Car Insurance Companies With Gap Coverage

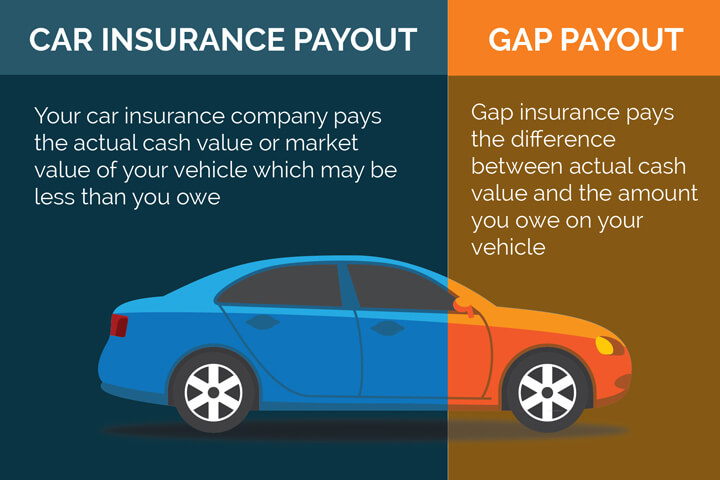

It may pay the difference between the balance of a lease or loan due on a vehicle and what your insurance company pays if the car is considered a covered total loss.

Car insurance companies with gap coverage. What do gap insurance companies provide. In some cases when you are insuring a new car you can get gap coverage as an add on endorsement to your standard policy. Health insurance policies. Gap insurance is an optional insurance coverage for newer cars that can be added to your collision insurance policy.

Check with your insurer to find out if it is offered. Simple gap insurance is an additional type of car insurance coverage purchased by the consumer and may only be issued by a licensed agent. Gap insurance is typically offered by a finance company when the vehicle owner purchases their vehicle but many auto insurance companies offer this coverage to consumers as well. Some insurers require your vehicle to be brand new in order for you to purchase gap insurance.

