Cash Out Structured Settlement

Whatever it is let fortune help you help yourself.

Cash out structured settlement. When you win or settle a personal injury suit you may have a choice to take your award as a one time lump sum payment or as a structured settlement which is a series of smaller payments over a period of years. The vast majority of the sales involve a portion of a person s structured settlement payments. Take advantage of fortune s expert knowledge and compassionate attitude. However making early withdrawals may incur costly surrender charges and tax penalties.

Get the seed money you need to invest in your future. The top reasons people chose to sell payments are. Cash out of your structured settlement. The steps to selling structured settlements and getting the most cash.

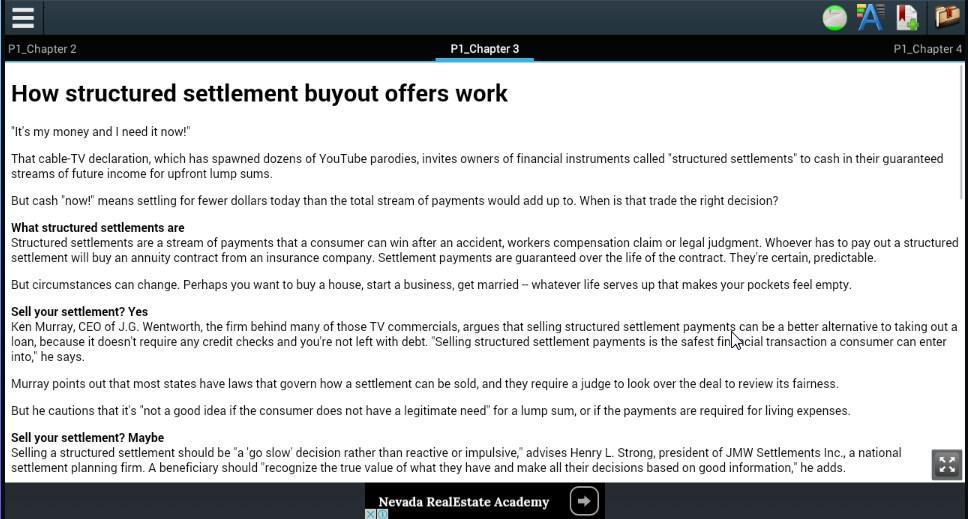

But we also know that by speaking to certain structured settlement buyers you can receive thousands of dollars more if you decide to cash out structured settlements. If you sold structured settlement payments in the past and want to know if you were underpaid call 877 540 1042. Cash out structured settlement we understand that people get tired speaking to companies regarding a structured settlement cash out. The question of whether or not to sell often boils down to deciding between selling payment versus other funding options.

Get enough cash to get yourself out of a rough spot. According to the national association of settlement purchasers less than 15 percent of structured settlement holders sell their settlement payments. Find out the real current cash value of your structured settlement. Why do people cash out their structured settlements.

Read on to learn what a structured settlement is what it means to cash out your settlement annuity and the process for doing so. With a few exceptions you can cash out payments from your structured settlement or annuity at any time. An alternative to withdrawing money early is selling future payments to a purchasing company at a discount. Drb capital has substantial experience in paying cash for structured settlements.

Why sell a structured settlement. 5 5 1 review s show reviews editor s take. The final result is a structured settlement or in other words a settlement that s been structured to be paid over time. This first step is vital to getting the most cash.

Credit lines and loans are plentiful these days and many people wonder if sacrificing consistent long term payments for a one time lump sum transaction is a good idea. Some unethical structured settlement brokers pocket huge sums by selling client information to companies that then contact those clients and promise quick cash for selling future payment rights. 1 pay off high interest debt 2 pay for education 3 purchase a home or vehicle and 4 pay medical bills. Sell my settlement payments.