Cash For Annuity Payments

They might offer anywhere from 60 to 85 of the value of your annuity.

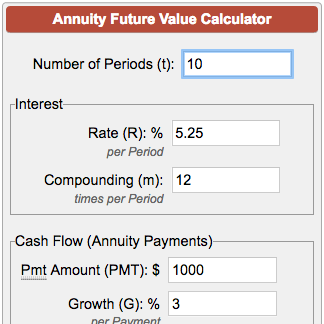

Cash for annuity payments. The goal in this example is to have 100 000 at the end of 10 years with an interest rate of 5. In a partial sale the seller exchanges a set period of time say three years of annuity payments for an immediate cash payment of that amount. For example if you wanted to sell annuity payments worth 10 000 and the factoring company has a 10 percent discount rate you would receive 9 000 in cash. These include when payments begin how long they last and whether money will go to a beneficiary when the annuitant dies.

However depending on your contract with your annuity issuer you might not have the ability to change your annuity policy or cash out. Two of the most common annuity payouts are period certain which guarantees income for a specific time period and guaranteed lifetime payments. Companies rather than other individuals buy these annuities and give the seller an upfront cash payment in exchange for the later annuity payout. With this option you are choosing to sell your annuity or structured settlement in its entirety ending any chance of periodic income payments in the future.

You may want to buy a house with your annuity money. To solve for the payment required the pmt function is configured like this. Getting 85 of your annuity s value would be considered a fairly good offer. Get cash now for your annuity payments rightway funding began helping people get to their cash quicker from the sale of some or all of their annuity payments enabling folks just like you to use your cash on your terms.

Other major expenses include cars and starting a new business. As you gather your financial resources you might find that receiving cash for your annuity payments could help you meet your objectives. Some other reasons you might want to sell your future annuity payments for cash you can use right now include wanting to pay for your education or for education for your children or loved ones. None will give you the full value of your future payments.

Factoring companies use discount rates to account for this discrepancy in value and make a small profit for giving you cash up front. It has made rightway funding so popular with our customers. When selling your future structured settlement or selling annuity payments for cash whether guaranteed or life contingent settlement payments you should be confident you are going forward with a trustworthy company that will get your sale of your settlement payment transaction approved. Annuity purchasers have options regarding how the annuity payouts are structured.