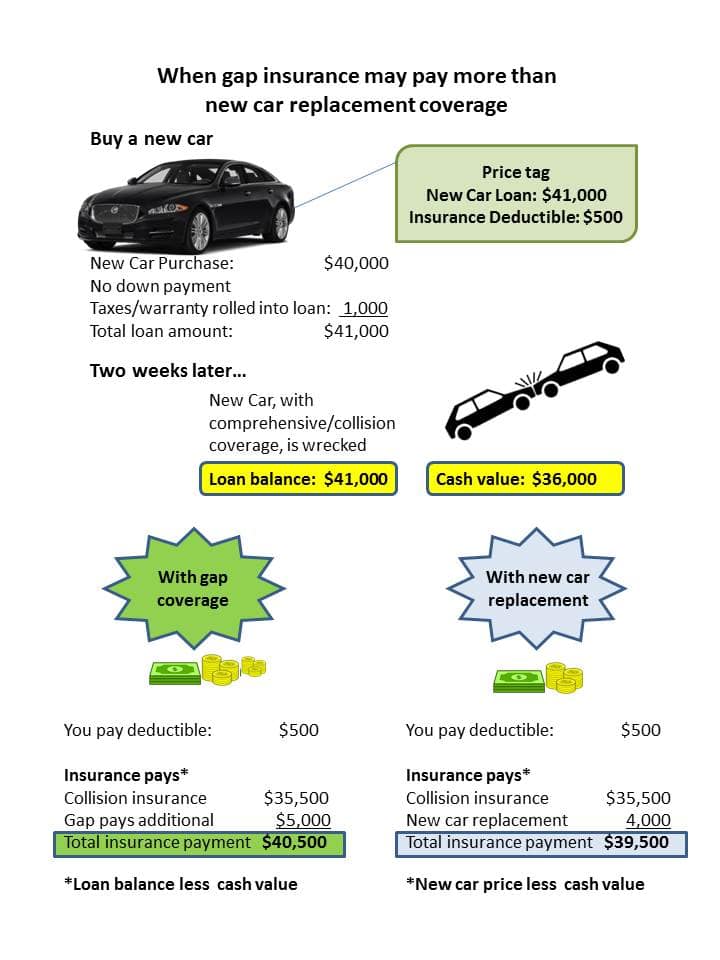

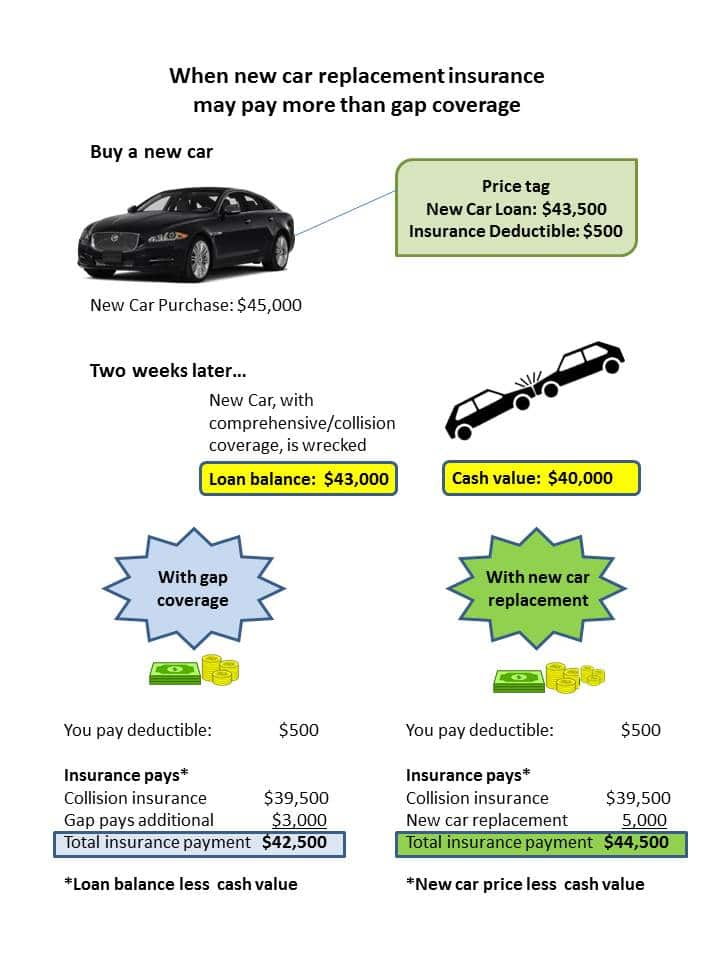

Gap insurance isn t just sold at car dealerships many insurers offer gap insurance as part of a car insurance policy. Costs vary due to insurance companies different rating systems but typically gap insurance is calculated as being 5 percent to 6 percent of your physical damage coverage costs. While there are several criteria for rating providers of gap insurance coverage the criteria that are most important include price confidence customer service quality and availability of a variety of coverage options. Lease loan coverage typically has limitations on how much it will payout such as 25 over the determined acv of your vehicle.

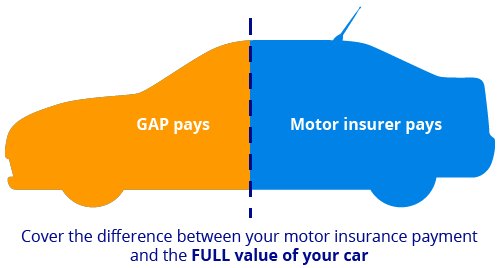

Gap insurance also known as loan lease payoff is an optional auto insurance coverage and applies if your car is totaled or stolen. Rating gap auto insurance providers is not the easiest job with so many companies offering the same insurance. Gap coverage will pay the difference between the amount you still owe on a vehicle and actual cash value acv paid out by your car insurance company. The second type of gap insurance is known as a gap waiver.

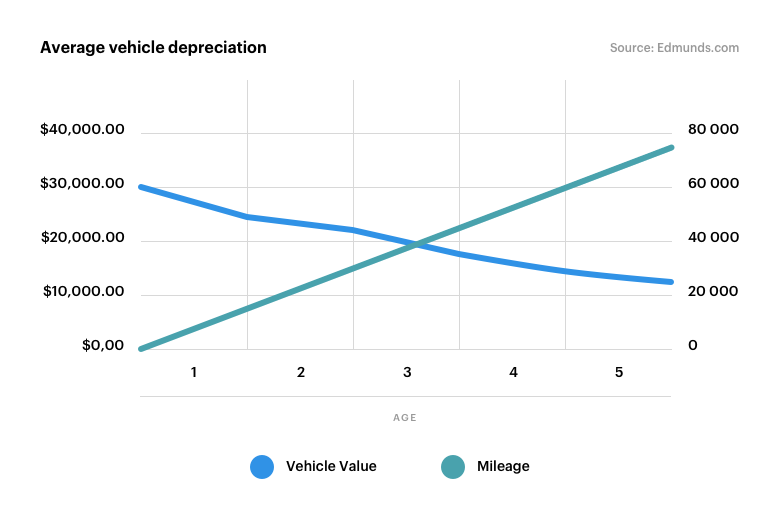

Say you just bought a car for 25 000 and you get into a wreck or it gets stolen six months later. And according to the iii buying gap coverage from an insurance company often costs less than buying it from a car dealership. If you get auto gap insurance gap insurance providers are offering extra coverage when it comes to the gap between what you recently paid for your vehicle and what its depreciated cost is today. Gap insurance providers include many major car insurance companies as explained earlier.

It s important to note some of the biggest car insurance companies may not offer gap insurance coverage.

/GettyImages-1004420614-d368080d9b9742c2a9b97753639288ec.jpg)