Cash Out Refinances

Cash out refinances reached a 10 year high in the fourth quarter of 2019 the latest figures available according to black knight.

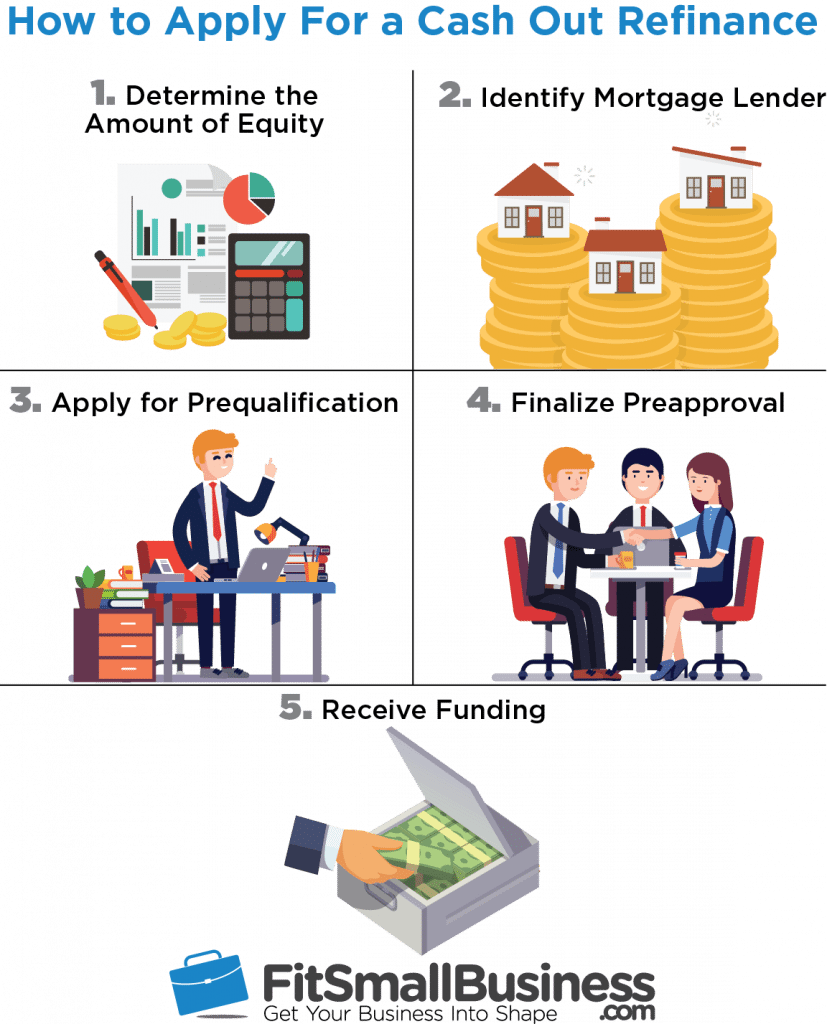

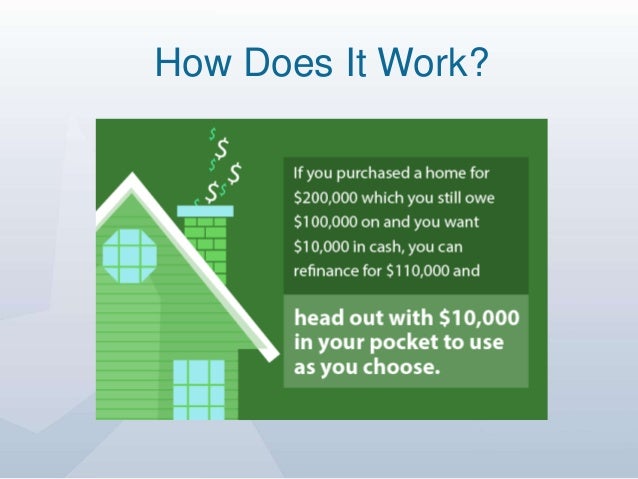

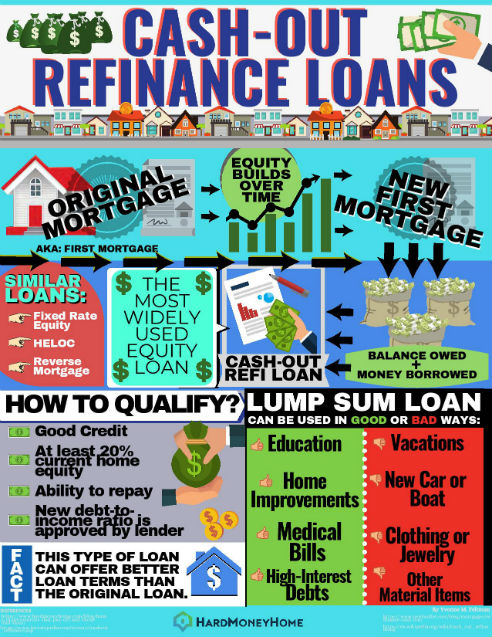

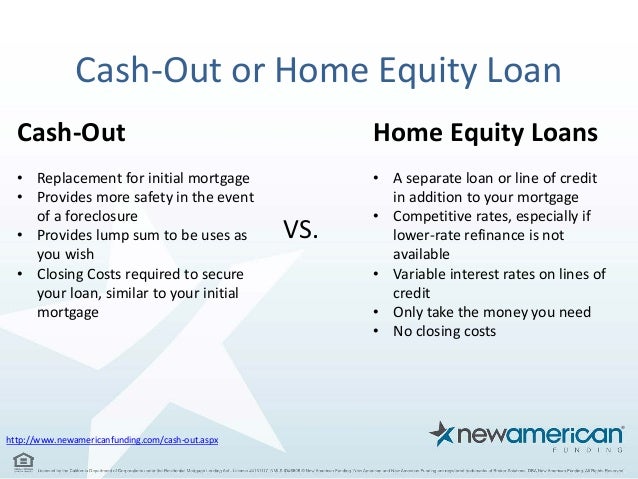

Cash out refinances. A cash out refinance can come in handy for home improvements paying off debt or other needs. Limited cash out refinance transactions must meet the following requirements. A cash out refinance replaces your current mortgage with a loan for more than. A cash out refinance is a mortgage refinancing option where the new mortgage is for a larger amount than the existing loan to convert home equity into cash.

