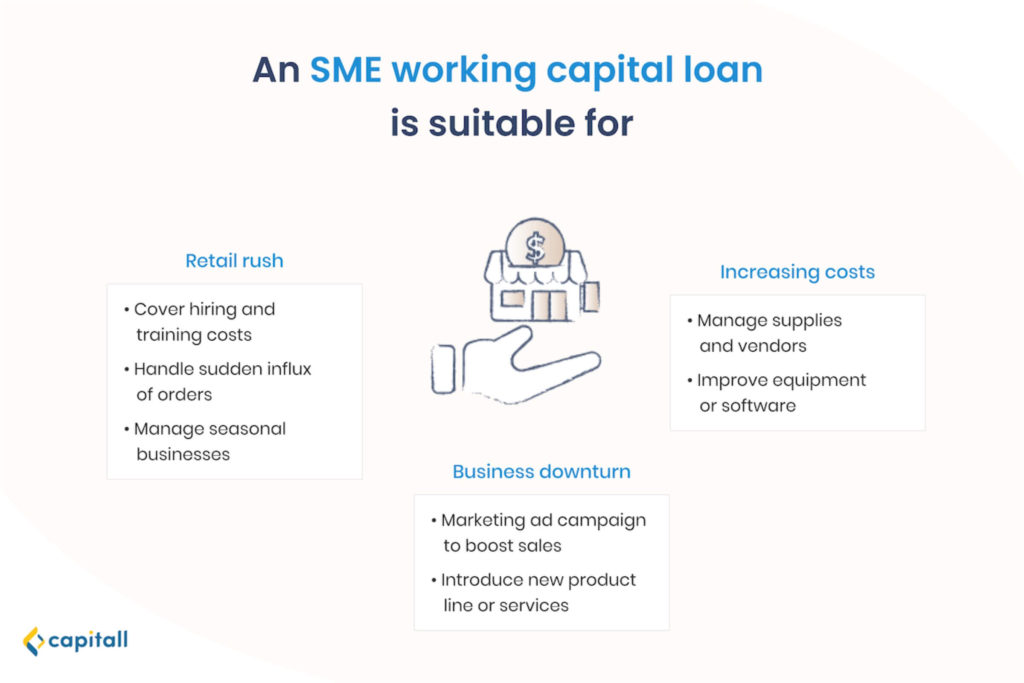

Capital business loans. Unsecured business loan is a loan that requires no collateral but is based upon the creditworthiness of the borrower and its business s revenue. A working capital loan is designed to cover short term business expenses such as payroll and inventory. Working capital loans are often tied to a business owner s personal credit so missed payments or defaults may hurt their credit score. Credible capital can find a solution for you.

See if your business qualifies for these small business administration loans. Working capital loans are usually taken when a company requires cash asset liquidity to cover day to day operational expenses so that they can put more money into expansion. Remember working capital loans work best for short term needs as opposed to investments that may take years to produce results. For this reason you can t use a working capital loan for expensive initiatives like developing a new product renovating your physical space adding a new division etc.

Understanding working capital loans. Learn more talk to a banker about relationship based rates as well as our more specialized lending products like non revolving lines of credit investor real estate loans and letters of credit. Can capital has over 20 years experience providing over 7billion in working capital to small businesses nationwide. This business loan can be availed by different businesses for different purposes.

A business term loan finances your high cost investment like business expansion loan or loan for purchasing tools or machinery for a smooth going business. Working capital loan. A working capital loan is a loan used by a company to finance its everyday operations such as payrolls rent and inventory. Apply for business loans online of upto 50 lakhs without collateral from tata capital.

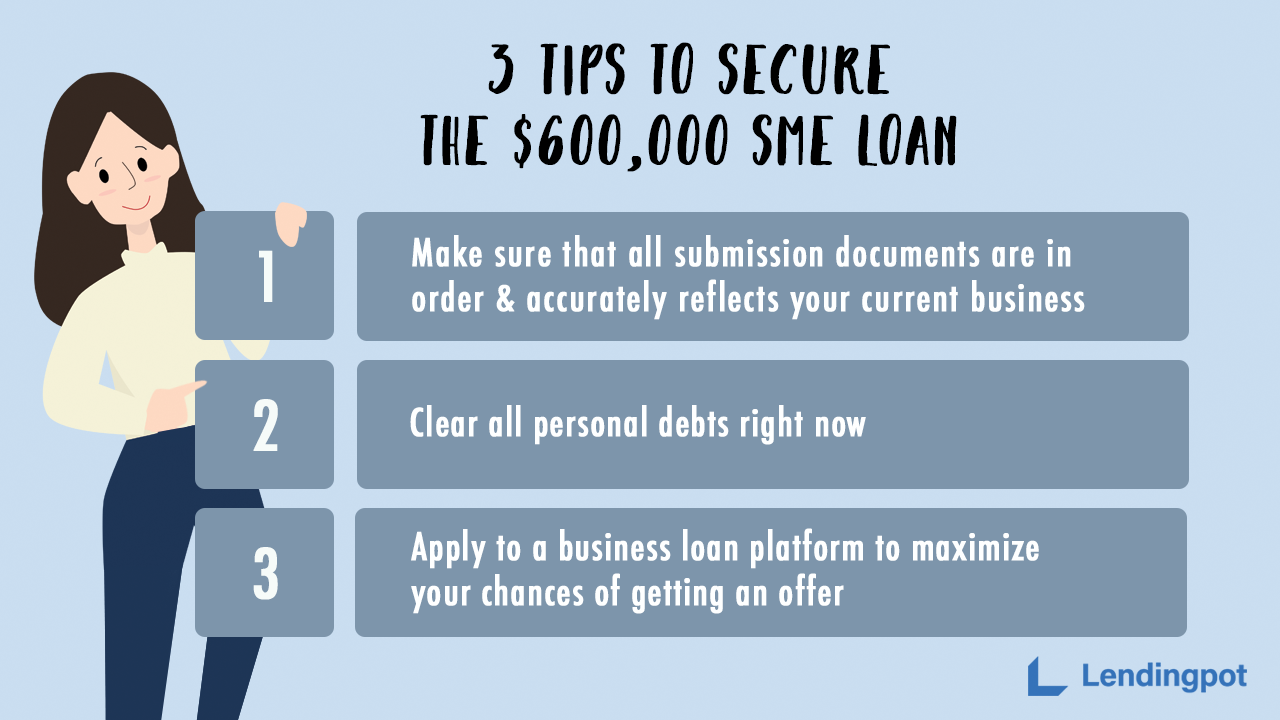

Types of business loans business term loan. Working capital loans also offer lower borrowing amounts than business term loans and sba loans. The uob business loan aims to help smes expand their business and gain access to working capital financing to support their day to day business operations. Learn more and compare options up to 5 million.