Cash Out Refinance Lenders

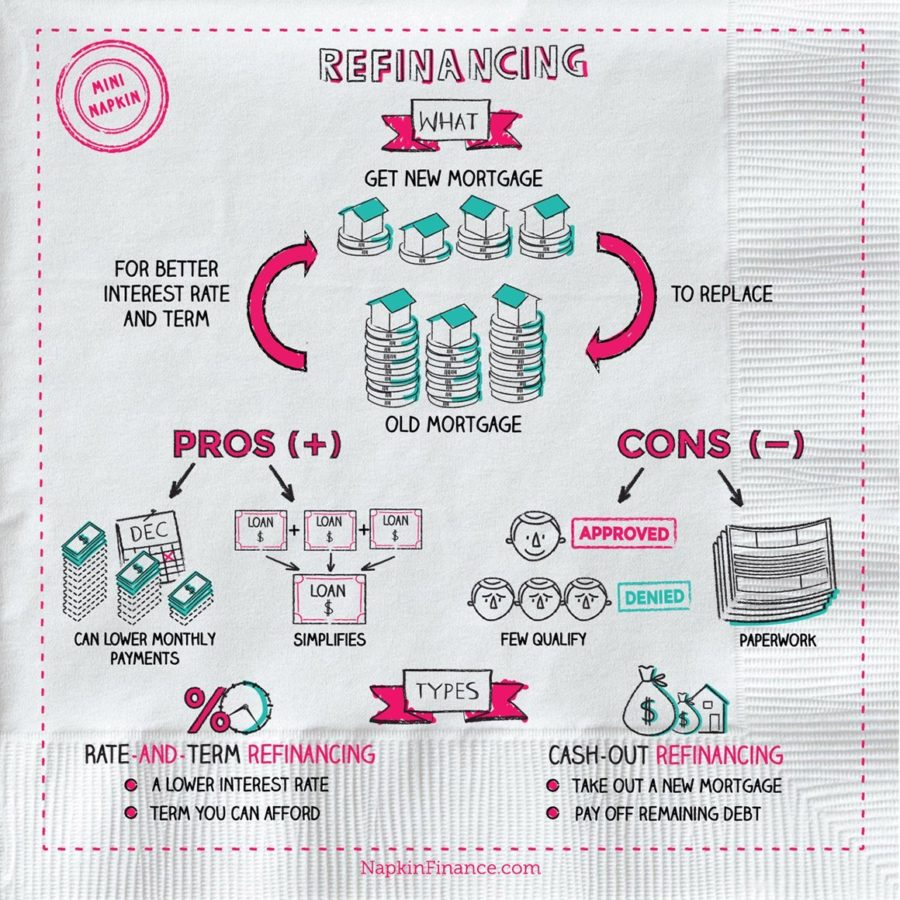

Cash in refinance is less common than rate and term refinance or cash out refinance.