Homeowners drew more than 41 billion in equity out of their. A cash out refinance is a refinancing of an existing mortgage loan where the new mortgage loan is for a larger amount than the existing mortgage loan and you the borrower get the difference between the two loans in cash. What is a cash out refinance. You ll pay slightly higher interest rates for a cash out refinance because.

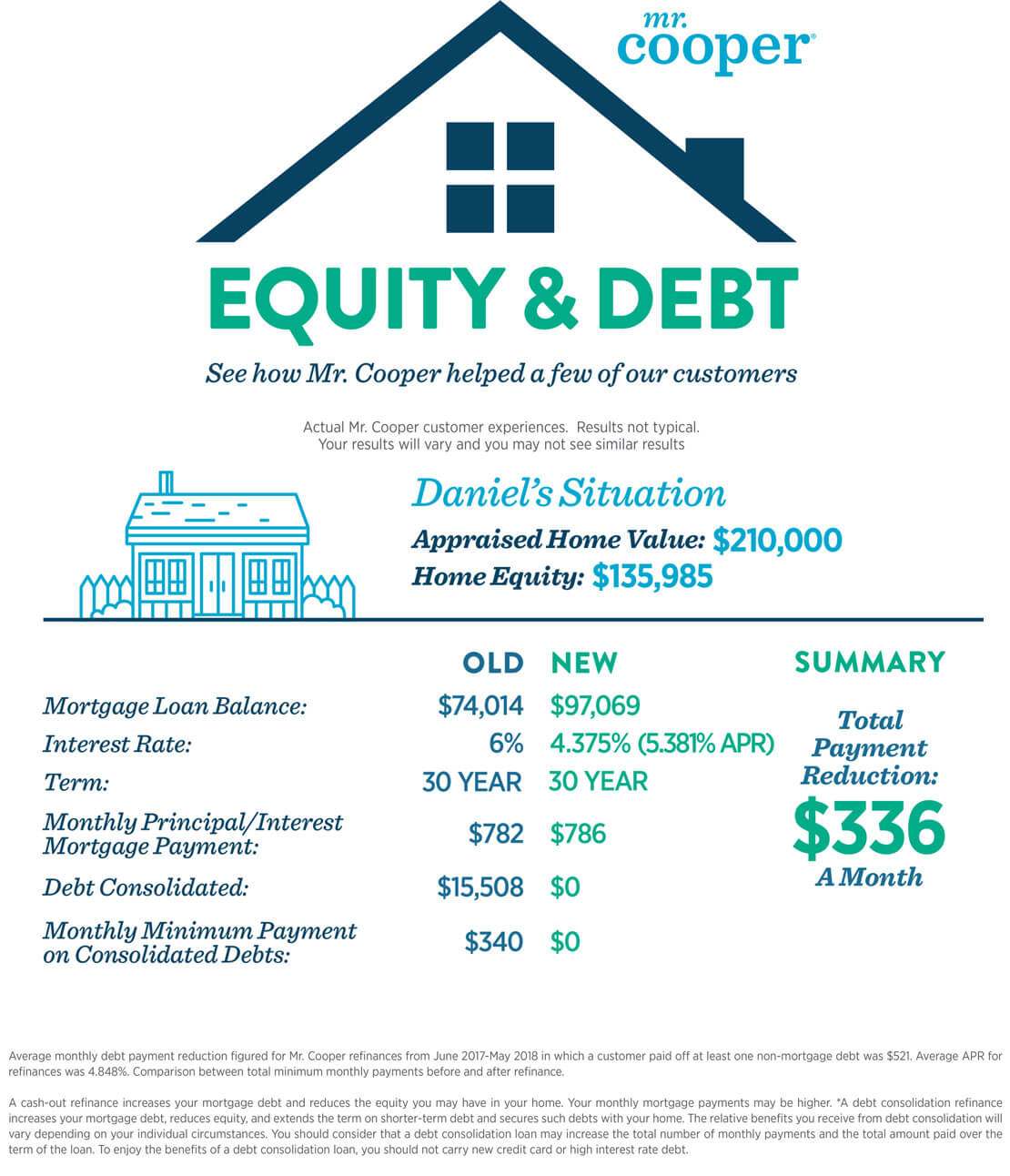

Cash out refinance pays off your existing first mortgage. This results in a new mortgage loan which may have different terms than your original loan meaning you may have a different type of loan and or a different interest rate as well as a longer or shorter time period for paying off your loan. Find and compare the current rates on cash out refinances available in your area. Compare cash out refinance rates.

Basically homeowners do cash out refinances so they can turn some of the equity they ve. The transaction is being used to pay off an existing first mortgage loan including an existing heloc in first lien position by obtaining a new first mortgage loan secured by the same property. A cash out refinance can give you the cash you need to pay down your outstanding debts and transfer what you owe to one convenient lower interest payment. Or for single closing construction to permanent loans to pay for construction costs to build the.

A cash out refi often has a low rate but make sure the rate is lower than your current mortgage rate.

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)