Cash Annuity

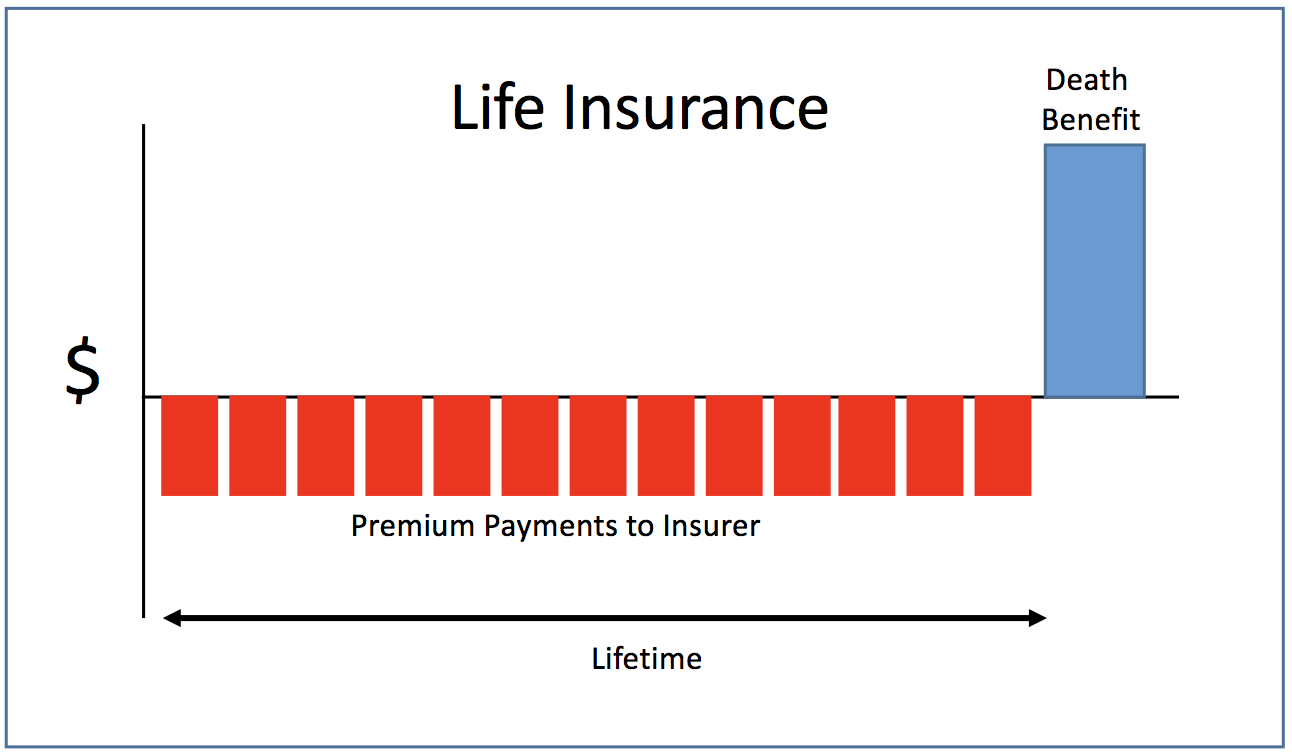

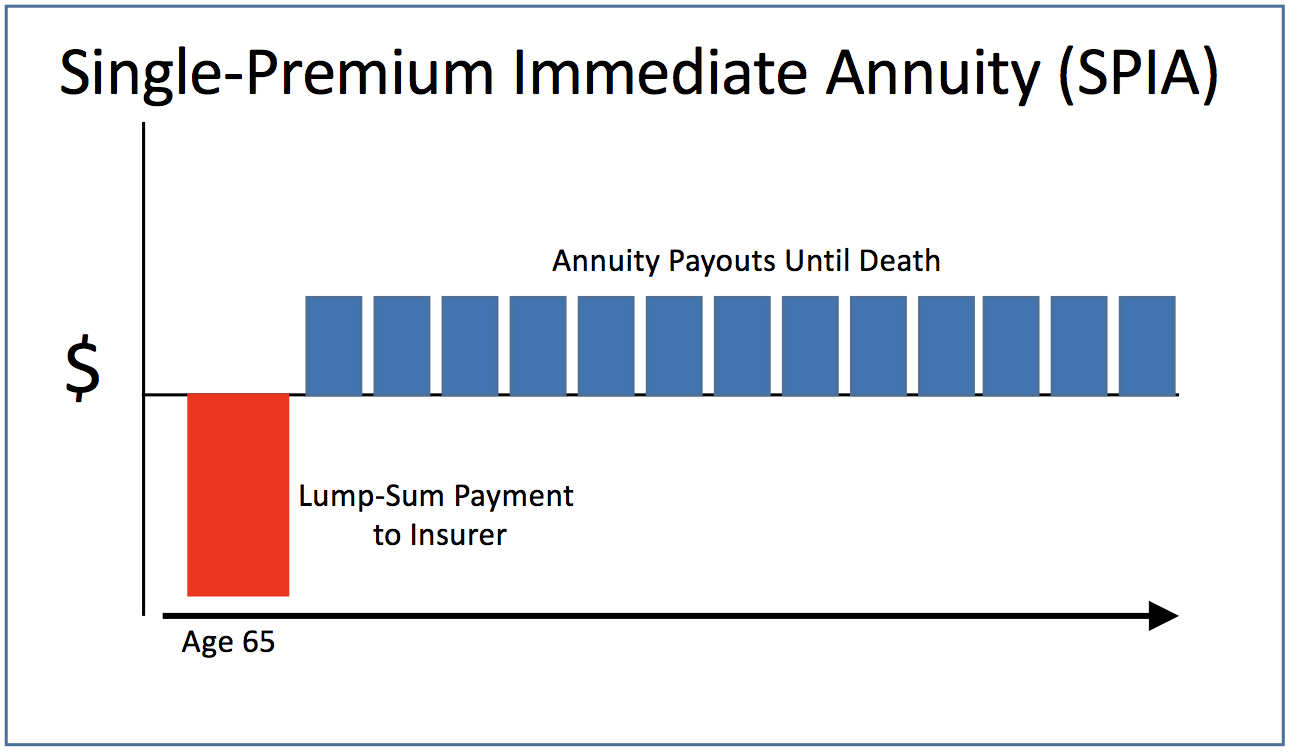

An annuity is a tax deferred retirement product sold by insurance companies.

Cash annuity. Just as it sounds this option is for those looking for the maximum sum of money. Image by julie bang. The trap is that a loan from an annuity is treated as a withdrawal. The advertised jackpot value shows how much the jackpot would be worth with 29 years of interest from investments the lottery operator makes.

