Cash Out Refinance Fnma

Loans qualified as student loan cash out refinances must be delivered to fannie mae with special feature code sfc 003 and sfc 841.

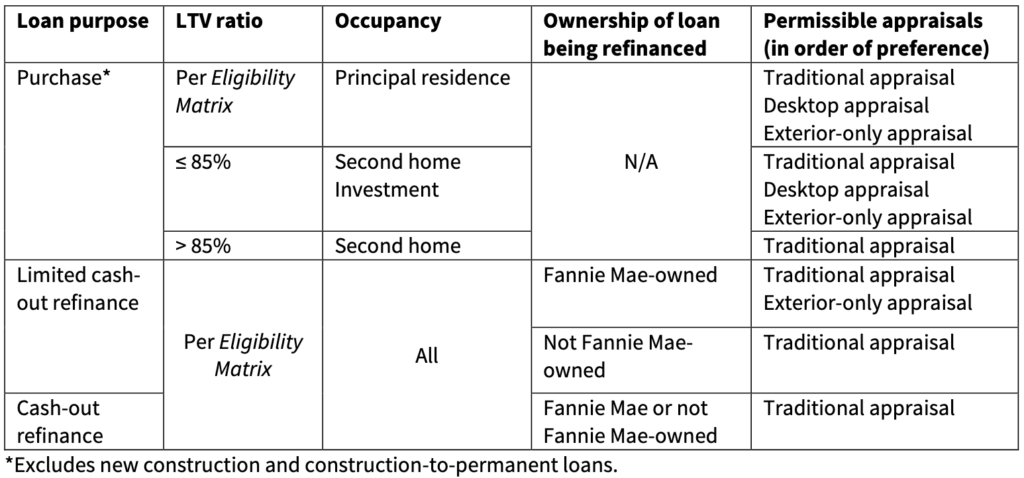

Cash out refinance fnma. Fannie mae loan guidelines allow borrowers to receive the lesser of 2 percent of the new loan amount or 2 000 cash back. Instead it can come from reconciling the variances between the estimated and actual loan payoff amounts said pava leyrer chief operating officer at northern mortgage services in grandville mich. Lower ltv cltv and hcltv ratios may be required for certain mortgage loans depending on the type of project review the lender performs for properties in condo projects. You may receive a relatively small amount of money upon closing a limited cash out refinance.

The cash you receive from a limited cash out refinance doesn t come from equity which differs from a standard cash out refinance. If the borrower started an lcor construction loan and would now like to deed the lot to the builder and treat the transaction as a purchase does the lot have to be deeded to the builder prior to the application. The maximum loan to value is 75 for 1 unit properties and 70 for 2 to 4 unit properties. The refinance mortgage must meet fannie mae s eligibility criteria for mortgages that are subject to subordinate financing.

Housing expense ratio like dti your housing expense ratio is another way lenders and mortgage investors like fannie mae determine the relative risk associated with making a loan to clients. The refinance loan balance may pay off closing costs such as lender and prepaid fees and a previous first mortgage and second. The borrower must meet the cash out refinance construction to permanent financing eligibility since they are receiving funds back for the cost overruns. Although the cash out refinance reserves requirement is maybe the most visible change in the new guidelines it s not the only one.

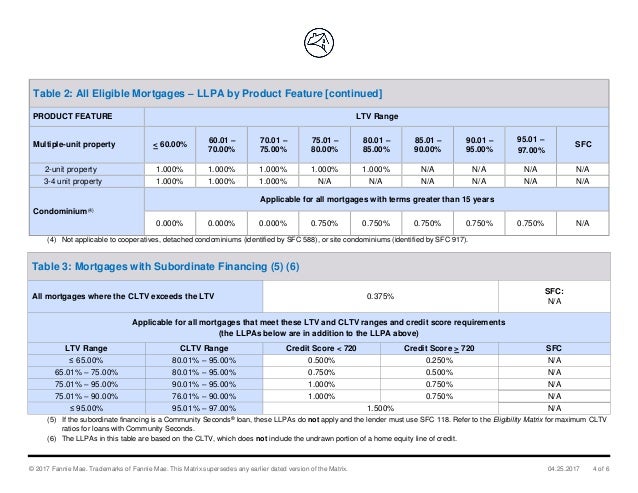

Where to apply for a rental property cash out refinance. According to guidelines a borrower must own a home for at least six months or pay on an existing home loan for six months in order to qualify for a fannie mae cash out refinance. Loan level price adjustments an llpa applies to certain cash out refinance transactions based on the ltv ratio and credit score.