Compulsory Insurance Law

All states have laws that assure compensation for victims of automobile accidents.

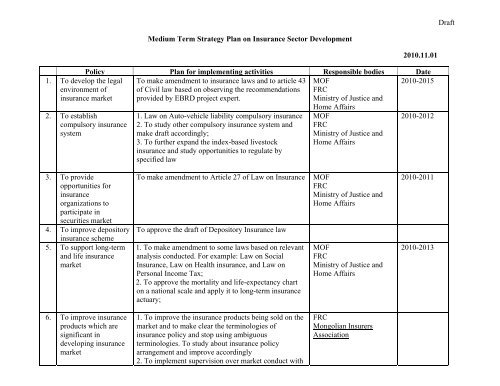

Compulsory insurance law. No matter your business risk there s an insurance policy to cover it. Who needs to be insured. The law society s compulsory professional indemnity insurance pursuant to section 75a of the legal profession act lpa the law society s compulsory professional indemnity insurance the scheme was introduced in april 1991 to ensure every practising lawyer has minimum insurance coverage. Compulsory insurance is any type of insurance coverage that is required by law before individuals or businesses may engage in certain activities.

Compulsory insurance is insurance that individuals businesses or other entities are required by law to have in force. Compulsory insurance is a type of insurance that protects victims against the costs of recovering from an accident. A standard insurance contract and a frontier insurance contract shall be concluded in accordance with this law the civil code the law on insurance standard terms and conditions of a contract of compulsory insurance against civil liability in respect of the use of motor vehicles approved by the bank of lithuania hereinafter. States require all registered vehicles to carry minimum compulsory auto liability insurance.

Effective in all states summary. However compulsory insurance requirements are not always easy to enforce. Other polices though not legally required make good business sense. Workers compensation coverage is mandatory for most businesses for instance.

Employers liability insurance is required by law under the compulsory insurance act 1969 if you run a business to provide cover in the event that one of your employees is injured or becomes ill as a result of working for you. The five types of statutes in effect presently are 1 financial responsibility laws 2 compulsory automobile liability insurance 3 unsatisfied judgment fund laws 4 laws requiring uninsured motorists coverage and 5 no fault automobile laws. Compulsory insurance usually covers perils that carry heavy financial costs. It is often intended to prevent the insured from financial ruin ensure the compensation of victims without burdening the state or both.

Almost all states require motorists to have compulsory auto liability insurance before they can legally drive a car. The supervisory institution and other legal acts of the. The idea behind this type of mandatory coverage is to protect the well being of those who would otherwise be adversely affected if the events covered in the terms of the policies were to take place. All employees doing non manual work earning a salary of 2 100 or less a month excluding any overtime payment bonus payment annual wage supplement productivity incentive payment and any allowance.

Compulsory auto liability insurance law and legal definition certain u s.