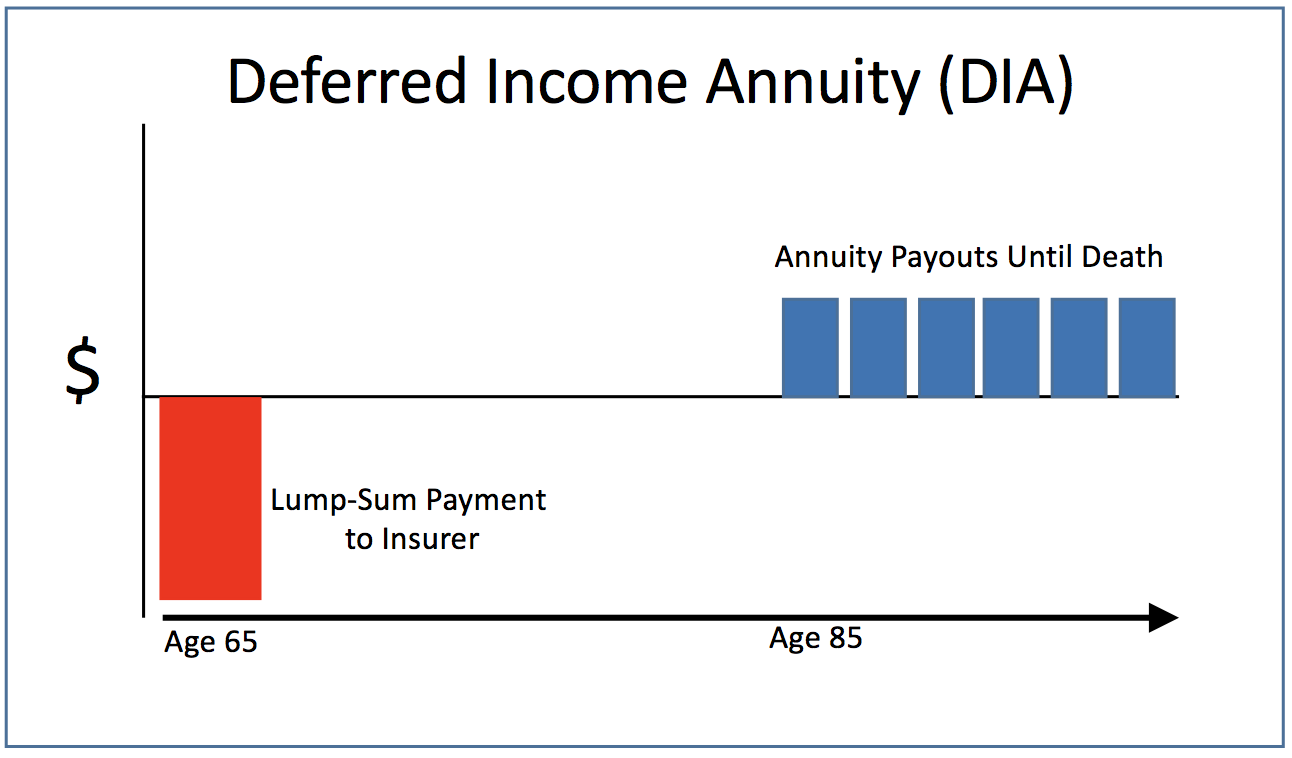

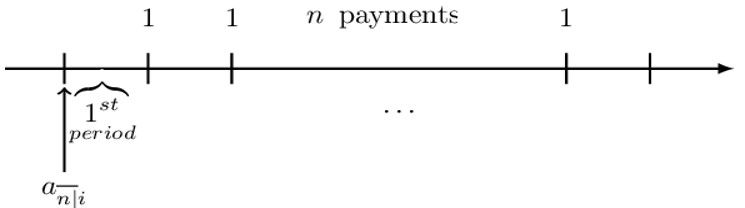

This is especially true in cases of medical or financial emergencies and new business opportunities. Whether you buy a deferred annuity for the future or an immediate annuity to guarantee lifetime payments right away you do have the option of cashing it in on the secondary market. An annuity is a promise from an insurance company to provide you with monthly income payments for life. An annuity due you may recall differs from an ordinary annuity in that the annuity due s payments are made at the beginning rather than the end of each period.

Income annuities offer you protection from running out of money by providing guaranteed retirement income. But your financial needs can change in an instant and may cause you to reevaluate your annuity. If so then partial annuity cash out is right for you. Learn the 5 reasons why income annuities are the best option.

Buyers sometimes assume that just like life insurance cash values they can borrow against their annuities. How to cash in annuities. We will work closely with you to customize an option that meets your financial needs. You may also owe surrender charges from the insurance company.

Lottery jackpot winners have the choice of taking the full prize in 30 payments over 29 years the first instalment is paid immediately or accepting a reduced cash lump sum. While immediate annuities provide an immediate cash flow they generally pay out less total money than deferred annuities which have more of an opportunity to grow. X trustworthy source investor gov website maintained by the securities and exchange commision s office of investor education and advocacy providing free resources about investing. To cash out your annuity contact your insurance company or agent.

Annuities provide a reliable stream of cash over a period of time. If you cash out your annuity before age 59 you may owe a 10 percent tax penalty.

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)