Cashing Out An Annuity

In formal tax code the irs says that cashing in annuities falls under the category of nonperiodic payments it is generally never advantageous to cash in an annuity early as annuities have special tax privileges under irs code and the irs has put into effect several penalties for taking money out early.

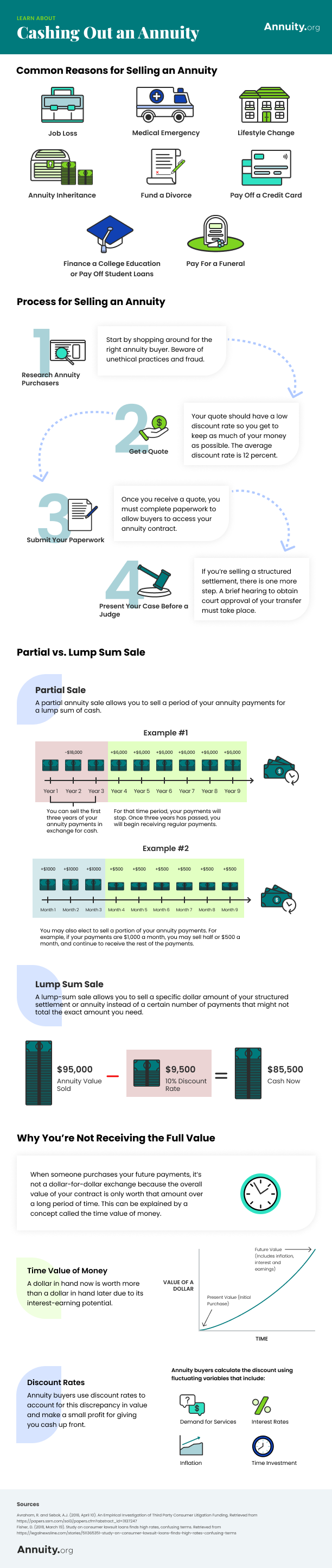

Cashing out an annuity. Find out the tax consequences when an annuity owner takes the lifetime maturity proceeds or cash surrender value in a lump sum cash payment. An annuity is a tax deferred retirement product sold by insurance companies. An alternative to withdrawing money early is selling future payments to a purchasing company at a discount. If you take money out of an annuity before you turn 59 1 2 and you don t qualify for any exceptions to the general rule then you will have to pay an additional 10 penalty on the withdrawal on.

With a few exceptions you can cash out payments from your structured settlement or annuity at any time. Money in an annuity grows tax deferred with distributions after age 59 1 2 being added to ordinary income. You may also owe surrender charges from the insurance company. In the majority of cases you cannot cash out your retirement annuity pension early in the uk.

For example if you buy a 50 000 fixed or variable annuity and the value grows to 75 000 the first 25 000 you withdraw is taxable. Because cashing out an annuity is the same as cashing in an annuity the answer is also the same. If you have any questions about cashing in your retirement annuity pension then it can be a good idea to speak with a pensions advisor. Think twice before cashing out your annuity it may be tempting to switch out of an annuity that has lost money over the past several years but that may be exactly the reason you may want to keep it.

While there are many types of annuities an immediate annuity starts paying you immediately as opposed to some time in the future. Annuities are retirement structures recognized by the irs to help investors with tax breaks while saving toward retirement. Just as with annuity withdrawals when you sell payments from an annuity that was purchased with after tax money taxes are applied only to interest and earnings. If you have purchased an annuity and wish to cash out i e withdraw cash or liquidate the.

To cash out your annuity contact your insurance company or agent. However making early withdrawals may incur costly surrender charges and tax penalties. If you cash out your annuity before age 59 you may owe a 10 percent tax penalty.

/GettyImages-924565162-5c41449b46e0fb0001ef303b.jpg)