Car Insurance Policy Limit

100 000 per person 300 000 per accident.

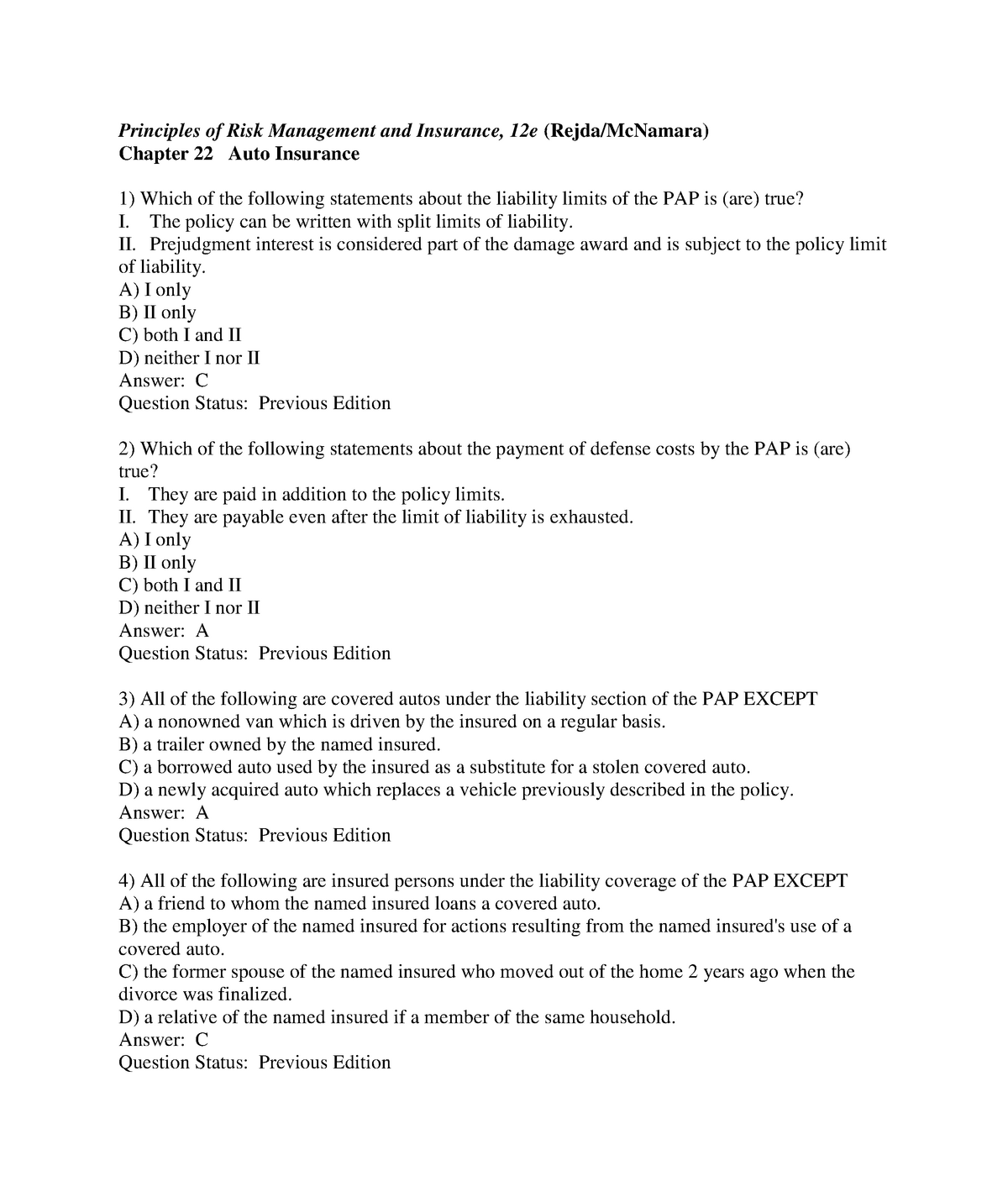

Car insurance policy limit. Each state sets minimum liability limits that all drivers are required by law to purchase. However you may want to consider increasing your liability insurance coverage limits to help protect yourself from the unexpected. Car insurance coverage limits are maximum amounts of money that your car insurance will pay out if you make a claim. Typical auto insurance policies include separate limits for different types of coverage such as.

If there are 100 000 in damages the insurance company isn t going to pay the excess 50 000. Once that limit is reached you re responsible for paying the rest of the cost out of your own pocket. Coverage limits are the maximum amount a car insurance policy will pay after a covered accident. Car insurance coverage limits are the maximum amount of money your car insurance company will pay for an accident.

One of the most common auto insurance policy structures for drivers in the u s. However the limit is likely less. What are car insurance coverage limits. Although the auto accident victim is not required to accept the insurance company s offer of policy limits and may choose to go after the offending driver directly by initiating court proceedings the likelihood of an ultimate recovery beyond the insurance policy limits will depend on whether the offending driver has assets sufficient to satisfy a judgment.

That can be a hard pill to swallow if you are in a large accident where bills add up quickly. For example if the limit on your collision coverage is 20 000 that is the most that your policy would pay out for damages to your vehicle after a collision. When your damages come to more than the insurance policy limits you may have a problem. All your passengers have comprehensive health insurance you shouldn t need this additional coverage.

In most cases bodily injury claims also meet or fall below the per person limits and additional expenses can be met with the per accident limits. Alabama department of insurance. Understanding your auto insurance policy accessed feb. All drivers in arkansas are required to have car insurance with minimum coverage of 25 000 bodily injury and 50 000 total coverage.

The higher the insurance coverage limits on your policy the more the insurance company will pay. A shopping tool for automobile insurance page 7. Generally the other driver s insurance policy will handle your claim for compensation. Is 100 300 50 which amounts to 100 000 per person bodily injury 300 000 per accident bodily injury and 50 000.

Minimum car insurance limits may not be enough to protect you. National association of insurance commissioners. For example if you buy a liability car insurance policy that has a 50 000 limit the insurance company is going to pay out only 50 000 to anyone who suffers injuries and or vehicle damage in an accident you cause.

:max_bytes(150000):strip_icc()/insurance-endorsement-or-rider-2645729-FINAL-5bdb553b46e0fb00518eef20.png)