Cash Out Refinance To Invest

The choice of whether to refinance an investment loan is a personal one.

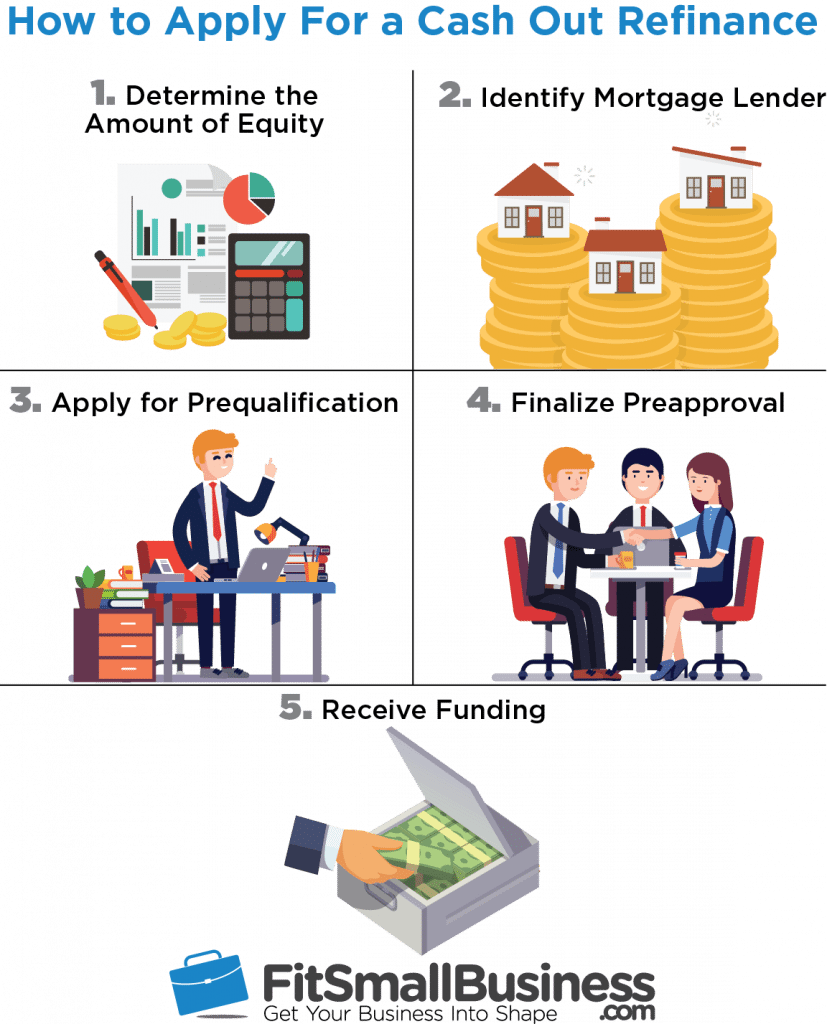

Cash out refinance to invest. Such property owners use the refinance loan for renovating an existing property or buying another investment property. A cash out refinance happens when real estate owners apply for a fresh loan on an existing property. But the strategy is risky and it s worth evaluating alternatives to see if there s a better option. Lower interest rates if you put an unexpected bill on a variable credit card you might pay a high amount of interest the prime rate that s tied to the federal funds rate set by the federal reserve plus a certain number of percentage.

However a cash out refinance for rental property works slightly differently than it does for a primary residence. Someone said they chickened out in 2005 by now you would have doubled your s p 500 index investment. But seeking a refinance to fund vacations or a new car isn t a good. 1 lock in massive outperformance.