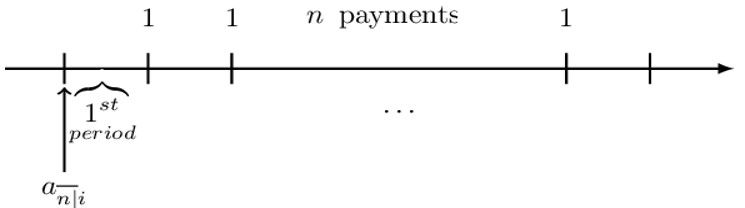

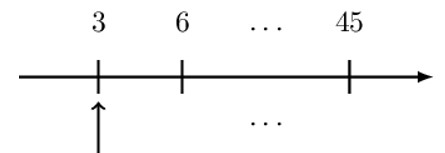

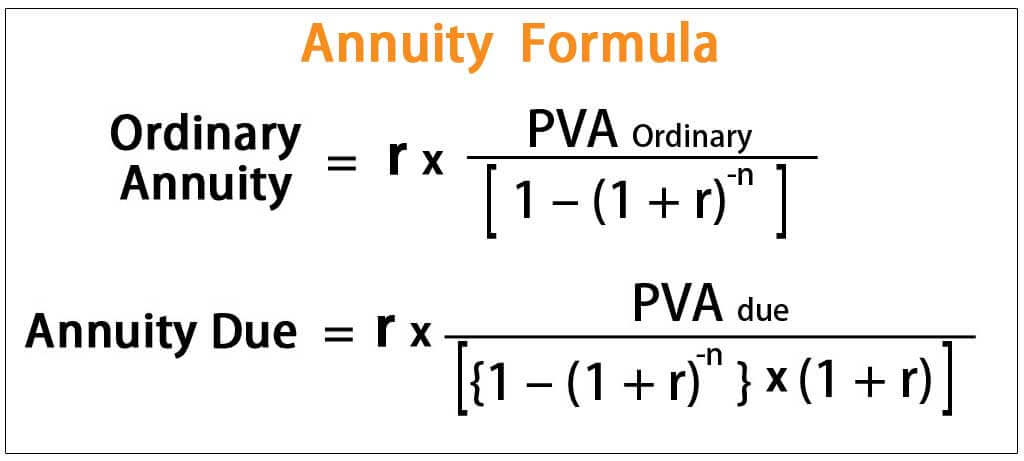

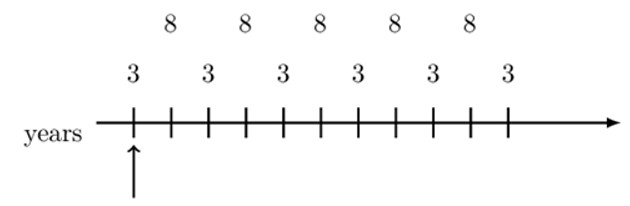

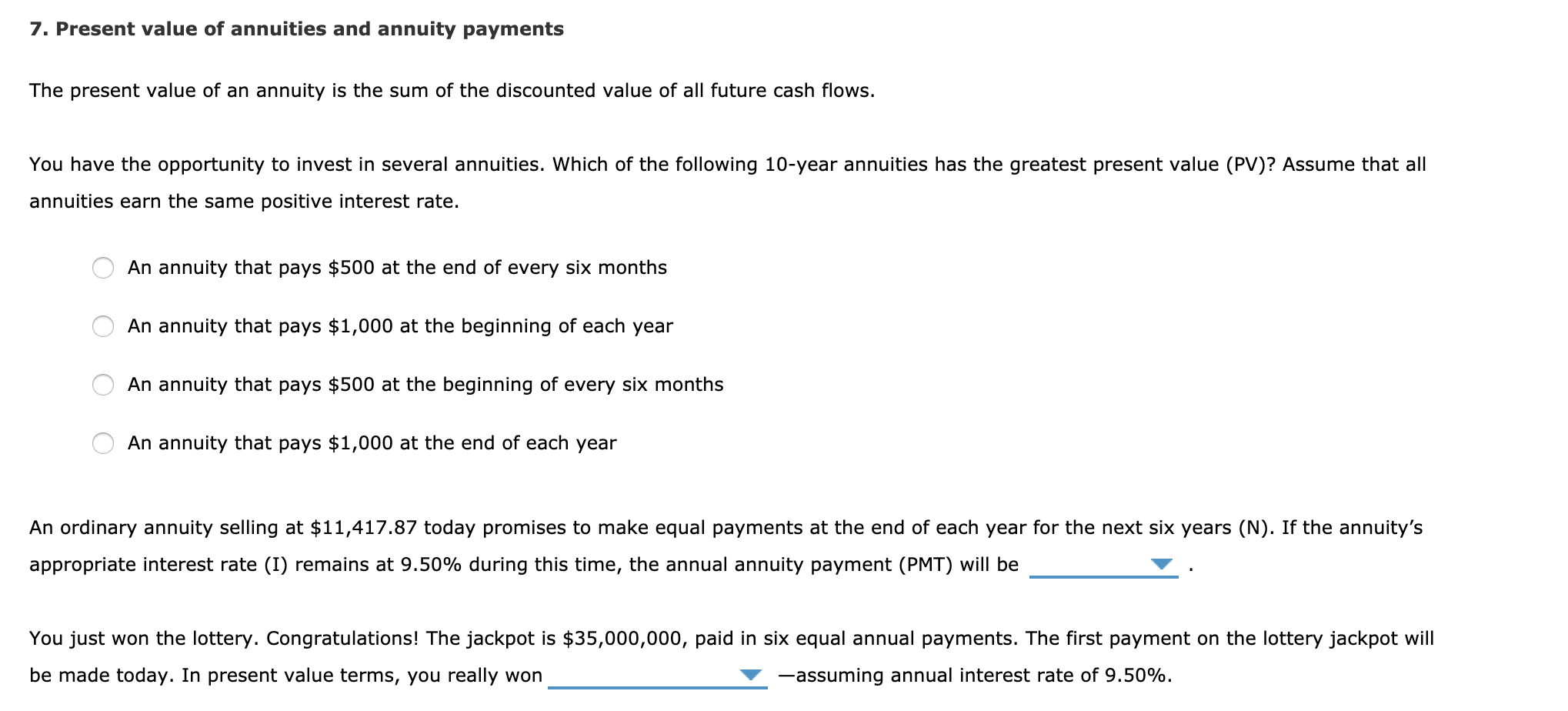

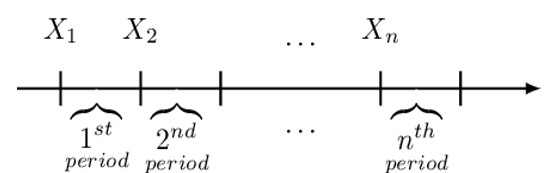

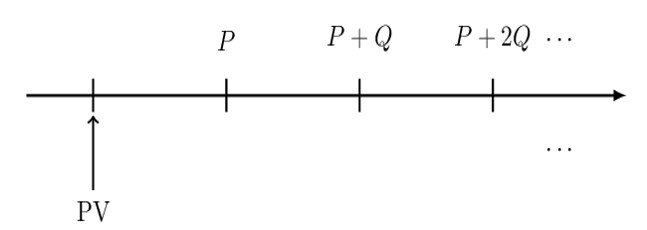

An annuity is a series of equal cash flows spaced equally in time.

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)