Commercial Business Loans

Sba 504 suitable for commercial real estate loans of 350 000 and above sba 7 a and sba express programs generally provide you with lower down payments and longer financing terms.

Commercial business loans. A factor rate is typically used for merchant cash advances and short term business loans to determine how much you will owe in interest. The uob property loan aims to help smes expand their business via property purchases or improve business cash flow via providing a cash out option through the property. Many commercial loans require collateral such as property or equipment. Small business administration sba financing.

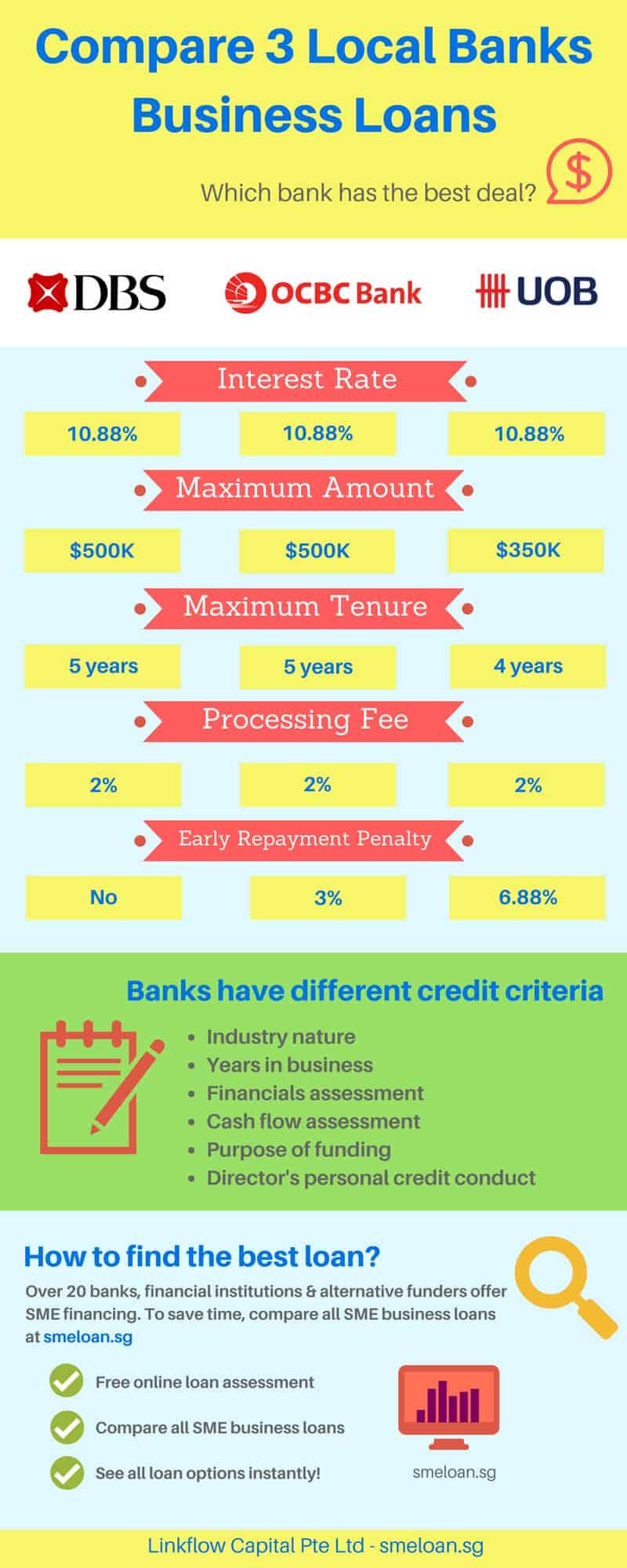

Business loans charge interest rates in slightly differently way to other types of loans they charge a risk margin based on how the lender views the business s prospects for success. A commercial loan is done between a bank and a business used to fund operating costs and capital expenditures. Uob business property loan provides financing option for smes looking to purchase industry commercial property or refinancing their existing industry commercial property loans with other banks. Other small business loans require an equity investment.

Down payment requirements vary but you should expect to invest at least 10 to 30 of your own capital when taking out a loan. Under a commercial real estate blanket loan businesses can fold multiple properties into one financing arrangement for convenience and flexibility.