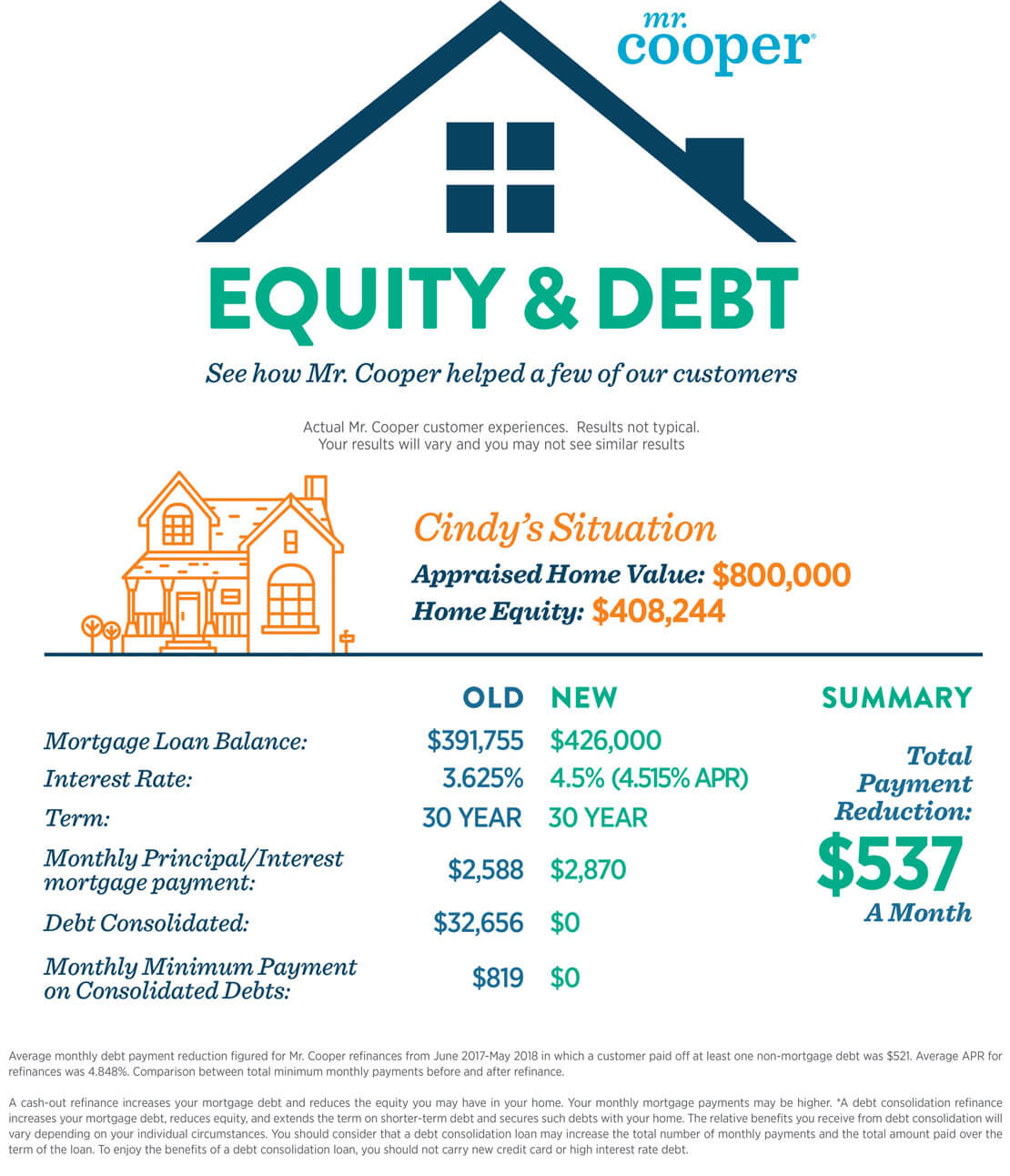

A cash out refinance can give you the cash you need to pay down your outstanding debts and transfer what you owe to one convenient lower interest payment. Cash out refinancing can provide a significant amount of money at attractive interest rates. While they were hard to come by just a few years ago many lenders now offer investment property owners the chance to cash in on their non owner occupied homes equity. Pros of a cash out refi to buy stocks.

A cash out refinance on a rental property is a great way to get money out of your investment. Long term you will do better with stocks than what any mortgage costs. If you are thinking of doing a cash out refinance to buy stocks here are some of my pros and cons. The decision to refinance investment property is usually common among investors that have more than 30 40 equity in their property.

I would definitely cash out and invest in stocks. When you re short on liquid cash but you have equity in your home refinancing provides a pool of money for home improvements education needs and other goals. Especially with refinance rates near all time lows. Cash out refinancing for primary residence owner occupied homes are gaining in popularity but so are cash out loans for investment properties.

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)