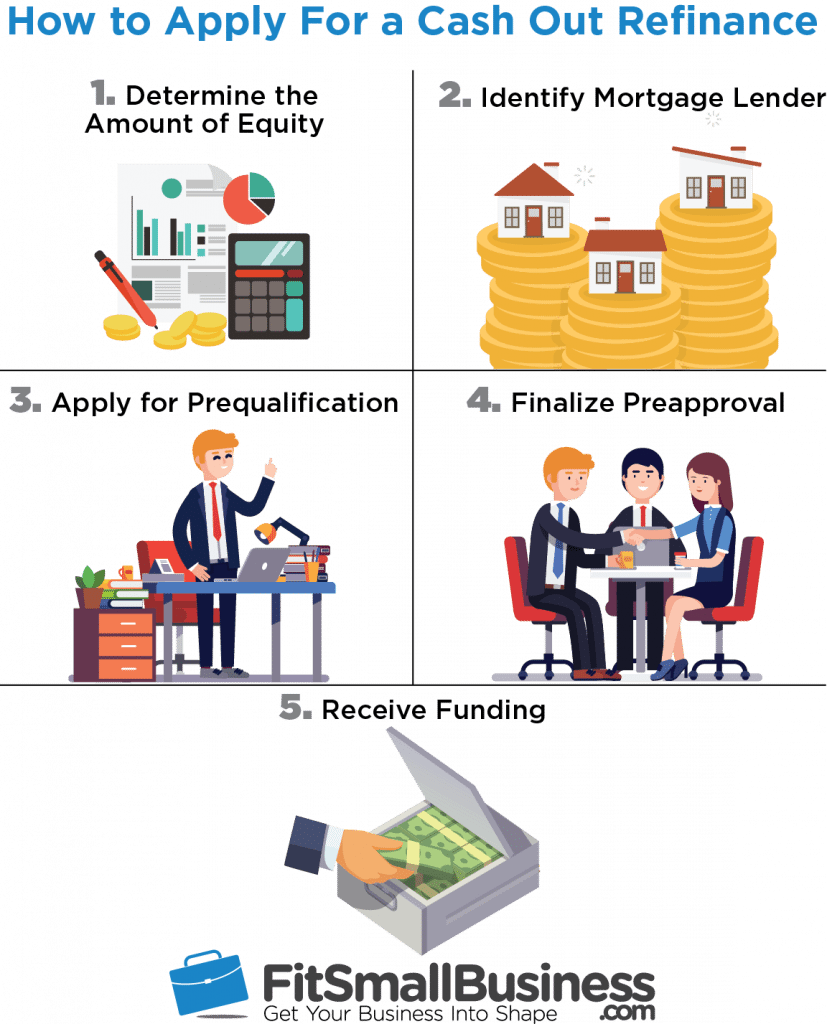

Cash out refinance lenders. Cash out refinance rules for conforming. If you want to take cash out of your home equity or refinance a non va loan into a va backed loan a va backed cash out refinance loan may be right for you. The following is the mortgage reports list of its best cash out refinance lenders for 2019. By borrowing more than you currently owe the lender provides cash that you can use for anything you want.

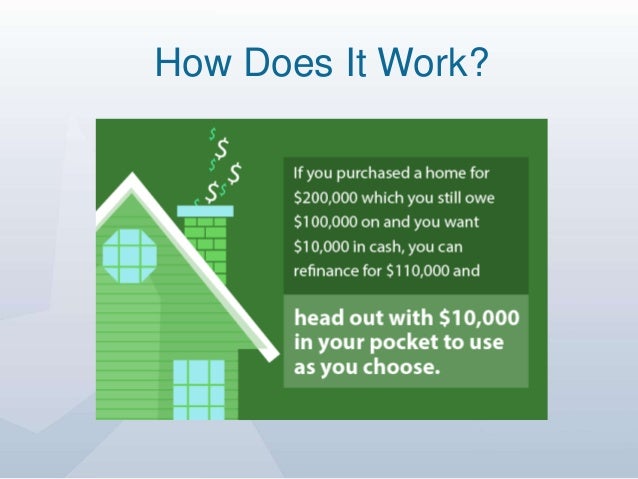

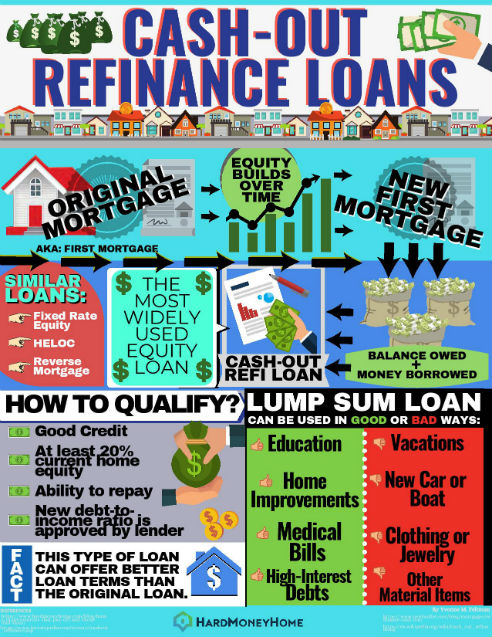

How cash out refinancing works. A cash out refinance will happen when you replace an existing home loan by refinancing with a new larger loan. You ll bring cash to the closing table to pay down your loan balance with this type of mortgage refinance. It s an interest saving option if you ve got the cash to do it because this type of loan can offer a lower mortgage rate shorter repayment term or both.

In most cases the cash comes in the form of a check or wire transfer to your bank account. In either case lenders may review your credit reports with a hard inquiry. Your options for cash out refinance lenders are extensive from all digital outfits with speedy online applications to major banks with branches nationwide for in person service. Also when your loan is added to your credit reports the average age of accounts on your reports will decrease and your loans will have a high balance relative to their original loan amount.

Cash out refinancing has long been used by homeowners to raise money for things like paying for a child s college education funding a major home renovation or consolidating debt. A va backed cash out refinance loan lets you replace your current loan with a new one under different terms. A cash out refinance is a refinancing of an existing mortgage loan where the new mortgage loan is for a larger amount than the existing mortgage loan and you the borrower get the difference between the two loans in cash. Lenders generally require you to maintain at least 20 percent equity in your home after a cash out refinance so you d be able to withdraw up to 140 000 in cash.

It s in alphabetical order. Reasons to use a cash out refinance.

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)

:strip_icc()/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)