Condo Insurance Vs Homeowners Insurance

Both condo insurance and homeowners insurance provide coverage for the dwelling.

Condo insurance vs homeowners insurance. Condo insurance by chris huntley on april 16 2020 putting a figurative safety net around the place where you and your family live with a homeowners insurance policy is an essential responsibility of property ownership. Personal property coverage which covers the owner and household members in and away from the. With condo insurance however you ll typically only need enough. Double check with your condo association before buying an ho6 policy.

Dwelling coverage which is also called dwelling insurance is a feature of homeowners insurance that helps to pay to repair or rebuild the physical structure of a house and attached structures if they are damaged by a covered peril standard dwelling insurance helps cover damage from hazards such as fire hail theft or ice. How condo and homeowners insurance works. The association buys a policy that the owners pay for equally in their association fees. Townhomes and rowhomes are always tricky.

The difference between the two policies is how they handle insuring the structure of the home. The difference in coverage you may need for studs in vs. Second rules and policies differ from complex to complex so be sure to ask any and all questions to make sure you get the right coverage for your condo. Dwelling coverage which covers damage to the structural components of the home including walls ceiling roofing plumbing and hvac systems among other things.

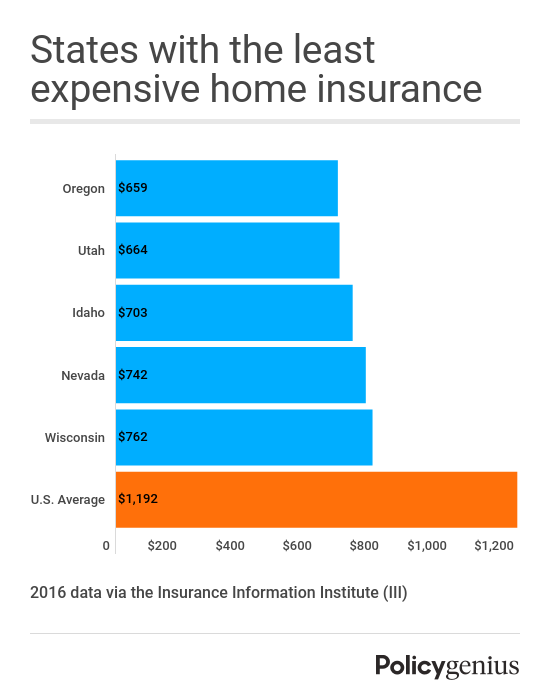

We find the average cost of homeowners insurance to be 952 per year. As we explain above you do not need as much dwelling coverage for a condo or co op so that dramatically cuts down on the price of a policy. All in can be over 100 000 in coverage a. Most homeowners associations cover only part of the building.

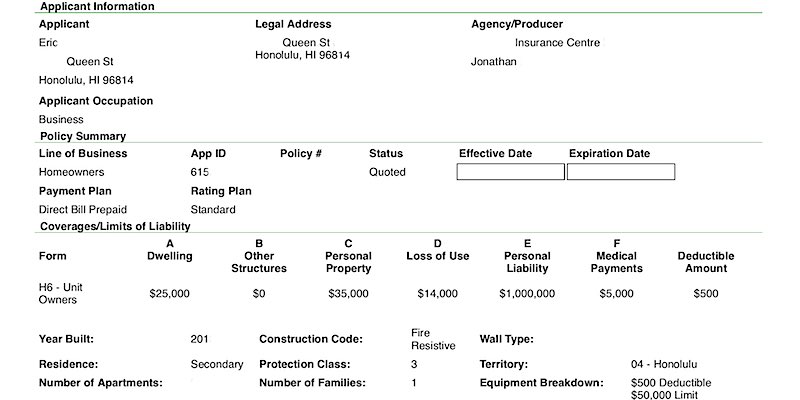

There are six separate components to homeowner s insurance. For homeowners insurance most standard policies will include the following types of coverage. Differences between condo homeowner insurance. Condo insurance and homeowners insurance are very similar in that both insurances provide the owner with coverage for the inside of the home their personal property as well as protection for personal liability.

There are a handful of key differences between condo insurance and homeowners. I am part of a homeowners association and own a townhome or rowhome. However there is a significant difference between the amount of dwelling coverage you will need and this is where you can the some of the differences between condo insurance vs homeowners insurance. Therefore the insurance policy is going to differ.

For condo and co op insurance you.