Car Insurance Drive Less Than 25 Miles A Day

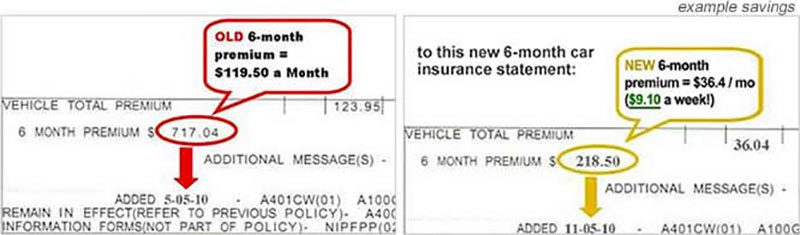

Many factors go into the cost of your auto insurance policy including how you purchase the policy.

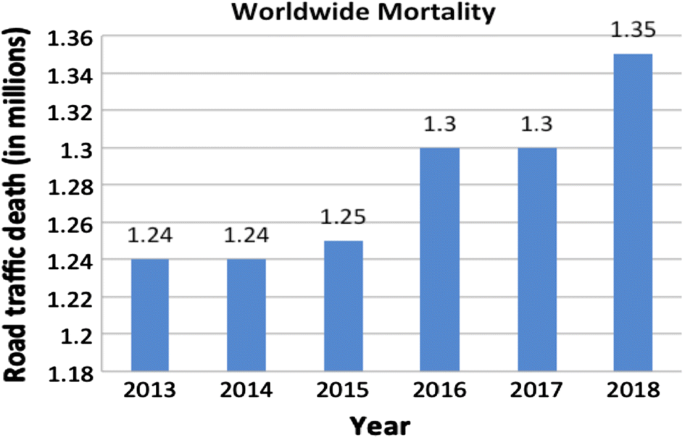

Car insurance drive less than 25 miles a day. However you might be able to get discounts by being a low mileage driver. Both of these conditions result in you being at a lower risk of potentially being in an accident than people. It was found that 7 major insurers give a discount for a commute distance of less than 15 miles exact number varies by state. The lower distance you travel the cheaper the insurance will be.

You can get cheaper car insurance if you drive less than 25 miles per day. In this article part 1 talks about low mileages car insurance discounts and part 2 discusses usage based car insurance. When you sign up for a usage based insurance. Usage based or pay as you drive or pay as you go insurance programs refer to programs offered by many auto insurance companies in which you can get a personalized premium by letting the car insurance company review your driving habits.

If you don t drive during prime times the cheaper the insurance will be. People who drive less than 50 miles a day have an advantage when it comes to finding cheap insurance. In general low mileage drivers are people who drive less than 7 500 miles per year. After all the risk of accidents lowers proportionately to the number of miles driven.

25 daily mileage discount calculation assumes 5 6 days per week commute or 7 500 miles per year of driving. That s not a hard line and some insurers use a different number. Online through a call center or with an agent. Usage based programs and discounts.

Finding cheap low mileage car insurance doesn t have to be tricky. You can lower car insurance quote by driving less. Enter your zip code below to compare the best low mileage car insurance companies. Based on your driving patterns you may get a discount of up to 50.

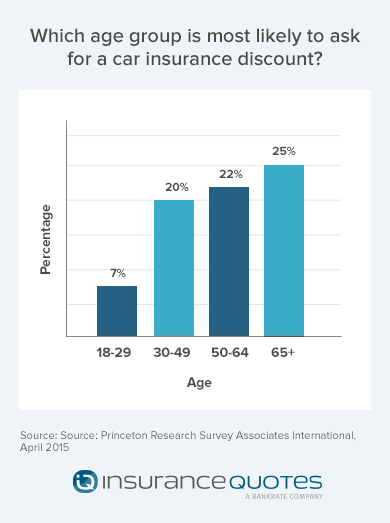

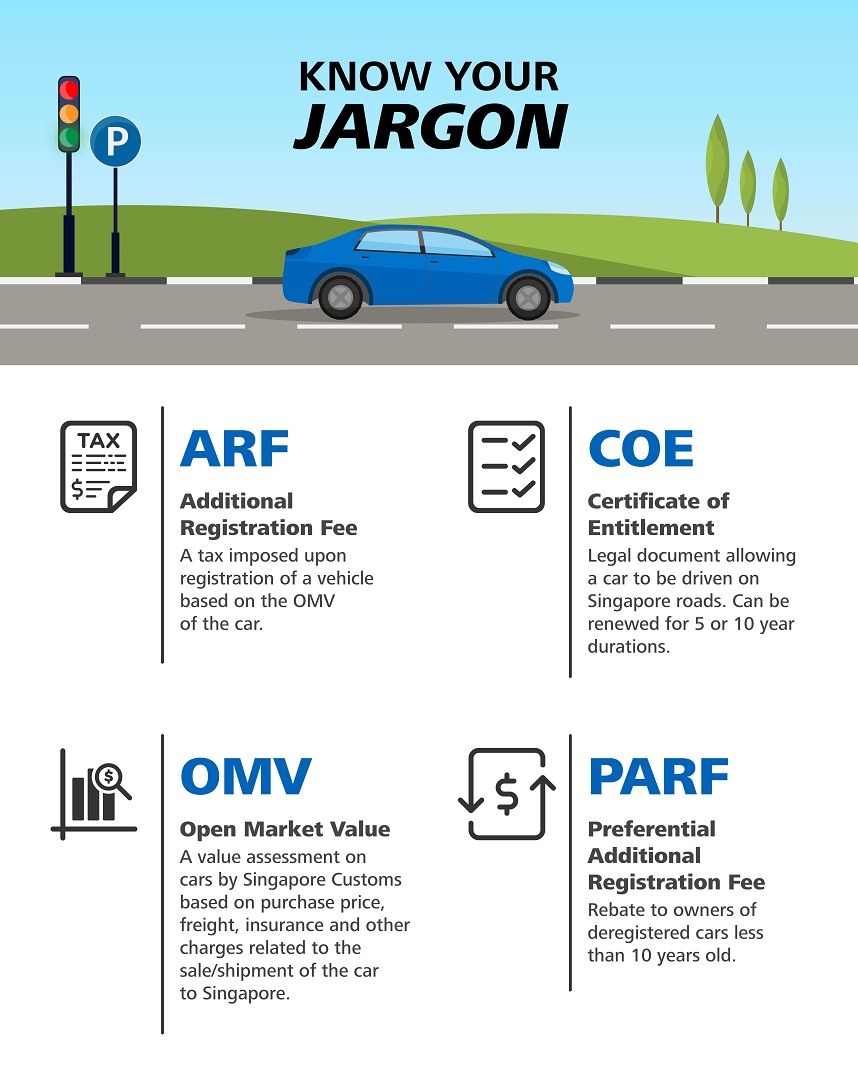

Safeco insurance says members who drive fewer than 8 000 miles a year can save up to 20. When car insurance companies offer you a rate it s usually based on the standard national average. But allstate says this is a good deal for people who typically drive less than 25 miles a day work from home are retired are a stay at home parent or a commuter. First the insurer creates a base rate based on standard insurance variables such as your age and your driving and claims history the type of vehicle you drive and where you live and in most states your credit history.

Car insurance by the mile is only partly based on how many miles you drive.